Gerald Celente’s description is fitting:

“When people lose everything, and they have nothing left to lose, they lose it.”

As the super rich powerful elite continue to ransack and pillage the remaining wealth of the middle class, we inch ever closer to people losing it en masse.

Man Self Immolates in Protest of Courts, Federal Government and the Death of The Rule of Law

|

Mac Slavo

June 18th, 2011 |

Tom Ball of New Hampshire set himself on fire in front of a Cheshire County family courthouse on Wednesday. The story has received very little attention from the mainstream media, likely because Ball provided the reasons and justifications for his act in a 15 page letter to the New Hampshire Sentinel just prior to his death, in which he unleashed a tirade against the US court system, police, child protective services, the US justice system and its arrest policies, and the Federal government.

From what we are able to gather, his ordeal began in 2001 with what he claims was an accidental injury caused to one of his children when the child was misbehaving. Ball reportedly slapped the child after having warned her thrice and she ended up with a cut lip. The child was not permanently or severely harmed, but the mother called police at the (forced) urging of a mental health practitioner and the state got involved. Ball was eventually found not guilty, but the story doesn’t end there.

Among other things, Ball attempts to explain in his letter what happened that night, and the events that followed for the last ten years, finally leading him to self immolation.

By some he will be referred to as a domestic terrorist for his calls of violence, by others as a revolutionary for his actions and call to arms, others still will dismiss him as a head case. This is, however, an important event and the people, as well as government and their agencies, should take notice.

Some excerpts from his letter to the Sentinel:

There are two kinds of bureaucrats you need to know; the ones that say and the ones that do. The bridge between them is something I call The Second Set of Books. I have some figures of the success of their labors. You and I are in these numbers, as well as our spouses and children. But first let me tell you how I ended up in this rabbit hole.

My story starts with the infamous slapping incident of April 2001. While putting my four year old daughter to bed, she began licking my hand. After giving her three verbal warnings I slapped her. She got a cut lip. My wife asked me to leave to calm things down.

When I returned hours later, my wife said the police were by and said I could not stay there that night. The next day the police came by my work and arrested me, booked me, and then returned me to work. Later on Peter, the parts manager, asked me if I and the old lady would be able to work this out. I told him no. I could not figure out why she had called the police. And bail condition prevented me from asking her. So I no longer trusted her judgment.

After six months of me not lifting a finger to save this marriage, she filed for divorce. Almost two years after the incident, I was talking with her on the phone. She told me that night she had called a mental health provider we had for one of the kids. Wendy, the counselor told my then wife that if she did not call the police on me, then she too would be arrested.

Suddenly, everything made sense. She is the type that believes that people in authority actually know what they are talking about. If both she and I were arrested, what would happen to our three children, ages 7,4 and 1? They would end up in State custody. So my wife called the police on her husband to protect the children. And who was she protecting the kids from? Not her husband, the father of these children. She was protecting them from the State of New Hampshire.

This country is run by idiots.

…

So let us talk about those bureaucrats that do. These are the ones that actually carry out the evil deeds. I like call them the do-bies.

Any one swept up into legal mess is usually astonished at what they see. They cannot believe what the police, prosecutors and judges are doing. It is so blatantly wrong. Well, I can assure you that everything they do is logical and by the book. The confusion you have with them is you both are using different sets of books. You are using the old First Set of Books- the Constitution, the general laws or statutes and the court ruling sometime call Common Law. They are using the newer Second Set of Books. That is the collection of the policy, procedures and protocols. Once you know what set of books everyone is using, then everything they do looks logical and upright. And do not bother trying to argue with me that there is no Second Set of Books. I have my own copies at home. Or at least a good hunk of the important part of it.

I got my Second Set of Books when I sued the Jaffrey NH police department. Under the discovery rule, I write them with the material I wanted and it would arrive in the mail a few weeks later. I got the Police Academy Training Manual. I got the Department’s Policy and Procedure Manual. I got the no-drop protocol that the attorney general sent to all his or her prosecutors. I even got the domestic violence protocols for the court system, one hundred pages worth. Once you read it the material, then you will know what the police, prosecutors and judges will do. They are completely predictable once you know what set of books they are using.

…

I lost visitation with my two daughters when I got arrested. One was the victim-the other was the witness. After a not guilty, I expected to get visitation with my girls. But the divorce judge, Sullivan, decreed that counseling was in order and they would decide when we would reunite. I told the judge that the decision on whether these two girls had a father or a fatherless childhood was not leaving this courthouse.

…

On one hand we have the law. On the other hand we have what we are really going to do-the policies, procedures and protocols. The rule of law is dead. Now we have 50 states with legal systems as good as any third world banana republic. Men are demonized and the women and children end up as suffering as well.

So boys, we need to start burning down police stations and courthouses. The Second Set of Books originated in Washington. But the dirty deeds are being carried out by our local police, prosecutors and judges. These are the people we pay good money to protect us and our families. And what do we get for our tax money? Collaborators who are no different than the Vichy of France or the Quislings of Norway during the Second World War. All because they go along to get along. They are an embarrassment, the whole lot of them. And they need to be held accountable. So burn them out.

In the last 25 years they have arrested one in six adults in this country and forced 25% of the men, women and children into homelessness. In 50 years it will be one in three adults arrested and 50% of the men, women and children ending up homeless. Most of our kids will live to the age of 68 years old. As bad as it was for you, your children will have twice the odds of it happening to them.

Ball also cites the rise of the Tea Party as evidence that insurrection in America is growing, reasoning that one of the primary reasons for why this is occurring is because the middle class is being wiped out. He promotes direct action against agencies of the government, expanding on his call to “burn them out,” by providing details on Molotov cocktails.

And for a possible explanation of why this story did not get coverage across the popular news channels, we need only look at the following set of statements from his letter:

There will be some casualties in this war. Some killed, some wounded, some captured. Some of them will be theirs. Some of the casualties will be ours.

Now, nobody wants to get killed. But let us look at your life. You are broke after paying child support. She and the kids are not doing any better. None of you are middle class any more. You have no say in the kids education, their health treatment, you may not even have visitation with your sons and daughters. And everything you thought you knew to be true-the rule of law, the sanctity of the of the family, the belief that government was there to nurture your brood-all turned out to be a lie. Face it boys, we are no longer fathers. We are just piggy banks.

…

I only managed to get the main door of the Cheshire County Courthouse in Keene, NH. I would appreciate it if some of you boys would finish the job for me. They harmed my children. The place is evil. So take it out

Some where along the line I picked up the crazy notion that it is better to be dead as a free man than to live as a serf. The government needs to be a little more careful about what they teach in our schools.

Perhaps Tom Ball believed that his death would lead to a similar explosion of protests as those that occured in Tunisia after an act of self immolation by a street vendor whose livelihood was seized by police. Many point to this single act of desperation as the catalyst for the entire middle east movement of the last 6 months.

Whatever the case, Tom Ball’s experience was certainly not unique and he makes this clear in his statement to the world.

We are not advocating the violent activities being called for by Mr. Ball, yet we couldn’t help but think about a memorable trend forecast from Gerald Celente of the Trends Journal in which he said:

When people lose everything, and they have nothing left to lose, they lose it.

We saw this with the man who flew his plane into the IRS building in Austin, we saw it a couple days ago with Tom Ball, and we anticipate similar acts of protest and domestic violence in the future, likely with increasing frequency.

Hat tip Charlie, Zero Hedge, Activist Post, NH Sentinel

Author: Mac Slavo

Date: June 18th, 2011

Website: www.SHTFplan.com

Protesters try to remove a fence protecting the Greek parliament during a demonstration in Athens. Thousands of demonstrators besieged the Greek parliament on Wednesday in a large anti-austerity protest marred by violence. (Louisa Gouliamaki / AFP/Getty Images / June 15, 2011)

Protesters try to remove a fence protecting the Greek parliament during a demonstration in Athens. Thousands of demonstrators besieged the Greek parliament on Wednesday in a large anti-austerity protest marred by violence. (Louisa Gouliamaki / AFP/Getty Images / June 15, 2011)

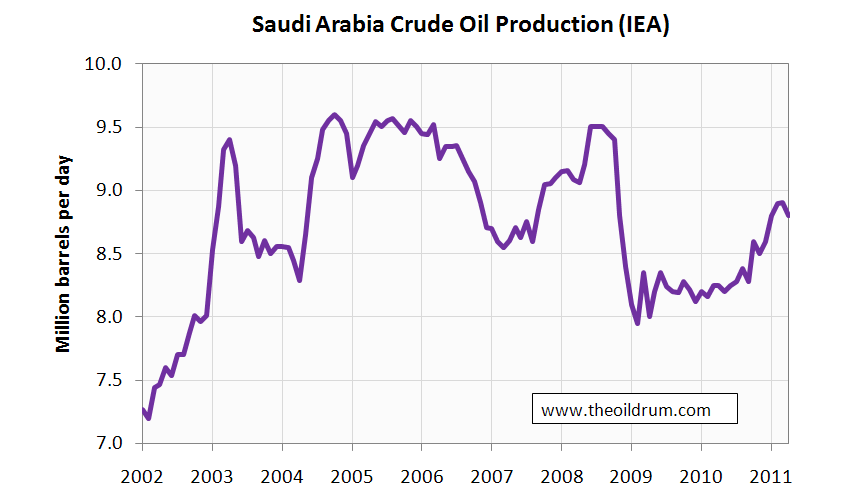

In a truly alarming development, Saudi Arabia is gearing up for all-out crude oil war in the Middle East.

In a truly alarming development, Saudi Arabia is gearing up for all-out crude oil war in the Middle East.