By Doug Casey, Chairman

Since writing The International Man in 1976, I’ve had quite a bit to say about internationalizing yourself. The book’s subtitle was Making the Most of Your Personal Freedom and Financial Opportunity Around the World; but in going over past editions of our newsletters, I find that most of what I’ve written in recent years has been about the financial aspects of expatriation. Now seems a good time to confront the rest of the subject head on – the reasons to very seriously consider leaving your home country, and to do so now, not next year.

The International Man is long out of print, of course, and only available through used bookstores and finders (including amazon.com). While I’m obviously biased, it’s actually still an excellent read, although the world is a different place and I’ve learned a few things since 1976. The book was directed to Americans, but found a fairly broad international market – becoming, among other things, the biggest-selling book in the history of Rhodesia. That, in and of itself, provides a bit of an object lesson in how things can change, I think.

When I first went to Rhodesia in 1978, war was still raging, but I was able to find an entrepreneurial local publisher, Gordon Graham. At the time, there were still about 250,000 people of European extraction among the 6-million population. And it was clear most of them were eyeing the exits and wondering where to go.

Most of the whites were native Africans, born to families that had been in the country for generations, and they felt they had just as much right to be there as the blacks. But when it comes to such things, it’s not a question of rights but of political power. Today there might be 5,000 whites still hanging on. But making what they called “the chicken run” 30 years ago was definitely the smart course. However, few of them had a “bolt hole” elsewhere. In any event, my book flew off the shelves, as people desperately scrambled for alternatives.

The problem – your problem – is that any country can turn into a 1970s Rhodesia. Or a Russia in the ’20s, Germany in the ’30s, China in the ’40s, Cuba in the ’50s, the Congo in the ’60s, Vietnam in the ’70s, Afghanistan in the ’80s, Bosnia in the ’90s. These are just examples off the top of my head. Only a fool tries to survive by acting like a vegetable, staying rooted to one place, when the political and economic climate changes for the worse. When the going gets tough, the mentally tough go elsewhere. The way your forefathers once did – at least, if you live in an immigrant-built country like the US, Canada, Australia, New Zealand, or Argentina.

I don’t know exactly when I became interested in exploring other lands. Maybe it began with reading Uncle Scrooge comics when I was a kid in the ‘50s. Uncle Scrooge (who is a fantastic character and one of the great heroes of American literature) was always taking Donald Duck and his three nephews off to an exotic clime for a high-adventure treasure hunt. Maybe it was when I wanted to be a paleontologist and read about Roy Chapman Andrews (a model for Indiana Jones) rooting for fossils in Mongolia. Or when I decided I’d like archaeology better and read about Heinrich Schliemann discovering Troy. But a couple of specific things really set the bit in my teeth.

One was when I was in Milan, looking to buy a Ferrari. The seller was a guy I remember well, Viviano Corradini, who was actually an American. I asked him why he was living in Italy. “You see this?” he said, as he veered the car way into the opposite lane and back again a couple of times, then slammed on the brakes, then accelerated – a wild little ride. “You can’t do this in the States. They’ll throw you in jail. Here, you can do anything you want!” He was right. After I bought the car we realized I didn’t have any plates, so he reached up into a closet and found some old New Jersey plates. “Here. Use these.” I did, no problem, for the next six months, all over Europe. It gave me some practical reality about not being controlled by other people’s arbitrary rules.

Another was in Switzerland, when I was hanging around for about a month with an ex-Foreign Legionnaire named Ron Schneeberger. He was planning to rob the national bank of Haiti, figuring that Papa Doc had about $50 million in negotiables sequestered there. That was a lot of money in those days. Ron reasoned, quite correctly, that if you robbed the corner liquor store, you’d get $50 and likely get killed. If you robbed an ordinary bank, you might get $5,000. But if you hit a government… who was going to pursue you?

Of course the world in general – and absolutely, positively Europe – is a bit more tightly wrapped now. And I don’t endorse the idea of reckless driving. Or of robbing national banks – at least not without the cover of being an executive with Goldman Sachs…

But the point is that, at different times, there are places that are good for doing certain things. And places where it is bad to be. Who wouldn’t have preferred to be in the USA, rather than the USSR, from 1920 to 1990? Ireland was a dismal, depressing place for decades after WW2; then in the ‘90s it blossomed. Africa was a very safe, prosperous, and enjoyable place before about 1960, when it started to degenerate into a giant hellhole.

About every country on the planet has had its good times and its bad times; that’s one reason the original Baron Rothschild sent his sons to several different ones. Some countries, like Russia, have been living at Hard Times Central since day one; others, like the US, have had good times for a long time.

A wise man, at least in my view, doesn’t allow himself to be limited by an accident of birth.

It’s most unfortunate (for them, anyway) that most people have a peasant mentality. They’re idiotically indoctrinated into thinking that their country is the best place in the world, simply because that’s where they were born. It makes sense in a way; their ancestors rarely ventured more than a day’s walk from the village where they were born. After all, there were stories of dragons and demons over the hill. Things haven’t changed much, except people have exchanged the mud hut for a McMansion. But they’ve retained that medieval serf worldview. And the CNN and BBC newscasts on their widescreens only reinforce the notion that things are dangerous outside their borders; they’re probably even more scared than their primitive ancestors. Assuming they watch anything beside sitcoms and sports.

It’s certainly possible to be happy living your whole life in the place you were born and grew up. But unless you were born a member of the lucky sperm club, it’s almost always suboptimal, and sometimes it can be disastrous. I suspect now is one of those unhappy times.

We’re of the opinion that the world at large, and the US in particular, is heading into some seriously turbulent times. The diminution of personal and financial freedom looks like a hyperbolic curve, at first with an almost unnoticeable slope, then one that gets steeper and steeper, at an accelerating rate. I think an excellent case can be made that the current crisis is an inflexion point, beyond which it goes vertical. As one of Obama’s closest counselors (and he’s a very scary guy) has said, “One can’t let a good crisis go to waste.”

A crisis (and this will be a very real one) always draws exhortations from the authorities to “unite” and “pull together” – which usually boils down to following orders and turning in those who don’t. People will want, and will get, “strong leadership.” This does not bode well for libertarians, classical liberals, and free thinkers, in general.

As the crisis deepens, it’s likely to be dangerous for someone who doesn’t agree with groupthink. Things are likely to be much mellower if you’re living somewhere they consider you a tourist, than to stay on your home turf where questions will be asked if you don’t join the hooting and panting chimpanzees that will surround you. You can absolutely plan on unwelcome social pressure in the years to come, especially as the wars expand.

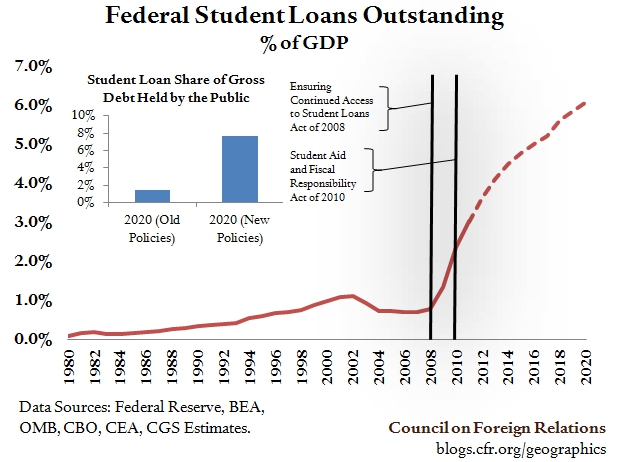

Coincidental with this is going to be the near destruction of the US dollar; I just don’t see any realistic way around that eventuality at this point. The consequences of that are going to be disastrous, but it’s possible to insulate yourself from many of them. The biggest problem, and also the one most people just don’t see, is political. There is almost no way you can effectively insulate yourself if a government, and society as a whole, goes crazy.

You might argue that really tough times in the US are a long shot; the US is “different” from other countries. It’s certainly true the US has been particularly blessed for most of its existence, because it actually was different. The problem is that what made the US different from every other country – a Constitution that expressly limited the powers of the state, and an explicit acceptance of property rights and the free market – has evanesced. It’s why I refer to it as the US, which is just another country, rather than America, which was a unique and excellent concept.

In any event, I suggest you at least consider the possibility of transplanting yourself, or at least start by transplanting some assets. Don’t look at it as a negative thing. The world is your oyster. Make the most of it. This is directed not only at Americans, but at everybody, everywhere. It just seems a little more urgent for Americans, as well as for Europeans, at this point.

In many ways the world seemed to turn over a new leaf in the ’80s. Not just with the election of Reagan and Thatcher, but with the appearance of many more like them, almost everywhere. Whether it’s the “hundredth monkey” hypothesis, or whether there really is such a thing as the “spirit of the century,” the majority of people tend to hold similar views at the same time. It’s strange. From about 1980-2000, all over the world, tax rates went down, regulation was relaxed, markets were freed up. The Soviet Union collapsed, apartheid in South Africa nonviolently disappeared, New Zealand fired two-thirds of its government employees, China liberalized. Even the constipated continents of Europe and South America loosened up. It looked like freedom was in the ascendant. But it couldn’t last.

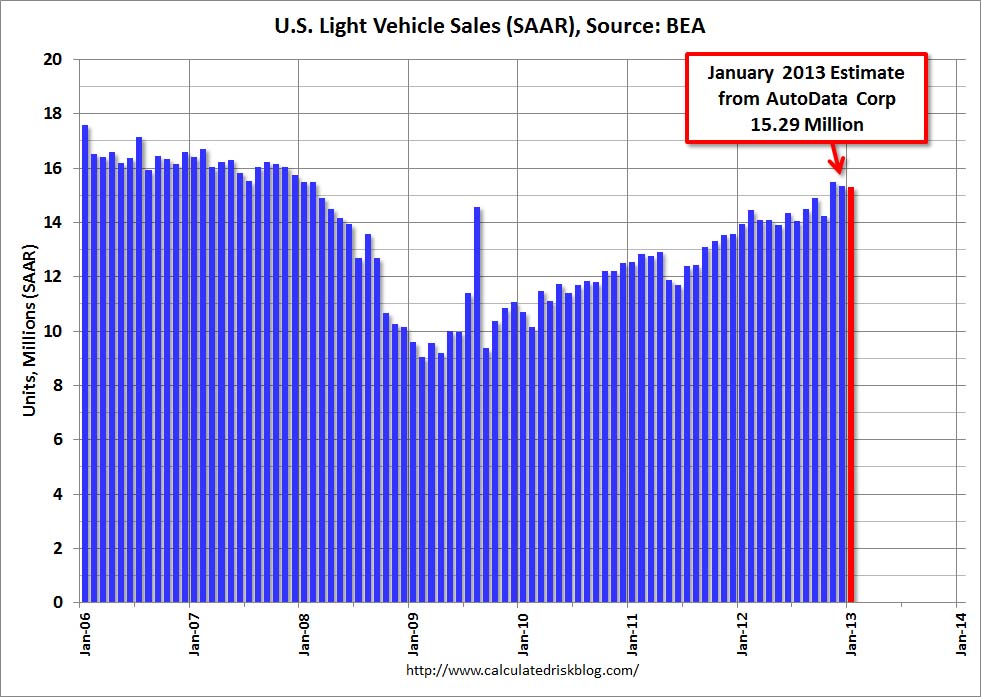

Now, certainly since September 11, 2001, the tenor of the world has changed again – radically. And the negative new trend has been supercharged by the financial crisis that began to unfold in 2007. Now practically everywhere, much higher taxes, onerous new regulations, border controls, and capital controls (to prevent the make-believe crime of money laundering), among other things, are the new order. It seems as if the clock has been turned back to the 1930s, but much worse, in that governments are much more powerful. And I fear a redux of the 1940s is in store. The whole world acted pretty much the same in the ’30s and ’40s as well, you’ll recall.

One thing I think you can plan on is foreign exchange controls. A government turns to FX controls during a currency crisis, to prevent its citizens from swapping the local currency for something foreign – transactions that would further weaken the local currency. FX controls, in effect, force people to stay with a sinking ship. But they are politically popular, for a number of reasons. They allow the government to “do something” during a crisis. They appeal to the average yahoo, partly because he doesn’t travel abroad and tends to question the patriotism of those who do. Only the rich (especially the “unpatriotic” ones) have assets out of the country, and it’s now time to eat the rich.

We’re heading into a currency crisis for the record books, and I think you can plan your life around some type of FX controls. If you don’t get significant assets out of your home country now, you may soon find it costly and very difficult to do so. Already, very few foreign banks and brokerage firms will take accounts from US persons. But although there are reporting requirements, there’s currently no law against Americans having overseas accounts, and no laws against foreign banks and brokerage firms accepting American business. Many institutions find that it’s simply not worth the aggravation and worry to deal with Americans.

At a bare minimum, you should have a meaningful amount of gold in a foreign safe deposit box. In addition, you should own some foreign property, preferably in a location where you would enjoy spending some time. These things are currently not reportable, and it would be impractical for the government to get you to repatriate that capital.

The ideal scenario, of course, is to have your main residence in one country, your assets in another, your business in a third, and your citizenship in a fourth. That isn’t practical for most. But you can certainly get assets abroad. And you may want to consider acquiring a second citizenship, which can considerably expand your options. The International Man has a lot on this topic. It’s not necessary, and often not even desirable, to establish official residency in the country where you’d like to spend time, because that risks getting stuck in its tax system. It’s usually smarter just to leave every 90 days to renew your tourist visa and not spend more than six months per year in any one country. That way you’ll be treated as a valued tourist, who should be courted, rather than as a citizen, who can be milked like a cow.

Once you do acquire another passport, the next question is whether you should renounce your US citizenship, which could give you huge tax and regulatory benefits. As everyone knows, the US is one of the few countries in the world that taxes its citizens regardless of where they may live – although it must be said that other governments seem to be moving in this direction.

The problem with renouncing your US citizenship is that the US assesses what amounts to an exit tax on Americans who do so.

Since 2004, any high-net-worth individual who renounces his citizenship is automatically assumed to have done so for tax reasons. And any individual deemed to have expatriated for tax reasons is deemed to have sold all his assets at fair market value on his last day as a US citizen. And, if the expatriate spends more than 120 days per year in the US, he can be taxed on his worldwide income and potentially is subject to estate tax.

In the near future, however, even that option may not be feasible. So let’s plan ahead…

I wrote The International Man as a guide for those who were looking for a place that could offer more of what they want. I can’t rewrite the book in this short report. But it’s worth making a few observations about the world in general, then about some areas and countries in particular.

First, there may not actually be any one “best” place, simply because you’re dealing with the human animal, who’s subject to all manner of fears, hysteria, vices, and assorted aberrations. I don’t know where Shangri-La is located. Therefore, you want some degree of diversification, so you always have a “Plan B” available.

Second, there are roughly 225 distinct political entities around the world, and there are likely to be more as time goes on. There are advantages to places that are unstable, poor, repressed, and backward, just as there are disadvantages to places that are stable, rich, free, and advanced. A lot depends on who you are and what you want to do. Try to keep an open mind.

Third, I don’t think there’s any doubt that the West – meaning North America, Europe, Australia/New Zealand, and Japan – is in relative decline. Meanwhile, places like China, India, and Vietnam are on the way up.

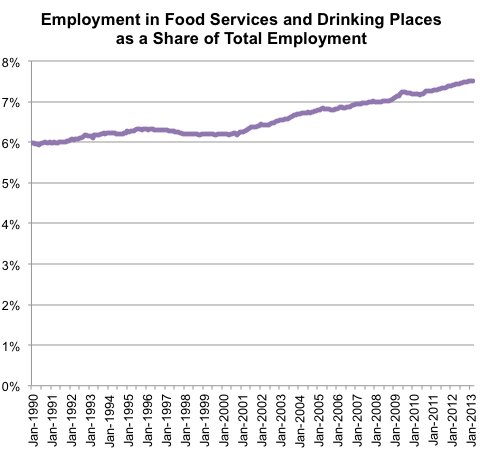

The reasons are simple. In the developing world, a worker earns between 1/5 and 1/30 what his counterpart does in the West. But he’s just as smart, might be even better educated, is likely to work twice as hard, and has less of an attitude of entitlement. It may be true (but less and less) that the developing country has less infrastructure. But now a number of them have telecoms, roads, airports, and such that are among the world’s newest and best, while many of those in the West are falling apart. At the same time, the general level of taxes and regulation tends to be much lower in developing countries; that’s a big reason why they’re developing. Part of the better social ambiance is reflected in people being free of debt; they may not make much, but they save something like 10% to 20% of what they do make. So, instead of a mountain of debt that must be paid off, there’s a growing pool of savings to be invested.

The days of automatically having the odds tilted in your favor simply because you were born an American are coming to an end. By the end of this century, wages will be more or less normalized the world over. Americans also have had a huge advantage in speaking English, the world’s most commonly spoken language, its lingua franca, and the language of science, business, aviation, entertainment, and other fields. But that advantage is also diminishing, as almost every educated person now has English as a second language. Most Americans have only English.

Negatives? Many of these places have large bureaucracies, as a legacy from buying into various strains of socialism imported from Europe. There may not be much regulation (of the type we have in the West), but there are still plenty of forms that need to be processed and approved. In order to make things happen, bribes must be paid. I’ve discussed the ethical implications of paying bribes in the past, but suffice it to say that as developing countries become freer and wealthier, bribery and general corruption will likely diminish. At the same time, as the US becomes less free and wealthy, bribery and general corruption will greatly increase.

I think it’s incumbent upon any self-directed free man to go where he can most fully realize himself. But where that is depends on who he is. And sometimes happenstance plays a part. I’m reminded of one of my favorite scenes in Casablanca. Claude Rains, as Renault the police inspector, asks Bogart:

“Rick, how’d a guy like you ever wind up in Casablanca?”

“I came for the water.”

“But there’s no water in Casablanca – this place is a desert…”

“Yeah, I was misinformed.”

Doug Casey is chairman of Casey Research and a highly sought-after speaker on investments and the economy. At 2 p.m. EDT on Tuesday, April 30, you can hear him discuss how to legally move your assets abroad in a special web event, titled Internationalize Your Assets. Joining him will be Euro Pacific Capital Chief Global Strategist and CEO Peter Schiff; GoldSilver.com founder and owner Michael Maloney; World Money Analyst Editor Kevin Brekke; and Casey Research Managing Director David Galland.

Get the details and register here.