Fascinating report put out by the Census Bureau this morning. Here are some key points:

- The nation’s official poverty rate in 2010 was 15.1 percent, up from 14.3 percent in 2009, the third consecutive annual increase in the poverty rate.

- There were 46.2 million people in poverty in 2010, up from 43.6 million in 2009, the fourth consecutive annual increase and the largest number in the 52 years for which poverty estimates have been published

- The number of people without health insurance coverage rose from 49.0 million in 2009 to 49.9 million in 2010, while the percentage without coverage -16.3 percent – was not statistically different from the rate in 2009.

- Breaking it down by ethnicity, living in poverty were 27.4% of all blacks, and 26.6% of all Hispanics. White, non Hispanics and Asians were doing better at 9.9% and 12.1% respectively.

Looks like us white folks are doing better than those minorities. I find this data fascinating. The number of people in poverty rose for the fourth consecutive year to an all-time high. But how could that be? Our very own government reported that Real GDP grew 3.0% in 2010. How could more people go into poverty if the economy grew strongly? It’s because the economy did not grow. The GDP numbers are a lie. The government borrowed from the Chinese, transferred the money to the poor and called it income.

The only people who recovered in 2010 were Wall Street bankers and big corporation CEOs like Immelt. The average person’s life got worse – little or no pay increases, higher food costs, and higher energy costs. If the economy had actually recovered in 2010, why did 6 million MORE people go on food stamps since 2009?

Obama and his minions got everything they asked for in 2009. They had both houses of Congress and they passed their plan, lock, stock and barrel. But somehow their Keynesian solutions led to greater poverty, 23% unemployment, and declining household income. Are you shocked that blacks and hispanics have almost three times the poverty of whites? When more than half your population is born out of wedlock and 50% of your kids drop out of high school and you depend on the government to pay your way in the world, what do you expect. At least they still have their Direct TV, cell phones, and SNAP cards.

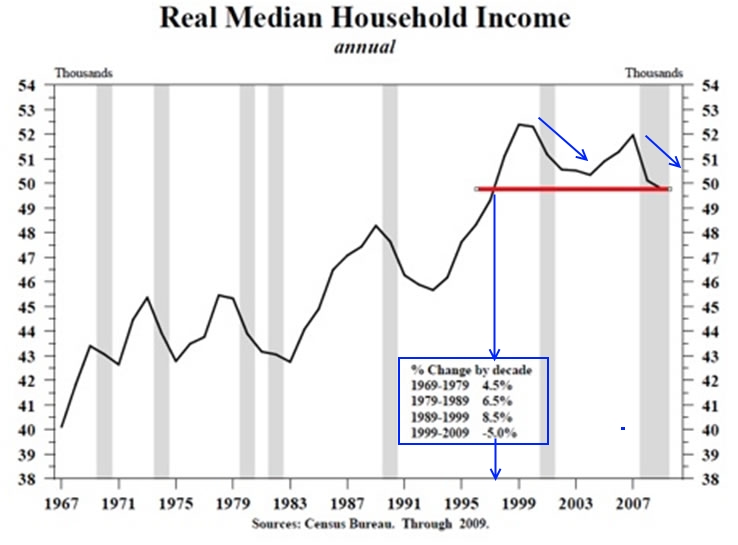

The most revolting figure in the report is the real median household income of $49,445. This means 50% of the households in the U.S. make less than $49,445 per year. Below is a chart showing the real median household income going back to 1975. It is now lower than it was in 1997 and 6% below the peak, reached in 1999. Imagine the result if we used the real rate of inflation, rather that the government manipulated piece of shit called the CPI. My educated guess would be that real median household income is lower than it was in 1986.

| Year | No. of Households | Nominal $ | Inflation Adjusted $ |

| 2009 | 117,538,000 | $49,777 | $49,777 |

| 2008 | 117,181,000 | $50,303 | $50,303 |

| 2007 | 116,783,000 | $50,233 | $52,163 |

| 2006 | 116,011,000 | $48,201 | $51,473 |

| 2005 | 114,384,000 | $46,326 | $51,093 |

| 2004 | 113,343,000 | $44,334 | $50,535 |

| 2003 | 112,000,000 | $43,318 | $50,711 |

| 2002 | 111,278,000 | $42,409 | $50,756 |

| 2001 | 109,297,000 | $42,228 | $51,356 |

| 2000 | 108,209,000 | $41,990 | $52,500 |

| 1999 | 106,434,000 | $40,696 | $52,587 |

| 1998 | 103,874,000 | $38,885 | $51,295 |

| 1997 | 102,528,000 | $37,005 | $49,497 |

| 1996 | 101,018,000 | $35,492 | $48,499 |

| 1995 | 99,627,000 | $34,076 | $47,803 |

| 1994 | 98,990,000 | $32,264 | $46,351 |

| 1993 | 97,107,000 | $31,241 | $45,839 |

| 1992 | 96,426,000 | $30,636 | $46,063 |

| 1991 | 95,669,000 | $30,126 | $46,445 |

| 1990 | 94,312,000 | $29,943 | $47,818 |

| 1989 | 93,347,000 | $28,906 | $48,463 |

| 1988 | 92,830,000 | $27,225 | $47,614 |

| 1987 | 91,124,000 | $26,061 | $47,251 |

| 1986 | 89,479,000 | $24,897 | $46,665 |

| 1985 | 88,458,000 | $23,618 | $45,069 |

| 1984 | 86,789,000 | $22,415 | $44,242 |

| 1983 | 85,407,000 | $20,885 | $42,910 |

| 1982 | 83,918,000 | $20,171 | $43,212 |

| 1981 | 83,527,000 | $19,074 | $43,328 |

| 1980 | 82,368,000 | $17,710 | $44,059 |

| 1979 | 80,776,000 | $16,461 | $45,498 |

| 1978 | 77,330,000 | $15,064 | $45,625 |

| 1977 | 76,030,000 | $13,572 | $43,925 |

| 1976 | 74,142,000 | $12,686 | $43,649 |

| 1975 | 72,867,000 | $11,800 | $42,936 |

The average family in the US is making much less money than they were 12 years ago. This supports John Williams contention that the US has virtually been in a decade long recession, despite what the government and main stream media report.

The situation continues to deteriorate. These families made up for their decline in income, by increasing their credit card, auto loan and student loan debt from $1.4 trillion in 1999 to $2.5 trillion today. Without jobs, incomes can’t rise. The Obama solution will be to funnel more of your money to those classified as in poverty. The only solution that will work is to liquidate the banks, liquidate the debt, wipe out those who made bad decisions, and start over. No one wants to accept the reality of this solution. It is too painful. It is mean and brutish. Tough shit. It is the only way. We could soften the blow by withdrawing our troops from around the globe, protecting our own borders and freeing up hundreds of billions in war spending for domestic purposes. What a concept – building bridges in the U.S. rather than rebuilding bridges we blew up in Iraq.

Otherwise we will continue on a path of ever declining income and bankers enriching themselves at our expense. But, at least I’m white. I got that going for me.

Income, Poverty and Health Insurance Coverage in the United States: 2010

Summary of Key Findings

The U.S. Census Bureau announced today that in 2010, median household income declined, the poverty rate increased and the percentage without health insurance coverage was not statistically different from the previous year.

Real median household income in the United States in 2010 was $49,445, a 2.3 percent decline from the 2009 median.

The nation’s official poverty rate in 2010 was 15.1 percent, up from 14.3 percent in 2009 ─ the third consecutive annual increase in the poverty rate. There were 46.2 million people in poverty in 2010, up from 43.6 million in 2009 ─ the fourth consecutive annual increase and the largest number in the 52 years for which poverty estimates have been published.

The number of people without health insurance coverage rose from 49.0 million in 2009 to 49.9 million in 2010, while the percentage without coverage −16.3 percent – was not statistically different from the rate in 2009.

This information covers the first full calendar year after the December 2007-June 2009 recession. See section on the historical impact of recessions.

These findings are contained in the report Income, Poverty, and Health Insurance Coverage in the United States: 2010. The following results for the nation were compiled from information collected in the 2011 Current Population Survey (CPS) Annual Social and Economic Supplement (ASEC):

Income

- Since 2007, the year before the most recent recession, real median household income has declined 6.4 percent and is 7.1 percent below the median household income peak that occurred prior to the 2001 recession in 1999. The percentages are not statistically different from each another.

Race and Hispanic Origin (Race data refer to people reporting a single race only. Hispanics can be of any race.)

- Among race groups, real median income declined for white and black households between 2009 and 2010, while changes for Asian and Hispanic-origin households were not statistically different. Real median income for each race and Hispanic-origin group has not yet recovered to the pre-2001 recession all-time highs. (See Table A.)

Regions

- Households in the Midwest, South and West experienced declines in real median income between 2009 and 2010. The apparent change in median household income for the Northeast was not statistically significant. (See Table A.)

Nativity

- Median income for households maintained by native-born householders declined between 2009 and 2010 in real terms. The change in the median income of all foreign-born households was not statistically significant. (See Table A.)

Earnings

- In 2010, the earnings of women who worked full time, year-round were 77 percent of that for men working full time, year-round, not statistically different from the 2009 ratio. The 2010 real median earnings of these men and women were not different from the 2009 earnings.

- Since 2007, the number of men working full time, year-round with earnings decreased by 6.6 million and the number of corresponding women declined by 2.8 million.

Income Inequality

- Based on the Gini Index, the change in income inequality between 2009 and 2010 was not statistically significant, while the changes in shares of aggregate household income by quintiles showed a slight shift to more inequality. The Gini index was 0.469 in 2010. (The Gini index is a measure of household income inequality; zero represents perfect income equality and 1 perfect inequality.)

Poverty

- The poverty rate in 2010 was the highest since 1993 but was 7.3 percentage points lower than the poverty rate in 1959, the first year for which poverty estimates are available. Since 2007, the poverty rate has increased by 2.6 percentage points.

- In 2010, the family poverty rate and the number of families in poverty were 11.7 percent and 9.2 million, respectively, up from 11.1 percent and 8.8 million in 2009.

- The poverty rate and the number in poverty increased for both married-couple families (6.2 percent and 3.6 million in 2010 from 5.8 percent and 3.4 million in 2009) and female-householder-with-no-husband-present families (31.6 percent and 4.7 million in 2010 from 29.9 percent and 4.4 million in 2009). For families with a male householder no wife present, the poverty rate and the number in poverty were not statistically different from 2009 (15.8 percent and 880,000 in 2010).

Thresholds

- As defined by the Office of Management and Budget and updated for inflation using the Consumer Price Index, the weighted average poverty threshold for a family of four in 2010 was $22,314.

(See <http://www.census.gov/hhes/www/poverty/data/threshld/index.html> for the complete set of dollar value thresholds that vary by family size and composition.)

Race and Hispanic Origin (Race data refer to people reporting a single race only. Hispanics can be of any race.)

- The poverty rate for non-Hispanic whites was lower in 2010 than it was for other racial groups. Table B details 2010 poverty rates and numbers in poverty, as well as changes since 2009 in these measures, for race groups and Hispanics.

Doubled-Up Households

- Doubled-up households are defined as households that include at least one “additional” adult: a person 18 or older who is not enrolled in school and is not the householder, spouse or cohabiting partner of the householder. In spring 2007, prior to the recession, doubled-up households totaled 19.7 million. By spring 2011, the number of doubled-up households had increased by 2.0 million to 21.8 million and the percent rose by 1.3 percentage points from 17.0 percent to 18.3 percent.

- In spring 2011, 5.9 million young adults age 25-34 (14.2 percent) resided in their parents’ household, compared with 4.7 million (11.8 percent) before the recession, an increase of 2.4 percentage points.

- It is difficult to precisely assess the impact of doubling up on overall poverty rates. Young adults age 25-34, living with their parents, had an official poverty rate of 8.4 percent, but if their poverty status were determined using their own income, 45.3 percent had an income below the poverty threshold for a single person under age 65.

Age

- The poverty rate increased for children younger than 18 (from 20.7 percent in 2009 to 22.0 percent in 2010) and people 18 to 64 (from 12.9 percent in 2009 to 13.7 percent in 2010), while it was not statistically different for people 65 and older (9.0 percent).

- Similar to the patterns observed for the poverty rate in 2010, the number of people in poverty increased for children younger than 18 (15.5 million in 2009 to 16.4 million in 2010) and people 18 to 64 (24.7 million in 2009 to 26.3 million in 2010) and was not statistically different for people 65 and older (3.5 million).

Nativity

- The 2010 poverty rate for naturalized citizens was not statistically different from 2009, while the poverty rates of native-born and noncitizens increased. Table B details 2010 poverty rates and the numbers in poverty, as well as changes since 2009 in these measures, by nativity.

Regions

- The South was the only region to show statistically significant increases in both the poverty rate and the number in poverty — 16.9 percent and 19.1 million in 2010 — up from 15.7 percent and 17.6 million in 2009. In 2010, the poverty rates and the number in poverty for the Northeast, Midwest and the West were not statistically different from 2009. (See Table B.)

Health Insurance Coverage

- The number of people with health insurance increased to 256.2 million in 2010 from 255.3 million in 2009. The percentage of people with health insurance was not statistically different from 2009.

- Between 2009 and 2010, the percentage of people covered by private health insurance declined from 64.5 percent to 64.0 percent, while the percentage covered by government health insurance increased from 30.6 percent to 31.0 percent. The percentage covered by employment-based health insurance declined from 56.1 percent to 55.3 percent.

- The percentage covered by Medicaid (15.9 percent) was not statistically different from 2009.

- In 2010, 9.8 percent of children under 18 (7.3 million) were without health insurance. Neither estimate is significantly different from the corresponding 2009 estimate.

- The uninsured rate for children in poverty (15.4 percent) was greater than the rate for all children (9.8 percent).

- In 2010, the uninsured rates decreased as household income increased from 26.9 percent for those in households with annual incomes less than $25,000 to 8.0 percent in households with incomes of $75,000 or more.

Race and Hispanic Origin (Race data refer to those reporting a single race only. Hispanics can be of any race.)

- The uninsured rate and number of uninsured in 2010 were not statistically different from 2009 for non-Hispanic whites and blacks, while increasing for Asians. The number of uninsured Hispanics was not statistically different from 2009, while the uninsured rate decreased to 30.7 percent. (See Table C.)

Nativity

- The proportion of the foreign-born population without health insurance in 2010 was about two-and-a-half times that of the native-born population. The 2010 uninsured rate was not statistically different from the 2009 rate for native-born, the foreign-born overall and noncitizens but rose for naturalized citizens. Table C details the 2010 uninsured rate and the number of uninsured, as well as changes since 2009 in these measures, by nativity.

Regions

- The Northeast and the Midwest had the lowest uninsured rates in 2010. Between 2009 and 2010, there were no statistical differences in uninsured rates for any of the regions. The number of uninsured increased in the Northeast, while there were no statistically significant changes for the other three regions. (See Table C.)

Historical Impact of Recessions

Since 2010 represents the first full calendar year after the recession that ended in June 2009, one can compare changes in income, poverty and health insurance coverage between 2009 and 2010 with changes during the first year after the end of other recessions:

- Median household income declined the first full year following the December 2007 to June 2009 recession, as well as in the first full year following three other recessions (March 2001 to November 2001, January 1980 to July 1980 and December 1969 to November 1970). However, household income increased the first full year following the November 1973 to March 1975 recession, and the changes following the July 1990 to March 1991 and July 1981 to November 1982 recessions were not statistically significant.

- The poverty rate and the number of people in poverty increased in the first calendar year following the end of the last three recessions. For the recessions that ended in 1961 and 1975, the poverty rate decreased in the next full calendar year.

- After the most recent recession, there was no significant difference in the uninsured rate during the first full year after the recession. However, in the year following the recessions that ended in 1991 and 2001, the uninsured rate increased.

Supplemental Poverty Measure

The Census Bureau’s statistical experts, with assistance from the Bureau of Labor Statistics and in consultation with the Office of Management and Budget, the Economics and Statistics Administration and other appropriate agencies and outside experts, are now developing a Supplemental Poverty Measure. The Supplemental Poverty Measure, for which the Census Bureau expects to publish preliminary estimates in October 2011, will provide an additional measure of economic well-being. It will not replace the official poverty measure and will not be used to determine eligibility for government programs. See Income, Poverty, and Health Insurance Coverage in the United States: 2010 for more information.

The Current Population Survey Annual Social and Economic Supplement is subject to sampling and nonsampling errors. All comparisons made in the report have been tested and found to be statistically significant at the 90 percent confidence level, unless otherwise noted.

For additional information on the source of the data and accuracy of the estimates for the CPS, visit <http://www.census.gov/hhes/www/p60_239sa.pdf>.

![[Review & Outlook]](http://sg.wsj.net/public/resources/images/ED-AI932_1stimu_NS_20090127200020.gif)