Today is election day. The only people who don’t have to work on election day are government drones. The weather today is identical to the weather yesterday in Philly. My commute this morning to work was 15 minutes faster than yesterday. Since there were no government drones on the road today, I’ve concluded that my one way commute GOVERNMENT DRONE FACTOR = 15 MINUTES. So, besides the thousands of dollars per year I pay in taxes to support these overpaid underworked government drones, they also cost me 30 minutes per day of my life by clogging up the highways. As cities, states and the Feds run out of our money, government drones will be purged from the workforce. I can’t wait for my GOVERNMENT DRONE FACTOR to decline to 5 minutes.

Category: Politics

NOTHING TO LOSE

Does anyone else see a pattern? Do you realize many of the events that are occurring in our society on a regular basis are connected? Six weeks ago a young man killed 12 people at the Washington DC Navy Yard. He was clearly angry at the government for discharging him from the military. The MSM declared him mentally ill. A couple weeks later a dental hygenist from Connecticut tried to drive her car past White House guards and was shot dead. She was distraught by the actions of the government. The MSM declared her mentally ill. John Constantino, a 64 year old military veteran, self immolated on the National Mall a few days later as a protest against the government. The MSM barely covered the story, but declared him mentally ill. His neighbors begged to differ. Earlier this week a 20 year old man went on a shooting spree at LAX, killing a TSA agent. He specifically wanted to kill government employees. The MSM will declare him mentally ill in the near future. Last night another 20 year old man went on a shooting spree at the Garden State Plaza Mall and eventually killed himself. The MSM is blaming it on drugs.

The MSM propaganda machine is in the business of propping up the status quo. They are part of the status quo. The existing establishment is getting rich from the existing dynamic in this country. What we are witnessing is young people who are being driven off the deep end by the injustice, corruption, and lawlessness of our system. The acts of all these people are acts of hopelessness. Their “mental illness” is brought on by a culture of greed, materialism, and pillaging by the people controlling the levers of power. The MSM and Obama will blame guns for the problem, because they sense the rising anger in the country and want to disarm those who can see clearly what is happening. The scent of revolution is in the air.

These are not isolated instances. They are connected. There are 317 million people in this country and there are millions of young, disillusioned, angry people who are losing hope. When people have lost everything and have nothing more to lose, they lose it. This is a Fourth Turning. The mood of the country darkens by the minute. The instances of seemingly random violence will increase. I wouldn’t be going to any malls in the near future. They are such inviting targets for someone who wants to produce mass casualties.

The American sheeple respond well to fear and propaganda. But, if they start fearing malls, the existing establishment will crumble quickly. They need people to spend money they don’t have to keep this Ponzi scheme going. If you want to contribute to the downfall of the establishment, stop shopping. Today is election day. Don’t vote. Withdrawal all your support from the existing paradigm. If you have money withheld from your paycheck, increase the number of exemptions on your W-4 and reduce their tax revenues. Barter. Conduct cash transactions with people. Spread discontent whenever possible. Point out the corruption and evil of those in charge to anyone who will listen. It’s time for a little anarchy.

“Remember, remember, the Fifth of November, the Gunpowder Treason and Plot. I know of no reason why the Gunpowder Treason should ever be forgot… But what of the man? I know his name was Guy Fawkes and I know, in 1605, he attempted to blow up the Houses of Parliament. But who was he really? What was he like? We are told to remember the idea, not the man, because a man can fail. He can be caught, he can be killed and forgotten, but 400 years later, an idea can still change the world. I’ve witnessed first hand the power of ideas, I’ve seen people kill in the name of them, and die defending them… but you cannot kiss an idea, cannot touch it, or hold it… ideas do not bleed, they do not feel pain, they do not love… And it is not an idea that I miss, it is a man… A man that made me remember the Fifth of November. A man that I will never forget.”

Evey Hammond

Garden State Plaza Mall Shooting Ends With Gunman Taking His Life

Submitted by Tyler Durden on 11/05/2013 07:09 -0500

Last’s night latest mass shooting event, just three days after a comparable situation at LAX airport, and this time just minutes away from New York City, is over with the alleged gunman, Richard Shoop, 20, taking his life.

The gunman who opened fire inside a sprawling New Jersey mall was found dead inside the mall early this morning with a self-inflicted gunshot wound, authorities said.

Authorities identified the suspect as Richard Shoop, 20, of Teaneck, N.J., and said his body was found in a back area of mall around 3:20 a.m.

Police discovered his body more than six hours after they say Shoop entered the Westfield Garden State Plaza Mall Monday night and fired his weapon at least six times, Bergen County Prosecutor John Molinelli said at an early morning news conference. The gun, described as a modified rifle, was owned lawfully by his brother, Molinelli said.

Police are still sweeping the 2.2-million-square-foot building in Paramus to make sure all shoppers and employees evacuated. About 400 people were still inside the mall when police ordered a lockdown of the entire building.

There have been no other reported injuries at this time.

Shoop, according to Molinell, has a history of drug abuse and is known to law enforcement in Bergan County. Molinell said Shoop’s drug of choice was MDMA, also known as “Molly.”

Police found a suicide note at Shoop’s home, but did not disclose what was written.

Bergan County spokeswoman Jeanne Baratta said the first call came in shortly after 9 p.m. that a gunman was inside the mall. Police initially responded to an “active shooter” alert after reports of multiple shots fired.

Baratta said SWAT teams and other police agencies converged on the mall. Authorities swept the mall because they were unsure whether the gunman was still inside. Paramus Mayor Rich LaBarbiera intially said police found one shell casing inside the mall.

Panicked shoppers raced toward the exits or hid inside the mall. Witnesses said they saw authorities running inside the mall with their weapons drawn. The mall was immediately placed on lockdown.

Multiple eyewitnesses said the shooter was armed with some kind of rifle, wearing a motorcycle-style helmet and black clothing.

WATCH: Police Respond to Shooting at New Jersey Shopping Mall

Mall restaurant employee Joseph Rivera said his co-workers saw the suspect “…in full body armor. He had a huge rifle and a helmet on.”

Eric Delgado, 20, was shopping with friends inside the mall when heard a gunshot and saw the gunman. After Delgado saw the gunman, he along with seven others hid in a dressing room for 45 minutes and heard a second gunshot.

“He didn’t seem that he wanted to kill anyone because he clearly could of because there were people two feet in front of him that he could have shot at, but he didn’t shoot at them. Instead he shot towards the ceiling…” Delgado said.

A staging area has been set up near Chili’s Grill & Bar for family members to be reunited with anyone inside the mall during the lockdown.

Law enforcement officials have been informed by management of the Garden State Plaza Mall that it will be closed today. No word on when it will re-open.

The Garden State Plaza Mall, about 25 miles west of New York City, features more than 300 retail stores including Neiman Marcus, Nordstrom, Lord & Taylor, Gucci and Louis Vuitton.

The Top 6 Reasons Why Everyone Needs a Second Passport

The Top 6 Reasons Why Everyone Needs a Second Passport

By Nick Giambruno, Editor, International Man

Doug Casey has said over and over that spreading your political risk beyond one jurisdiction is the single most important thing he can recommend today.

Obtaining a second passport and citizenship in another country is a critical part in heeding Doug’s advice.

This is because it’s a fundamental step towards minimizing the political risk of being subjected to the whims of any single government.

The political diversification benefits that come with obtaining a second passport are universal and prudent for anyone in the world to obtain… especially those under a desperate (fiscally or otherwise) government.

Here are the top six reasons why everyone needs a second passport.

Reason #1: More Internationalization Options

Obtaining a second passport can literally open the door to a world of internationalization options for your assets and income that are off limits to citizens of certain countries. This is especially true for Americans, who are often treated as if they have the plague when they attempt to open foreign financial accounts and are increasingly being forced to close the ones they already have.

Due to the ever-growing pile of regulations, foreign banks and brokerages are making the logical business decision that the costs of compliance outweigh any benefits of having Americans as clients. Opening a foreign financial account as an American citizen ranges from being impossible to very difficult in most circumstances.

When you consider the totality of it, these vast regulations amount to a soft form of capital controls, which will likely turn into overt capital controls at some point in the future.

Obtaining a second passport can also make purchasing real estate in foreign countries easier. For example, while it is an excellent place to consider for a bolt-hole, Switzerland is a notoriously difficult place for a foreigner to purchase real estate. However, certain foreigners (EU citizens) have fewer restrictions imposed on them others.

Reason #2: More Visa-Free Travel

One characteristic of a good passport is how much visa-free travel it allows. Applying for a visa that has to be approved before your trip (as opposed to being able to obtain it at the border) is a real hassle. Having to jump through hoops in advance of a trip can be a frustrating, time-consuming, and costly process.

Brazil, Chile, and Argentina all collect a visa fee (of about US$160) from travelers who present a US passport.

According to a recent study, Finnish and Swedish passports offer visa-free travel to the most countries. Not surprisingly, a country like Afghanistan has one of the least useful passports. You can find more information on this study as well as the rankings of countries according to the visa-free access of their passports here.

Reason #3: Avoid Foreign Policy Blowback

If your home government has developed a bad habit of sticking its nose in the internal affairs of other nations, it could make you a target should you happen to be in the wrong place at the wrong time. Like an upscale shopping mall in Kenya in late September 2013.

There are, of course, passports that have minimal foreign policy blowback risk. For example, when was the last time you saw Swiss passport holders targeted?

Reason #4: Preempt Travel/People Controls

A second passport can also come in handy when a government decides to starting treating its own citizens as beef cows instead of milking cows (i.e., when they need more soldiers for war) or if passport restrictions and other types of people controls are implemented.

In any case, it prevents your home government from basically placing you under house arrest by revoking or cancelling your passport for any reason it sees fit.

The Syrian government, for example, previously refused to renew the passports of Syrians abroad whom it suspected of being associated with the opposition. This is not surprising and should have been completely predictable. Any government could and would behave in a similar manner as they all have the ability to revoke the citizenship and/or passport of their citizens at a moment’s notice under any pretext that they find convenient. Just look at how the US cancelled Edward Snowden’s passport by fiat.

It is not inconceivable that the US government would make it more difficult for Ron Paul supporters and libertarians to travel internationally one day in the future. Heck, they have already taken the first step and labeled them potential domestic terrorists.

The bottom line is that if you hold political views that the establishment of your home government does not like, don’t be surprised when they decide to restrict your travel options. In this case, having the political diversification that comes from having a second passport is even more important.

Reason #5: You Don’t Have to Live Like a Refugee

It’s like how the old Tom Petty song goes… “You don’t have to live like a refugee.”

Having a second passport ensures that you will always have another place to potentially call home, another place where you will always have the legal right to live and work. In worst case scenarios, a second passport guarantees that once you get out of Dodge, you won’t have to live like a refugee.

Having citizenship in another country gives you the legal right to live and work there and possibly other countries. EU citizens have the right to live and work in the 28 member countries.

Reason #6: Renunciation

In all likelihood, you will need a second passport should you decide to take the drastic step of renouncing your citizenship. This allows you to reap huge tax and regulatory benefits if your home country burdens its citizens with suffocating and inescapable tax policies.

It should be noted that the US has what amounts to an “exit tax” for citizens who renounce and meet certain conditions. This puts a premium on renouncing before you qualify to be stung with the “exit tax.” It is an especially attractive option for entrepreneurial and internationally-mobile young Americans who have a large portion of their potential earnings still in the future.

Of course, few will actually follow the path of Facebook co-founder Eduardo Saverin or singer Tina Turner and take the extreme step of renunciation. And you certainly don’t need to. There are MANY other ways you can internationalize and reduce your political risk.

Not Easy, But Necessary

Unfortunately, there are no paths to obtaining a legitimate second passport that are at the same time fast, easy, and inexpensive.

However this does not diminish the necessity of doing so. Political risk is growing in most parts of the world (especially the West). This is especially true for countries in deteriorating fiscal health, which will predictably turn to increasing measures to squeeze their citizenry for every penny they can get away with.

You have probably noticed there is a lot of misinformation and bad advice out there regarding second passports, which, if followed, could likely end up causing you significant problems and limiting your options. Your goal should be the opposite: minimizing your problems and expanding your options.

It is essential in these shark-infested waters to have a trusted resource like Casey Research to provide you with reliable information. You can find our top picks for the best countries to obtain a second passport in and how to do it here.

CORPORATE FASCIST STATE

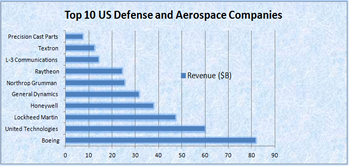

There are 10 mega-corporations that control the food and consumer product market in the United States, keeping the masses consuming processed food and taking pills to counter the effects of the processed foods. There are 6 mega-corporations that control the mass media (propaganda) outlets, keeping the sheep controlled and distracted. There are 8,500 banks in the United States and the top 10 mega-banks control 54% of all deposits, control 90% of the credit card market, and control 80% of the mortgage market. In 1990 there were more than 15,000 banks and the top 10 controlled only 20% of the deposits. Too Big to Control or Trust. There are essentially 7 mega-corporations that deal the majority of arms in the world. They are the military industrial complex. They love war. They promote war. They profit from misery, death and destruction. The healthcare industrial complex is dominated by 11 mega-corporation drug dealers. They never seem to cure anything, but they sure can treat you with drugs for life. Much better for the bottom line.

In reality, less than 50 mega-corporations control our lives. They control our politicians. They control our government. They use their immense profits to buy influence. They buy off our politicians with campaign contributions and bribes. They buy off officials at all levels of Federal, State, and local government. They pay for tax laws that benefit them. They write the laws and regulations governing their industries. They collude to further enrich themselves at the expense of the citizens. You are living in a corporate fascist state. If you can’t see that, you must be dependent upon the good graces of these mega-corporations.

CODE NAME PUFFERFISH

I find it hysterical that Romney’s campaign gave Christie the code name “PUFFERFISH” when they were vetting vice presidential candidates. Christie is an asshole. He is an obese prick. He blusters about unions and cutting spending, but it is a bullshit storyline. He kissed Obama’s bony ass for his Sandy relief and then spent it on campaign commercials. He loves photo ops, as long as the camera has a wide angle lense. His idea of consensus is to spend more of your money. His annual budget has more spending than Corzine’s last budget. He is positioning himself as the moderate Republican candidate in 2016. He kisses the asses of Democrats on social and spending issues, while acting like a neo-con on foreign affairs issues. The worst of both worlds wrapped in bacon. He would be a disaster as president. He is in the back pocket of Wall Street and they must have really big pockets to fit Pufferfish in there.

NEW BOOK ON ROMNEY CAMPAIGN AND RUNNING MATE SELECTION: Chris Christie’s Checkered Past “Littered With Land Mines”

In the nine months since Christie’s endorsement of Romney in October 2011, Boston had formed a mixed view of the governor who George W. Bush had once nicknamed Big Boy. Christopher James Christie, 51, was less than two years into his first term as governor of New Jersey, suave as sandpaper and morbidly obese. He was also one of the most intriguing figures in American politics. His voice was like an air horn, cutting through the clutter. There was no one better at making the referendum case against Obama, at nailing the President to the wall with ferocity and caustic humor. Christie’s temperament was ideally suited to the unfolding tenor of the race. “We’re in a street fight, and he’s a street fighter,” Romney’s chief strategist Stuart Stevens told Romney. “He’s the best street fighter—and he’s comfortable saying things that you’re not comfortable saying.”

He was also a fundraising dynamo, but he and his staff were overbearing and hard to work with, demanding in ways that would have been unthinkable from any other surrogate. Months earlier, Christie had banned Romney from raising money in New Jersey until Christie had given the O.K. to do so—a move Romney found galling, like something out of The Sopranos. Are you kidding me, Mitt thought. He’s going to do that? There were plenty of New Jersey donors who’d given money to Mitt in 2008; now Christie was trying to impose a gag order on talking to them? “He sounds like the biggest asshole in the world,” Stevens griped to his partner, Russ Shriefer. More recently, Trenton insisted on private jets, lavish spreads of food, space for a massive entourage. Romney ally Wayne Berman looked at the bubble around Christie and thought, He’s not the President of the United States, you know.

Chronically behind schedule, Christie made a habit of showing up late to Romney fundraising events. In May he was so tardy to a donor reception at the Grand Hyatt New York that Mitt wound up taking the stage to speak before Christie arrived. When the Jersey governor finally made his grand entrance, it was as if Mitt had been his warm-up act…

…The list of questions Myers and her team had for Christie was extensive and troubling. More than once, Myers reported back that Trenton’s response was, in effect, Why do we need to give you that piece of information? Myers told her team, We have to assume if they’re not answering, it’s because the answer is bad.

The vetters were stunned by the garish controversies lurking in the shadows of his record. There was a 2010 Department of Justice inspector general’s investigation of Christie’s spending patterns in his job prior to the governorship, which criticized him for being “the U.S. attorney who most often exceeded the government [travel expense] rate without adequate justification” and for offering “insufficient, inaccurate, or no justification” for stays at swank hotels like the Four Seasons. There was the fact that Christie worked as a lobbyist on behalf of the Securities Industry Association at a time when Bernie Madoff was a senior SIA official—and sought an exemption from New Jersey’s Consumer Fraud Act…

…There was Christie’s decision to steer hefty government contracts to donors and political allies like former Attorney General John Ashcroft, which sparked a congressional hearing. There was a defamation lawsuit brought against Christie arising out of his successful 1994 run to oust an incumbent in a local Garden State race. Then there was Todd Christie, the Governor’s brother, who in 2008 agreed to a settlement of civil charges by the Securities and Exchange Commission in which he acknowledged making “hundreds of trades in which customers had been systematically overcharged.” (Todd also oversaw a family foundation whose activities and purpose raised eyebrows among the vetters.) And all that was on top of a litany of glaring matters that sparked concern on Myers’ team: Christie’s other lobbying clients, his investments overseas, the YouTube clips that helped make him a star but might call into doubt his presidential temperament, and the status of his health.

Ted Newton, managing Project Goldfish under Myers, had come into the vet liking Christie for his brashness and straight talk. Now, surveying the sum and substance of what the team was finding, Newton told his colleagues, If Christie had been in the nomination fight against us, we would have destroyed him—he wouldn’t be able to run for governor again. When you look below the surface, Newton said, it’s not pretty…

…After 11 days of teeth-gnashing labor, several of the issues that the vetters had unearthed around Christie were still unresolved. Myers and her team were sticklers. Uncomfortable producing a final report they considered incomplete, they made a point of being meticulous about framing and flagging the problems, including a refrain in bold applied to a number of items. On Todd Christie’s securities-fraud settlement: “[Governor] Christie has been asked to disclose whether Todd Christie incurred any monetary or other penalty as a result of the SEC/NYSE action. If Christie’s possible selection is to move forward, this item should be obtained.” On Christie’s defamation lawsuit: “Christie has been asked to provide the terms of the settlement of this matter. If Christie’s possible selection is to move forward, this item should be obtained.” On Christie’s household help: “Christie has been asked to provide the names and documented status of all domestic employees. This material has not been received. If Christie’s possible selection is to move forward, these items should be obtained.” On Christie’s lobbying clients: “Christie has provided only one of the twelve or so [public disclosure] filings made [in the time he was a lobbyist] … If Christie’s possible selection is to move forward, these items should be obtained.”

Then there was this: “In response to the questionnaire, Governor Christie indicates that he has no health issues that would hinder him from serving as the vice-presidential nominee. Published reports indicate that Christie suffers from asthma and was briefly hospitalized last year after he suffered an asthma attack. He is also obese and has indicated that he struggles with his weight. ‘The weight exacerbates everything,’ he is quoted as saying. Christie has been asked to provide a detailed medical report. Christie has been asked to provide a copy of all medical records from his most recent physical examination. If Christie’s possible selection is to move forward, this item should be obtained.”

Despite the language in the report indicating that Christie had not been sufficiently forthcoming with his medical records, Romney and Myers agreed that what he had provided put their minds at ease about his health. But the dossier on the Garden State governor’s background was littered with potential land mines. Between that and the pay-to play snag, there was no point in thinking about Christie further. With the clock running out, Romney pulled the plug again, this time for good…

Conservatives who’ve been following Christie already knew his background was extremely problematic.

File this story away for the run up to 2016 where the Karl Rove-led consultant class will tell us that Christie’s the only one who can win. Just like they told us McCain and Romney were the only ones who could win.

HOW LONG CAN THE DELUSION LAST?

The stock market is at extreme valuations only seen in 1929, 2000, and 2007. It is being propped up by the belief that Bernanke’s QEternity can permanently keep stock valuations valued 50% higher than historical relationships would predict. Is this time different? The answer to this question reveals whether you are a delusionist or realist.

Hussman’s article is long and filled with charts, so I’ll pick out the key takeaways.

A brief update on the bloated condition of the Federal Reserve’s balance sheet. At present, the Fed holds $3.84 trillion in assets, with capital of just $54.86 billion, putting the Fed at 70-to-1 leverage against its stated capital. Given the relatively long maturity of Fed asset holdings, even a 20 basis point increase in interest rates effectively wipes out the Fed’s capital. With the present 10-year Treasury yield already above the weighted average yield at which the Fed established its holdings, this is not a negligible consideration.

Notice though, that after the 0.25% interest that the Fed pays banks to hold their reserves idle, the Fed still turns over more than 2% in interest annually to the Treasury from its debt holdings. At an estimated portfolio duration of about 8 years, it actually takes an increase in interest rates of about 0.25% annually for capital losses to wipe out interest earnings, thereby turning monetary policy into fiscal policy by creating net losses to the Treasury. Essentially, to the extent that the Fed eventually closes its holdings at a net loss, it would be as if the Treasury borrowed at a higher interest rate than it otherwise might have.

The main concern is that the more the Fed’s balance sheet expands, the more likely it is that the exit will be problematic. Already, a normalization of Treasury bill yields to even 0.25% would require a balance sheet contraction of over $1 trillion, or additional payments to the banking system approaching $10 billion annually in order to keep reserves idle. Such payments would predictably become politically contentious very quickly. Considering how glorious the expansion of the Fed’s balance sheet has been for investors, we should not be surprised if the eventual normalization turns out to be equally inglorious.

In any event, I continue to believe that it is plausible to expect the S&P 500 to lose 40-55% of its value over the completion of the present cycle, and suspect that whatever further gains the market enjoys from this point will be surrendered in the first few complacent weeks following the market’s peak. That’s how it works. If all of this seems like hyperbole, please recall my similar concern at the 2007 peak (see Fair Value – 40% Off), and the negative 10-year return projections – even on best-case assumptions – that we correctly estimated for the S&P 500 in 2000. These numbers relate to the striking gap between present valuation levels and normal historical precedent, not to personal opinion.

Leash the Dogma

John P. Hussman, Ph.D.

It’s fascinating to hear central bankers talk about the economy, because in the span of a few seconds they can say so many things that simply aren’t supported by the evidence. For anyone planning to watch the confirmation hearings for the next Fed Chair, the evidence below is provided as something of a leash to restrain the attacking dogma.

There’s a lot of ground to cover this week – the Phillips Curve, quantitative easing, the Fed’s bloated balance sheet, the “wealth effect,” the misguided “dual mandate,” and the largely unrecognized bubble in stock prices. We have a Federal Reserve relentlessly pursuing a “trickle down” monetary policy that has weak economic effects, thin historical support, and ominous implications for future investment outcomes and the stability of the financial markets. So let’s get started.

The Phillips Curve

Consider first the notion of the “inflation-unemployment tradeoff” – the so-called Phillips Curve. Part of the reason that investors fall for this idea so easily is that many of them learned it from a nicely drawn diagram in some economics textbook. Like the one below. The idea is that as the unemployment rate rises, inflation falls, and as unemployment falls, inflation rises. The belief in this tradeoff has become so dogmatic that economists often comment about how we might intentionally target a higher rate of inflation in order to bring the unemployment rate down. Nice, clean diagrams lend themselves to such simplistic and dogmatic thinking.

Below is what the actual data look like, depending on exactly how the proposed relationship is stated.

The first chart shows the relationship between the unemployment rate and the most recent year-over-year inflation rate. The relationship isn’t even downward sloping, but more importantly, it’s extraordinarily noisy. The clean curves presented in textbooks are so much more convenient.

The next chart is what people have in mind when they think of low unemployment causing inflation, and high unemployment as causing deflation. The chart shows the unemployment rate versus the CPI inflation rate one year later. Again, the relationship slopes the wrong way, but is in any case an insignificant relationship lost in a cloud of noise.

Of course, one might argue that the Phillips curve is best stated as a relationship between the unemployment rate and the change in the inflation rate over the following year. This one at least gets the sign of the relationship right, but that relationship is again insignificant relative to the surrounding noise.

The next chart is what people have in mind when they think of reducing unemployment by allowing higher inflation. It shows the relationship between the CPI inflation rate, and the unemployment rate in the following year. If one believes that raising inflation is a way of lowering unemployment, the data is completely unsupportive. In the real world, inflationary periods often feature economic and speculative imbalances that are followed by recession and higher unemployment.

Without torturing every permutation of this relationship, suffice it to say that the foregoing clouds of noise and weak relationships show up in every other statement of the inflation-unemployment tradeoff, regardless of whether one uses levels, changes, trailing data, subsequent data, CPI inflation, core inflation, or mixtures of all of these.

What’s perplexing about this entire inflation-unemployment argument is that the original “Phillips Curve” proposed by A.W. Phillips in 1958 was a relationship between unemployment and wage inflation, based on century of data where Britain was on the gold standard and general price inflation was virtually non-existent. So the Phillips curve is actually a relationship between unemployment and real wage inflation.

The resulting relationship can be stated very simply: wages rise, relative to other prices, when unemployment is low and labor is scarce; wages fall, relative to other prices, when unemployment is high and labor is abundant. The chart below nicely illustrates this relationship in U.S. data. It relates current unemployment to subsequent real wage inflation.

Unfortunately, even the true Phillips curve is emphatically not a relationship that can be manipulated to create jobs or lower the unemployment rate. The natural response of policy-makers and economists has been to ignore Phillips’ original formulation and torture the data instead. This torture usually takes the form of an “expectations augmented” Phillips Curve. This is the notion that various levels of inflation get built into expectations, causing the Phillips Curve to shift up and down over time, but retaining a “short-run” tradeoff that can be manipulated.

The concept of a “natural rate of unemployment” is closely related – the basic idea is that the Phillips Curve shifts up and down over time, but can still be manipulated by clever policy makers with compassion and vision. The red lines give some idea of the proposed torture to the data.

Even these short-run “Phillips Curves” are overwhelmed by noise unless one draws so many that every few consecutive points represent a separate little Phillips Curve – and half of them would slope the wrong way. When one compares this mess with the true Phillips Curve – an unambiguous relationship between unemployment and real wage inflation, it’s evident that these alternate formulations are an effort to bend the evidence to support an interventionist dogma.

Quantitative Easing

The same sort of dogma can be found in other discussions of monetary policy and its presumed effectiveness. For example, quantitative easing essentially proposes that rapid increases in the monetary base can achieve reductions in the unemployment rate. But when we examine the data, we find very little to support this view, regardless of whether the relationship is posed in terms of growth rates, levels, changes, coincident changes, or subsequent changes in unemployment.

Of course, quantitative easing has had an enormous effect on the stock market in recent years. That’s not because there is any historical relationship between changes in the monetary base and the stock market prior to 2008. Indeed, in data prior to 2008, the correlation between growth in the monetary base and returns in the S&P 500 during the same year is almost exactly zero (slightly negative, actually), while the pre-2008 correlation between growth in the monetary base and returns in the S&P 500 over the following year is also almost exactly zero (again slightly negative).

Though one can show a very high correlation between the level of the monetary base and the level of the S&P 500 since 2008, the fact is that two reasonably diagonal lines will almost always be correlated more than 90%. The rule is simple – if two lines run diagonally without a great deal of intervening variation relative to that trend, the correlation will always be nearly perfect, whether or not there is any mechanistic relationship between them at all. If you have a four-year old child, I can nearly guarantee that over the past four years, the correlation between the level of the S&P 500 and the height of your child has been over 90%. Heck, since the end of 2008, the correlation between the S&P 500 and a diagonal line has been 95%.

In my view, most of the response to quantitative easing reflects psychological factors rather than mechanistic ones. Certainly the scale of QE has been enormous, and suppressed short-term interest rates have undoubtedly motivated a reach-for-yield in more speculative assets. But it remains true that the amount of credit market debt in the U.S. is roughly 19 times the current size of the monetary base (with an average maturity of about 5-6 years), while the value of U.S. equities is easily over 6 times the monetary base. So quantitative easing effectively relies on the extent to which investors shun zero-interest cash amounting to less than 3.9% of that available portfolio. In any environment where low-interest but liquid and non-volatile securities become desirable as even a small part of investor portfolios, quantitative easing is likely to lose its presumed ability to “support” financial markets.

The other psychological contributors to the recent success of quantitative easing are the sheer novelty of QE, as well as the misattribution of the 2009 market rebound to monetary policy instead of the more logical, immediate, and salient factor – the abandonment of “mark-to-market” rules by the Financial Accounting Standards Board. In our view, the crisis ended on precisely March 16, 2009 (see The Grand Superstition), and had little to do with monetary policy.

The Fed’s Balance Sheet

A brief update on the bloated condition of the Federal Reserve’s balance sheet. At present, the Fed holds $3.84 trillion in assets, with capital of just $54.86 billion, putting the Fed at 70-to-1 leverage against its stated capital. Given the relatively long maturity of Fed asset holdings, even a 20 basis point increase in interest rates effectively wipes out the Fed’s capital. With the present 10-year Treasury yield already above the weighted average yield at which the Fed established its holdings, this is not a negligible consideration.

Notice though, that after the 0.25% interest that the Fed pays banks to hold their reserves idle, the Fed still turns over more than 2% in interest annually to the Treasury from its debt holdings. At an estimated portfolio duration of about 8 years, it actually takes an increase in interest rates of about 0.25% annually for capital losses to wipe out interest earnings, thereby turning monetary policy into fiscal policy by creating net losses to the Treasury. Essentially, to the extent that the Fed eventually closes its holdings at a net loss, it would be as if the Treasury borrowed at a higher interest rate than it otherwise might have.

The main concern is that the more the Fed’s balance sheet expands, the more likely it is that the exit will be problematic. Already, a normalization of Treasury bill yields to even 0.25% would require a balance sheet contraction of over $1 trillion, or additional payments to the banking system approaching $10 billion annually in order to keep reserves idle. Such payments would predictably become politically contentious very quickly. Considering how glorious the expansion of the Fed’s balance sheet has been for investors, we should not be surprised if the eventual normalization turns out to be equally inglorious.

The Wealth Effect

Regardless of whether or not the faith of investors in quantitative easing is based on misattribution and superstition, hasn’t the perception of its effectiveness been behind the recent advance in stock prices? The answer in the short run is an emphatic “yes.” There is no question – and we have no argument – that quantitative easing has been the primary driver of what we view as a dangerously speculative advance in equities.

Indeed, the whole point of quantitative easing, if one listens to Ben Bernanke, appears to rely on a belief that higher securities prices will make investors feel wealthier and will go out and spend, thereby creating economic demand and encouraging job creation. In effect, the Fed is pursuing what my friend John Mauldin calls “trickle-down monetary policy” – the idea that if the Fed can make the rich richer, the benefits will drizzle down to the unwashed masses. And so, Fed policy has relentlessly sought to create what is now the widest U.S. income distribution since 1929, just before the Great Depression.

The truth is that Fed policy has the capacity to do enormous damage by adding fuel to asset price bubbles when investors are already inclined to take risk, yet has very little power to “support” asset prices when investors are inclined to avoid risk (see Following the Fed to 50% Flops). The confidence that the Fed can, in all circumstances, drive asset prices higher is largely psychological – mostly due to misattributing the 2009 recovery to monetary policy instead of the move to end “mark to market” accounting. Yet even to the extent that stocks have been driven higher, there is very little evidence that the “wealth effect” on jobs and economic activity has been large. This is something that the Fed should have understood years ago.

So let’s go to the data and examine the “wealth effect.”

The chart below presents the most generous interpretation of the “wealth effect” that we can identify in the data. There is clearly a positive relationship between stock market changes and changes in real GDP over the same and subsequent year (after that, the relationship becomes negative and much of the temporary gain is lost). The relationship explains about 18% of the historical variation in real GDP growth rates. But notice the effect size. Essentially, each 1% change in the S&P 500 is associated with a temporary change of about .05% in GDP growth over the following two years, reversing after that point. So if correlation was causality, and dollars were doughnuts, the best-case scenario for QE – assuming that the correlation could be perfectly manipulated – is that driving stock prices up by 50% might help to generate a temporary increase in GDP growth of about 2.5% over what it might have been otherwise. Of course, to the extent that the increase in asset values was artificial, the opposite contraction could then also be expected.

When we look more carefully at the relationship between stock prices and GDP, an additional problem emerges. Specifically, this relationship cannot be usefully manipulated, as all of the correlation between stock market changes and economic growth is captured in periods where stocks were rebounding from prior lows.

See, stock market troughs tend to precede economic troughs by a few months, and stock market recoveries from those troughs tend to precede subsequent economic recovery. It turns out that the entire relationship between stock price changes and economic changes is captured by the 30% of historical periods when stocks were at least 10% below their prior two-year highs. If one excludes these periods, the relationship between stock market gains and economic gains in the other 70% of the data vanishes completely.

So the Fed is attempting to exploit an already weak relationship between stock prices and economic growth, with the further complication that nearly all of this relationship is due to the co-cyclicality of stock prices and GDP, rather than being a true wealth effect. Friedman and Modigliani were right – consumers spend based on their assessment of their lifetime “permanent income,” not based on temporary fluctuations in volatile asset prices.

All of the above applies equally to the unemployment rate. In general, each 2% variation in GDP from trend-growth is accompanied by a 1% move in the unemployment rate in the opposite direction (a regularity known as Okun’s Law). Nearly all of the relationship between stock prices and changes in the unemployment rate, like GDP, are captured in the 30% of periods where stock prices were depressed by at least 10% relative to their two-year highs. There is simply no evidence in the historical record that stock market changes and unemployment changes are related outside of those periods of recovery.

The Dual Mandate

To some extent, one can’t blame the Fed for the weakness of recent economic progress, despite the massive financial distortions it has created. The dual mandate to pursue “stable prices” consistent with “maximum employment” asks the Fed to pursue employment outcomes that are poorly related to its instruments. That mandate is a relic of a long-discredited dogma that the Phillips Curve applies to general prices instead of real wages, and that the relationship can be manipulated. Unfortunately, Ben Bernanke and Janet Yellen still appear to believe this.

As former Fed Chairman Paul Volcker recently observed:

“I know that it is fashionable to talk about a “dual mandate” — that policy should be directed toward the two objectives of price stability and full employment. Fashionable or not, I find that mandate both operationally confusing and ultimately illusory: operationally confusing in breeding incessant debate in the Fed and the markets about which way should policy lean month-to-month or quarter-to-quarter with minute inspection of every passing statistic; illusory in the sense it implies a trade-off between economic growth and price stability, a concept that I thought had long ago been refuted not just by Nobel prize winners but by experience.

“The Federal Reserve, after all, has only one basic instrument so far as economic management is concerned—managing the supply of money and liquidity. Asked to do too much—for example, to accommodate misguided fiscal policies, to deal with structural imbalances, or to square continuously the hypothetical circles of stability, growth, and full employment—it will inevitably fall short. If in the process of trying it loses sight of its basic responsibility for price stability, a matter that is within its range of influence, then those other goals will be beyond reach.”

The Fed, very simply, is pushing on a string. It is a dogmatic effort that is unsupported by historical evidence. Even to the extent that the Fed’s efforts have “worked” in driving stock valuations higher, much of this effect is due to psychological, rather than mechanistic, relationships. In the words of Zorba the Greek, the “full catastrophe” of economic life here is driven by dogma and superstition. This will end very badly.

Stock Valuations – an unrecognized bubble

Recently, as part of his book promotion tour, Alan Greenspan has hit the media circuit. His remarks include the assertion that stocks are still attractively valued, based on his estimate of the “equity risk premium.” See Investment, Speculation, Valuation, and Tinker Bell for a full discussion of the Fed Model, “equity risk premium” calculations, and a variety of far more reliable valuation methods that are tightly associated with subsequent S&P 500 total returns.

The simple fact is that on metrics that have been reliable throughout history, and even over the past decade, stock market valuations are obscene. Importantly, these same valuation metrics were quite optimistic about prospective market returns at the 2009 low.

As a side-note, one should not confuse the message with the messenger here. It’s no secret that my insistence on stress-testing our return/risk estimation methods against Depression-era data resulted in missed returns in the interim (2009-early 2010), but none of that reflects our valuation metrics, which indicated prospective 10-year S&P 500 total returns in excess of 10% annually at the time. The real concern in 2009 was that even after similar valuations were observed during the Depression, the stock market still went on to lose two-thirds of its value. So I’m quite open to criticism about my insistence on stress-testing (which I still believe was a fiduciary obligation given the events at the time). But one should be careful in concluding that this removes the ominous implications of present valuations.

On the basis of a wide variety of historically reliable fundamentals, we currently estimate 10-year S&P 500 nominal total returns of just 2.5% annually. Notably, the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) is now at 25. Prior to the late-1990’s bubble, the only time the Shiller P/E was higher was during three weeks in 1929 that accompanied the extreme peak of the market before stocks crashed. Meanwhile, the price/revenue ratio of the S&P 500 is presently 1.6 – a level that is double its pre-bubble norm, and even further above levels historically associated with bear market lows.

We observe similar extremes in other reliable measures that aren’t dominated by cyclical movements in profit margins. The apparently “reasonable” market valuations based on margin-sensitive fundamentals (e.g. forward operating earnings) implicitly assume that all of history can now be ignored: profit margins will no longer be highly cyclical; margins will no longer vary as the mirror image of deficits in combined household and government savings (see Taking Distortion at Face Value); and they will instead permanently remain more than 70% above their historical norm.

Aside from the fact that we can fully explain the present surplus of corporate profits as the mirror image of deficits in the household and government sectors, the other reason to focus on normalized earnings, cyclically-adjusted earnings, revenues, and other “smooth” fundamentals is simple: they are strikingly accurate guides across history. Another such measure is the ratio of stock market capitalization to nominal GDP, based on Federal Reserve Z.1 Flow of Funds data. Again, the present multiple is about double the historical pre-bubble norm.

While the valuation of the S&P 500 Index itself was higher in 2000, it’s notable that the overvaluation of the S&P 500 was skewed in 2000 by extreme overvaluation in very large-capitalization stocks, while smaller capitalization stocks were much more reasonably valued. In contrast, we have never in history observed the median stock as overvalued as we observe presently. Indeed, the median price/revenue ratio of stocks in the S&P 500 now exceeds the 2000 peak. Likewise, as Damien Cleusix has observed, if we examine valuations by quartiles (25% of stocks in each bin), the average price/revenue ratio of the two middle quartiles also exceeds the 2000 extreme.

For the sake of completeness, I should also note that virtually every “overvalued, overbought, overbullish” syndrome we define is on red alert. I hesitate a bit on this point, because in contrast to nearly a century of market history where these syndromes were reliably associated with deep losses, the emergence of these syndromes since late-2011 has repeatedly been followed by yet further speculation (see the chart in The Road to Easy Street). My impression remains that this is not a permanent change in market dynamics, but simply reflects an anvil that has not yet dropped. So these syndromes have admittedly done us no favors in the more recent period. Still, it remains our job, and our discipline, to view market action within its full historical context.

Among the many largely equivalent ways to define an overvalued, overbought, overbullish syndrome, the blue bars on the following chart present one of the many we observe at present: Shiller P/E anywhere above 18 (overvalued), S&P 500 at a 5-year high and at least 8% over its 40-week smoothing (overbought), with bullish sentiment greater than 50% and bearish sentiment less than 20% based on Investors Intelligence figures (overbullish). Notice that we did not observe this particular variant in 2000 because bearish sentiment never fell below 20% in that year. Also, while sentiment data was not available in 1929, we can impute sentiment reasonably on the basis of past price movements. Using imputed sentiment, we can also include 1929 in the set of instances here.

Notice that we’ve observed three instances this year – in May, in August, and today. Given the lack of follow-through from recent syndromes, we have to at least allow for the possibility of a further blowoff, as the seduction of quantitative easing has encouraged investors to ignore these conditions. On the economy, the best we can say is that while some widely-followed Fed surveys and Purchasing Managers indices have improved modestly in recent months, the most recent rolling correlation between these measures and actual economic outcomes (employment growth, industrial production) has become even more negative at the same time (see When Economic Data is Worse than Useless). Again, my impression is that this is not a permanent change in economic dynamics, but a temporary effect of distortions from quantitative easing, but it does force us take a more agnostic view of the economy than we might otherwise have.

In any event, I continue to believe that it is plausible to expect the S&P 500 to lose 40-55% of its value over the completion of the present cycle, and suspect that whatever further gains the market enjoys from this point will be surrendered in the first few complacent weeks following the market’s peak. That’s how it works. If all of this seems like hyperbole, please recall my similar concern at the 2007 peak (see Fair Value – 40% Off), and the negative 10-year return projections – even on best-case assumptions – that we correctly estimated for the S&P 500 in 2000. These numbers relate to the striking gap between present valuation levels and normal historical precedent, not to personal opinion.

None of our own challenges in this decidedly unfinished half-cycle relate to our consistent ability to correctly assess long-term investment prospects. We may yet see some amount of further short-term speculation, but already for the median stock, the long-term investment outlook has never been worse.

The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Only comments in the Fund Notes section relate specifically to the Hussman Funds and the investment positions of the Funds.

Fund Notes

As of last week, Strategic Growth Fund remained fully hedged, with a “staggered strike” position that raises the strike prices of its index put options somewhat closer to present market conditions. With the resurgence of multiple “overvalued, overbought, overbullish” syndromes on a wide range of criteria, we have no basis to speculate on a further short-term blowoff here, even though we can’t rule it out. My impression is that even very short-term measures are stretched, so some amount of retreat in overbought conditions and overbullish sentiment might encourage a modest position in index call options as a constructive hedge against any climax in the recent speculative run (though remaining well-hedged otherwise due to longer-horizon concerns). We’ll let the evidence drive our discipline. For now, we remain defensive. Meanwhile, Strategic International remains fully hedged. Strategic Dividend Value remains hedged at about 50% of the value of its stock holdings. In Strategic Total Return, we clipped our precious metals holdings back to about 5% of assets early last week, also taking the duration of the Fund below 6 years (meaning that a 100 basis point move in interest rates would be expected to impact Fund value by less than 6% on the basis of bond price fluctuations). The Fund presently holds about 4% of assets in utility shares.

HOLY SHIT VIDEO OF THE DAY

CENTERFIELD – THOSE WERE THE DAYS

We’re going to see John Fogerty tonight at the Borgata Casino in Atlantic City. My family isn’t as psyched as me. Creedence Clearwater Revival is one of my favorite bands of all time. But they were only together from 1967 to 1972, when I was less than nine years old. I became a fan later in life. My first real introduction to John Fogerty was when I was in college at Drexel University in West Philly. I lived in a dump at 33rd and Baring Street with two friends in 1985 and 1986. We lived in the bottom two bedroom one bath unit in this three story unit. The neighborhood was iffy. A black dude once came through the bedroom window with a knife on a Sunday afternoon. The MOVE standoff, which had happened a few years before and resulted in the death of a Phila policeman, occurred a block away from our humble abode.

Music always brings me back to a time in my life. John Fogerty released the album Centerfield in 1985. I was 22 years old. I realized that life was good. College is a great time in a guy’s life. I put in the time to keep a 3.7 GPA in accounting, while having plenty of time to play sports with my buddies, go to frat parties, and spend time at our college bars. We were all poor, but you could get drunk on $10 in those days. Our bar was called The Jailhouse. It was connected to Cavanaugh’s Bar. They were located between 31st and 32nd on Market Street. We lived on hot dogs and instant mash potatoes for most of the week, but on Thursdays Cavanaugh’s had an all you could eat buffet for $3 and $2.50 pitchers of beer. Let’s just say we got our money’s worth on Thursdays. Sadly, these bars were knocked down a few years after I graduated and replaced by a university building. You can see from the picture they had real character – also known as college dives.

Intra-mural sports was our main form of recreation in college. It’s a surreal time in a guy’s life. You have no money, no attachments, no real responsibility, and no real stress. You have your friends and a few hours per day of school work. My buddies: Paul, Mac, Jay, Bill, Mike, Peez, Rich, Joe, and few others all loved sports. We formed teams to play intra-mural football, basketball and softball. I was 170 pounds and could run full court games of b-ball for three hours with ease. Those were the days. Studying, music, drinking and not worrying about the future, not in any particular order. It was 1985. The internet was only used by scientist geeks. The Apple Mac had just come on the scene. Virtually no one owned a desktop PC. Laptops didn’t exist. Cell phones didn’t exist. Cable TV only had 100 stations with nothing worth watching. Young people interacted by sitting around and talking. We actually made eye contact and had to verbalize what were thinking.

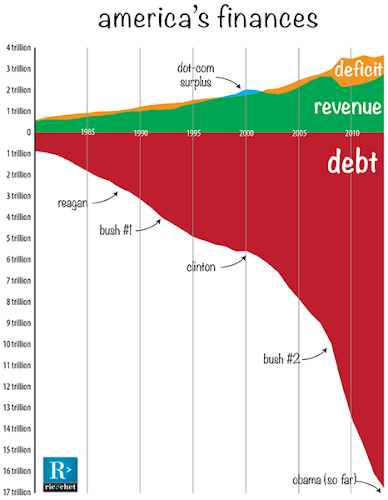

It was 1985, Reagan’s Morning in America. I voted for the first time in 1984 and bought into the Republican storyline. In retrospect, I was clueless about the world, politics, finance, the Federal Reserve, women, and just about everything. Americans were convinced that the Soviet Union evil empire was still a threat to our security. In reality, they were on the verge of collapse. America had entered the delusionary debt boom that continues to this day. I didn’t care about any of these real world issues. I was living in a bubble. I loved sports, music and hanging with my friends. And that brings me to John Fogerty. Our Intra-mural softball team had a bunch of excellent ball players, with yours truly playing shortstop. Drexel is located between Walnut and Market from 32nd Street to 34th Street. Their ball fields were located at 45th & Market in the heart of the West Philly slums. Low income housing tenements towered over the ball fields. It was a beautiful setting for sports.

In college there are a lot of good athletes. We faced some good competition, but our team was stacked. Over the course of a few weeks we defeated every opponent. We reached the championship game and won a close tense game to be crowned intra-mural school champs. There were no fans to carry us off the field. The only people who knew we were champs were us. We did what all great champions do. We headed for The Jailhouse to celebrate our victory. Ten guys, a dark college bar, $2.50 pitchers of Schmidt’s, and a juke box. John Fogerty had been out of the public eye for about a decade. Then he roared back on the scene with his album Centerfield. The song lends itself to banging on tables and singing the lyrics at the top of your lungs while being very very drunk. The song has one of the best opening riffs of all time. You can’t get the chorus out of your head:

Oh, put me in, Coach – I’m ready to play today;

Put me in, Coach – I’m ready to play today;

Look at me, I can be Centerfield.

As the evening progressed, the empty pitchers piled up on the table. We probably played Centerfield on the jukebox 10 times. I do remember Mike Philips dancing on the top of our table while we sang the song. I also remember him falling off the table. I haven’t seen him since the day we graduated 27 years ago.

The Jailhouse didn’t put much money into maintenance or upgrading the décor. The tables were 50 years old and you sat on benches. The men’s room was upstairs. It consisted of a room length trough for dudes to piss in. On this particular night cigarette butts or some other object must have been blocking the drain. The trough was filled to the brim with piss. It was overflowing onto the floor. We were drunk and not particularly concerned about Jailhouse plumbing issues. We just pissed in the trough and returned to singing Centerfield. Later in the evening as we were running out of gas, I witnessed the consequences of an overflowing piss filled trough. As you recall, the bathroom was upstairs, directly over the tables below. It seems the piss leaked through the floor above and soaked the drop ceiling tiles below. I watched as a piss soaked tile came crashing down with a thump a couple tables over. It was a fitting end to a memorable evening. Of the ten guys in the Jailhouse that night, I only keep in touch with one. I long ago lost contact with them. Life has a way of creeping up on you. You meet the love of your life, have kids, and get tied up in your career. Before you know it, 28 years have passed, you’ve added 40 pounds, lost most of your hair, and you’ve turned into a cranky 50 year old anarchist blogger.

Every time I hear this song on the radio I’m transported back to a simpler, happy time in my life. No cares. No pressure. No responsibility. No worries. Just friends, fun and beer. It’s a melancholy feeling. I’m very happy with my life and my family but sometimes, like Eddie Money says – I wanna go back. In a few hours when Fogerty goes into the opening riff for Centerfield, I’ll close my eyes and get transported back to that night at The Jailhouse.

There are two other songs from that album that I like as much or more than Centerfield. I love listening to the sax in a rock song.

This one rose into the top 10.

Time is a funny thing. It slips away when you weren’t looking. Find some time to enjoy yourself today and remember the good times, with good friends, good (???) beer, at a good bar.

And you run and you run to catch up with the sun, but it’s sinking

Racing around to come up behind you again

The sun is the same in a relative way, but you’re older

Shorter of breath and one day closer to death

Every year is getting shorter, never seem to find the time

Plans that either come to naught or half a page of scribbled lines

Hanging on in quiet desperation is the English way

The time is gone, the song is over, thought I’d something more to say

Pink Floyd

Things That Make You Go Hmmm – Fiat Monkees and Golden Beatles

Things That Make You Go Hmmm – Fiat Monkees and Golden Beatles

By Grant Williams

By Grant Williams | October 29, 2013

Madness!! Auditions. Folk & Roll Musicians-Singers for acting roles in new TV series. Running Parts for 4 insane boys, age 17-21. Want spirited Ben Frank’s types. Have courage to work. Must come down for interview.

On September 8-10, 1965, this ad appeared in the Hollywood Reporter and Daily Variety, as two aspiring filmmakers, Bob Rafelson and Bert Schneider, inspired by what was to become one of the best and most influential musical films of all time, set about trying to cast the leads in a television show about four crazy kids living the rock ‘n’ roll lifestyle that the protagonists in the aforementioned film had made so appealing to the masses.

That film was A Hard Day’s Night, its stars The Beatles, and the four young men (chosen from 437 applicants) who would be groomed to supplant them in Americans’ hearts and minds were Davy Jones, Mickey Dolenz, Peter Tork, and Mike Nesmith. Together, these four part-time musicians and wannabe actors would become The Monkees; and Rafelson & Schneider’s plan was to make them bigger than even The Beatles could dream of being. Armed as they were with the power of television entering its golden age, they had the odds stacked in their favour — or so it seemed.

In 1965, the Beatles were the preeminent band in the world and at the very peak of their power. The time seemed right for a knock-off band that would enable its architects to live the high life and create untold riches out of thin air. After all, The Beatles were genuinely talented songwriters and musicians, and those were in limited supply, even in the 1960s. It was far easier to produce a band that didn’t have to rely on something tangible, such as talent, in order to be accepted by the public — as long as you could sell it to people by capitalizing on The Beatles’ success.

That band was to be The Monkees.

The premise was, in the words of Dolenz, to produce “a TV show about an imaginary band … that wanted to be The Beatles, [but] that was never successful”….

The Beatles were music’s gold standard; the Monkees would be a convenient fiat alternative….

How did the fiat alternative to John, Paul, George, and Ringo fare? Well, the answer is perhaps somewhat surprising.

Initially, The Pre-Fab Four, Mike, Davy, Peter, and Mickey (it just doesn’t have the same ring[o] to it, I’m afraid), were assiduously kept away from the musical instruments they were supposed to play when recording the songs that would, according to Rafelson & Schneider’s strategy, sell by the millions and make everybody rich — despite the fact that they were all reasonably accomplished musicians and, in the case of Nesmith and, latterly, Dolenz, capable of composing successful pop songs.

Jones was chosen to sing lead vocals (something that rankled with the rest of the band, who felt that Dolenz’s more distinctive voice was far more likely to set the band apart); Dolenz was picked as the drummer (even though Jones was far more accomplished in that role, but his diminutive stature meant he disappeared behind the high-hat cymbals); Nesmith took lead guitar (even though Dolenz was an accomplished guitarist but had never played drums before); and that left Tork, who picked up the bass (even though Nesmith was skilled in the playing of that instrument) and keyboards.

In short, an alternative to the most successful band of the day was created by parties interested in having a simpler, more lucrative alternative under their control. It was created and configured not with its long-term viability in mind but rather with appearances as the main driver, in the expectation that, even though the level of talent underpinning the band was hardly of the calibre of Lennon & McCartney, it would be enough — at least for a while.

And guess what? It was.

In August 1966, the Monkees’ debut single, “Last Train to Clarksville”, was released and Monkeemania was born. The group’s network TV show debuted a month later, in September 1966 (in the days when there were only a handful of channels to watch). It was designed to appeal to the teen audience enthralled with the lovable Brits, and so the band’s popularity was assured…. As long as the masses accepted The Monkees, the talent underpinning their success was of altogether secondary importance.

The following year, 1967, something rather extraordinary happened.

That year, The Beatles released a collection of songs in an album entitled Sgt. Pepper’s Lonely Hearts Club Band — which would go on to be voted the number-one album of all time by Rolling Stone magazine (a position it retains to this day). Meanwhile, another popular rock combo of the day, The Rolling Stones, released two albums, Between the Buttons and Their Satanic Majesties Request; Jimi Hendrix introduced the public to Are You Experienced?; and The Doors unveiled their eponymous debut album, featuring “Break on Through”, “The End”, and “Light My Fire”.

Well, guess what?

The number-one, top-selling album of 1967 was (drum roll, please):

Yes folks, More of The Monkees, featuring “When Love Comes Knockin’ (At Your Door)”, written by Carole Bayer Sager and Neil Sedaka; “Sometime in the Morning”, penned by Gerry Goffin and Carole King; “(I’m Not Your) Steppin’ Stone”, by Boyce and Hart; and the instant classic “I’m A Believer” … hot off the pen of Neil Diamond….

But ultimately, over time, something which is real will always be recognized by the masses as superior to something created for superficial purposes — particularly during times of crisis.

For those keeping score at home, The Beatles and The Rolling Stones are second only to Bob Dylan’s 11 albums in the top 500, with 10 each, and the Beatles have 4 albums in the top 10 (including, of course, the number-one album of all-time in Sgt. Pepper).

The Monkees don’t appear in the top 500.

Why do I bring this up? Well, of course, this is one of those weeks when I’m going to be talking about gold again — yes, finally! — and my thoughts were triggered by an article I read in, of all places, the Hindu Business Line.

India’s love affair with gold is well-understood in this part of the world and completely misunderstood in the West — a phenomenon I have always found fascinating — but recently it has become abundantly clear that this disconnect is widening almost daily as the Western fixation with The Gold Price and the Eastern obsession with The Price of Gold take ever more divergent paths.

After the recent frenzied activity at the Reserve Bank of India (which, if it had taken place in the USA, would absolutely have been labeled “The War on Gold” by CNN) as they tried every means possible to stop Indian citizens from buying gold (something I documented in “Never The Twain“, TTMYGH August 27 2013), I set about thinking why it is that attitudes in the opposing hemispheres are so different regarding the yellow metal….

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

Why Obamacare Will Not Conquer American Culture

Why Obamacare Will Not Conquer American Culture

It’s become quite obvious that, politically, Obamacare has conquered America. (It now has the power of law.) However, it will eventually fail. In fact, it’s failing already because of something that transcends politics – our ingrained culture.

I had a conversation yesterday with a very astute European friend. While discussing the differences between Europeans and Americans, he said:

On the scale of a whole society, Americans change slower, Europeans change faster. But individually, Americans change faster, and Europeans slower.

And he is quite right about this. Europeans change in groups, but Americans very seldom do. And even when they do, those changes seldom last.

He went on:

This gives Americans an advantage: they can try many more solutions before choosing. But if a society-wide change is imposed on them, it may never find mass adoption; the majority will resist it, and wait it out.

Obamacare is one of these society-wide European-style solutions, shoved down the throats of American culture. Confused by politics (which is, more or less, the purpose of politics), most Americans haven’t known what to think about it, so they are waiting to see what happens.

At the moment, what they see is very bad and while they may hope it works itself out, we know it won’t for one simple reason: Americans expect to choose, and to change their choice whenever they want.

Americans expect to choose a product this year, but to change to a different one next year, when something better comes along. This is deeper than the noise and clamor of politics – it is ingrained in our culture.

Obamacare transgresses the American cultural norms, and will therefore fail – sooner or later, in one way or another.

Why Obamacare Is Much Like A Viking Invasion

In the early Middle Ages, the Vikings wrought havoc on the British Isles. They plundered wherever they wished, extorted astonishing amounts of silver from the kings of England, and never suffered a serious defeat. They conquered, clearly and definitely.

But a funny thing happened to the Vikings over time – they became Englishmen.

The Vikings started as a wild band of pagan destroyers and thieves, and ended up, in a fairly short span, as Christian British farmers.

Why did they make this change? Because the English way of life – English culture – was far more attractive than a life of frozen oceans, killing, and drunkenness.

The Vikings conquered militarily, but they were defeated culturally.

The same thing is happening to Obamacare in America: It conquered politically, but it will fail culturally.

Culture trumps conquest, whether it be the conquest of arms or the conquest of politics.

Obamacare will fail because Americans expect to choose, and to change their choice when they want.

When Americans want a different doctor or hospital, they expect to get it. If they don’t, they’ll break the rules: either they’ll bribe people to get what they want, pay for political favors to get what they want, go to the black market to get what they want, or start taking over hospital administration offices. (I fear that there may be a few shootings too.)

American culture expects choices; it is built for individual changes, not collective changes. This is in the DNA of the culture, and no matter which political gang controls the levers of rulership, the culture will not simply follow.

Whether in one way or many, sooner or later, Obamacare will fail. American culture is not dead yet.

Paul Rosenberg

[Editor’s Note: Paul Rosenberg is the outside-the-Matrix author of FreemansPerspective.com, a site dedicated to economic freedom, personal independence and privacy. He is also the author of The Great Calendar, a report that breaks down our complex world into an easy-to-understand model. Click here to get your free copy.]

FOURTH TURNING GETS MORE INTERESTING BY THE MINUTE

Chinese launching their new nuclear submarine force this week. The Russians conducting surprise missile defense exercises. Israel attacking Syria today. This Fourth Turning gets more interesting by the minute. Stock market euphoria at the top of a bubble. An economy in recession. A desperate president whose approval ratings are at all time lows and whose domestic agenda is in absolute shambles could do something really stupid. The entire world resembles a room full of TNT inhabited by a bunch of monkeys lighting matches. It isn’t long before the whole thing goes KABOOM!!!!

The Russian Aerospace Defence Forces carried out live firing exercises at the Kapustin Yar testing ground in Russia’s southern Astrakhan region on Wednesday. The training involved carrying out exercises using the s-300 Favourite, S-400 Triumph and Pantsir-S missile defense systems.

First Glimpse Of China’s Nuclear Submarine Fleet

Submitted by Tyler Durden on 10/30/2013 22:20 -0400

…

While the submarines displayed on Sunday were the older generation of nuclear vessels that are part of China’s northern fleet – and not the more advanced Jin-class based at the southern Chinese island of Hainan – the display in the domestic media nonetheless reflects the Chinese military’s growing confidence.

“It is still the first time that the Xia class has been discussed in such detail in China’s state-run media,” said Taylor Fravel, an expert on Chinese security at the Massachusetts Institute of Technology in the US. “As China’s military modernisation continues to advance, the PLA has become more willing to discuss its capabilities.”

…

In recent years, the People’s Liberation Army Navy has become increasingly active in the Pacific, particularly in staking Chinese claims to disputed maritime territory in the South China Sea.

Chinese ships and aircraft have also become more aggressive in challenging Japanese control of the Senkaku Islands – which China calls the Diaoyu – in the East China Sea. Japan has administered the uninhabited group for decades, but China and Taiwan both claim sovereignty.

Syrian Army Base Rocked Again By Overnight Explosions, Israel Implicated

Submitted by Tyler Durden on 10/31/2013 08:03 -0400

The last time major explosions were reported near Damascus, it was in May when Israel and its air force did everything in their power to provoke the Assad regime to escalate military operations both domestically and abroad. It almost succeeded when three months later Obama nearly led a falseflag-driven “liberation” force facilitating Saudi and Qatari energy interests in the region and their pipeline ambitions below Syria. Since then Israel had been largely dormant, seething in its (and Saudi) disappointment that it was unable to play Obama like a fiddle.

The unstable detente changed again overnight, when as Haaretz reports “a large explosion was heard at a Syrian army missile base in Latakia. Eye witnesses told the Britain-based Syrian Observatory for Human rights that the explosion took place near Snobar Jableh, south of the city. It was not yet clear whether anyone was wounded in the strike.” And not surprisingly, it is once again Israel’ that was implicated in the latest regional provocation because as Haaretz adds, the “strike follows Lebanese media reports that Israeli aircraft circled above southern Lebanon.”

“The official Lebanese news agency reported that Israeli aircrafts were sighted on multiple occasions Wednesday in the south of the country. According to the report, which was based on a press statement by the Lebanese army, the airplanes entered Lebanese airspace at around 1:40 P.M. and circled over various places before leaving over the Mediterranean Sea near Tripoli and Naqoura at 5 P.M.”

From Haaretz:

A Facebook page run by Syrian rebels claimed that the strike occurred at around 7 P.M. According to the page, a missile was fired from the sea and struck the Syrian base but did not result in any casualties. Israeli sources declined to comment on the reports.