Stay focused on your iGadgets and latest episode of Duck Dynasty. Let all your Facebook internet friends know what you ate for breakfast and how you feel about those dastardly Tea Party terrorists. Your owners don’t want you to focus on the increasingly desperate acts of Americans across the country. All is well. People lighting themselves on fire isn’t a big deal. Focus on your fantasy football team and root for your favorite political party in the Debt Ceiling Super Boil. The Fourth Turning mood change isn’t real. Right?

Author: Administrator

OBAMA PURPOSELY TRYING TO MAKE YOUR LIFE MISERABLE

This entire government shutdown farce is nothing but bullshit political optics. First of all, why is the American taxpayer paying to employ 800,000 non-essential government drones? Where I work, if you are non-essential you are not needed. Obama is trying to make the American people feel the pain of a government shutdown. Therefore, he is using government employees to block access to places where government employees are never needed. He is spending more of your money to keep you from accessing government run properties.

The longer this fake shutdown goes on, the more it reveals that we can do without the 800,000 drones. Our lives aren’t being impacted by these drones getting a paid vacation on our dime. The lowlifes in Congress have already agreed to provide back pay to these people while they sit at home and watch Jerry Springer. Will they owe the taxpayer the days they didn’t work? Not a fucking chance. They have probably filed for unemployment too. Will they have to pay that back when they receive their back pay? I doubt it.

Let’s assume each of these non-essential government drones is costing the taxpayer $100,000 in salary and benefits. That is probably conservative. I just found $80 billion of annual cost savings. Sounds like a lot, but let’s consider it in relation to the big picture. Your leaders spend $3.7 trillion of your money annually. That is $10 billion per day. We could fire those 800,000 non-essential government drones and it would amount to 8 days of government spending. Let that sink in for a moment.

I picture the government as Jaws and myself as Sheriff Brody.

No matter what ultimate bullshit compromise is reached by the lowlifes in Washington DC, it won’t even make a dent in what really needs to be done. This boat is going to sink.

Park Ranger: ‘We’ve been told to make life as difficult for people as we can’

Wesley Pruden of the Washington Times reported yesterday that “the Park Service appears to be closing streets on mere whim and caprice.”

It is difficult to imagine that shutting people out of parks and privately owned concessions has to do with anything other than politics. One of these “whims” is the parking lot at Mount Vernon, which is “privately owned by the Mount Vernon Ladies’ Association.”

A Park Service ranger in Washington said that

“We’ve been told to make life as difficult for people as we can. It’s disgusting.”

Steven Dinan of the Washington Times reported today that Bruce O’Connell, the owner of the Pisgah Inn, which holds a concession on the Blue Ridge Parkway was told to “cease operations.” He said

“The level of intimidation and coercion became such that we backed down. Then after sleeping on it, our own convictions took front and center and we decided to reopen.”

According to mounting sources, President Obama has been hard at work trying to make the public feel the “shutdown,” despite the fact that eighty percent of federal employees are still working. Josh Barro of Business Insider reported this week,

“…of about 4.1 million people who work for the federal government, about 80% will still be expected to show up for work.”

The owner of the “privately run, funded and staffed” Claude Moore Colonial Farm said that “we think they have closed us down illegally…” as reported today by J.D. Tuccille of reason.com. The staff was even “threatened with arrest” if they showed up for work, despite the fact that they are not government employees. The owner said,

“We have had to cancel every event at the Farm this week so we have already lost more than $15,000 in operating income because October is the busiest month of the year for us.”

Hans Bader of OpenMarket.org compiled many of these distrubing stories today. He reported that sites that were previously open without guards, such as the Lincoln Memorial, now have guards assigned to keep out the public. The Martin Luther King Jr. Memorial is now “fenced off” despite the fact that it was previously open 24/7 without guards. Bader writes,

“the government is actually expanding its presence at national monuments in order to drive people away, at increased expense to taxpayers.” [added emphasis]

Bader also reflected at Liberty Unyielding on the politics surrounding the sequester, where similar tactics were used.

Additionally, Patrik Jonsson of the CSMonitor reported today that the National Park Service has rebuked “offers by state and private officials to help keep the Grand Canyon and other places open.” It is clear that the goal of keeping the public away from national (and privately owned) parks and monuments is a disturbing, expensive and childish political move.

Follow Renee Nal on Twitter @ReneeNal and Facebook.

Check out her news and political commentary on Liberty Unyielding, Gather and TavernKeepers.com for news you won’t find in the mainstream media. Renee is also a guest blogger for the Shire Blog.

THEY CAN’T IGNORE THIS SELF-IMMOLATION

Does this Fourth Turning appear to be picking up momentum? As the economy continues to spiral downward, Wall Street continues to loot and pillage, and Washington DC politicians continue to do nothing but posture and bloviate, people have begun to lose their minds. In the last week we’ve had a man lose it and kill 12 people in Washington DC. Yesterday we had a woman lose it and get gunned down by DC police. Today we have a man self-immolating on the Mall in Washington DC.

It seems they have the right place. The next step is likely to be people losing it and assassinating politicians and bankers.

The MSM completely ignored the self-immolation of Tom Ball in New Hampshire over a year ago. There was a complete MSM blackout on the story. Only the alternate truth telling media like TBP picked up the story:

http://www.theburningplatform.com/2011/06/20/nh-man-burns-self-at-courthouse-in-protest/

Not this time. When someone self immolates themselves on the National Mall during a government shutdown, it can’t be ignored. The self-immolation of a man in Tunisia started the Arab Spring revolutions in 2010. The Middle East has been ablaze in violence and revolution since then.

Is this past week of people going off the deep end in the nation’s capital the start of the American Spring? Are people across the country going to start losing it?

I know one thing for sure. Fourth Turnings never fizzle out. They grow in intensity and in violence.

Coming to a street corner near you.

Man Sets Himself On Fire On National Mall, Near White House

Submitted by Tyler Durden on 10/04/2013 17:25 -0400

NBC Washington reports that “Passersby on the National Mall in Washington, D.C., ripped off their shirts to help extinguish the flames after a man apparently tried to set himself on fire Friday, witnesses and authorities said. The man was conscious and breathing when he was flown by helicopter to Washington Medical Center, D.C. police said. There was no immediate report on his condition. The incident, which was reported at 4:24 p.m. ET, occurred on Seventh Street Southwest near the National Air and Space Museum, U.S. Park Police said. Witnesses told several media organizations, including NBC Washington, that they saw the man pour gasoline on himself from a red canister and then set himself ablaze. Police said they couldn’t confirm those reports. Nearby joggers stopped and ripped off their shirts to smother the flames, NBC Washington reported.”

The burned man was promptly carried off the Mall using a helicopter.

A fire official says a man has been flown to the hospital after setting himself on fire on the National Mall.

Fire crews responded Friday afternoon to a report of a man on fire at 7th and Madison streets. A witness says she saw a man dump a red canister of gasoline on his head and then set himself on fire.

D.C. Fire Department spokesman Tim Wilson says the man has life-threatening injuries.

His name and age weren’t immediately known.

FEINSTEIN: “WE MUST BAN BLACK AUTOMATIC INFINITYS”

It sounds like our police state thugs are attempting to spin this story so they don’t come across as incompetent boobs who murdered a black woman for driving recklessly.

When did Post Partum Depression become a mental illness? Don’t millions of woman get this every year? I guess we should ban all women who have recently had a baby from driving cars.

We were told that the car rammed the front gate at the White House. Sorry. The video shows no ramming of anything. Her front end is not damaged in any way.

We were told the perpetrator had a gun and was shooting. Sorry. Another MSM bullshit lie. The only people firing guns were the donut eaters.

We were told that a police officer was injured by the suspect. Sorry. Barney Fife ran into his own police barrier at 70 miles per hour and destroyed his police car.

Shooting a black, unarmed, depressed, female with a baby in the backseat really rallies the country around our police state thugs. What would we do without them?

Poor Chris Matthews. He had gotten that old tingle up his leg hoping it was a white middle aged male Tea Party terrorist, related to Ron Paul, with an AK-47 trying to take out the black guy in the White House.

Maybe next time Chris.

You can rest easy now. We are safe from depressed black female dental hygenist terrorists.

Miriam Carey, Capitol Suspect, Suffered Post-Partum Depression

The woman was believed to be Miriam Carey, 34, a dental hygienist from Stamford, Conn., authorities told the woman’s family, according to a family spokesman.

Police earlier said they were witholding the name of the driver of the car involved in the chase pending positive identification and notification of next of kin.

Authorities said the woman led police on a chase down Pennsylvania Avenue to the Capitol after ramming a gate at the White House.

Authorities described Carey has having a “mental illness.”

“She had post-partum depression after having the baby” last August, said the woman’s mother, Idella Carey.

She added, “A few months later, she got sick. She was depressed. … She was hospitalized.”

Carey had a 1-year-old daughter named Erica, her mother said. Police confirmed that a 1-year-old girl was taken from the car and put in “protective custody.”

READ MORE: Attempt to Ram White House Gate Ends With Female Suspect Dead

PHOTOS: Capitol Hill Lockdown and D.C. Chase

Idella Carey said her daughter had “no history of violence” and she did not know why she was in Washington, D.C. She said she believed Carey was taking the little girl to a doctor’s appointment today in Connecticut.

Dr. Steven Oken, her boss of eight years, described Carey as a “non-political person” who was “always happy.”

“I would never in a million years believe that she would do something like this,” he said. “It’s the furthest thing from anything I would think she would do, especially with her child in the car. I am floored that it would be her.”

A neighbor, Erin Jackson, said she believed Carey lived in the Stamford home with the baby and the girl’s father. Asked if she believed Carey suffered from a mental illness, Jackson said “absolutely.”

Jackson recognized the black Infinity sedan seen on television from the incident as resembling Carey’s car. She said the woman’s tires recently were slashed in an incident in Connecticut.

Police, including FBI and bomb disposal units, surrounded a home in Stamford Thursday evening that authorities say is linked to the investigation, but won’t give specifics. Police there said they were awaiting a search warrant from Washington, though 50 people from the apartment building already were being evacuated for the night.

Cops said Carey eluded police after they stopped her car and drew their guns. When she continued to flee, she drove “very erratically, very dangerously,” said Senate Sergeant at Arms Terrance Gainer.

She ultimately rammed a police car and was shot by police without exiting the car, Gainer said. Two officers, one from the Capitol Police and one from Secret Service, were injured in the incident.

No weapons were found in the car, police said.

Silk Road Died, Bitcoin Crashed. So why am I so happy?

Silk Road Died, Bitcoin Crashed. So why am I so happy?

By Paul Rosenberg, FreemansPerspective.com

You may have heard that Silk Road – the truly free online market – was taken down today, by the FBI. In response, the price of Bitcoin crashed 24%.

Yet here I am – just a few hours later, feeling very optimistic. Why? Because the philosophy of freedom just showed itself to be massively stronger than statism and its “don’t think, just obey” philosophy.

Here’s What Happened

As I was finishing my lunch, I saw a story posted on the takedown/crash. I did a bit of checking and conversed with a friend, and then hustled over to a place I know where crypto-anarchists hang out online.

These guys were already talking about replacing Silk Road, and doing a better job of it.

Forget about the drugs aspect of this – I don’t care for drugs and neither do the people I listened in on – they just want to build free markets.

Contrast that to a financial site, where I found a couple of Bitcoin haters, a Fed trying to supercharge as much fear as he/she could, and several people trying to buy Bitcoin at its lows, or lamenting that they were out of extra cash to buy right away.

But here’s the interesting part: In the face of an orchestrated attack (and you can be sure that the Feds arranged the day’s events for maximum fear – that’s what they do), even these people, within minutes, were walking forward, not backward.

A Better Philosophy Wins Out

Arguably, the greatest triumph of a new philosophy has to be that of the early Christians (of the 1st, 2nd and 3rd centuries AD), they simply would not be stopped, no matter what was thrown at them.

And why wouldn’t they turn back? Because the Roman way was ridiculous and barbaric. Their gods were vile, vain, sometimes stupid and often cruel. Who wants to worship that? These Christians – whatever their faults or virtues – had found a God who loved them, who wished to help and enlighten them, who said they were meant to be free and prosperous.

Which way would you choose?

The Romans persecuted them and sometimes killed them, but they would not be turned around. These people chose the better philosophy, and in the end, they won.

Today, I saw the same thing, wrapped in modern circumstances.

Freedom-minded people are not stopping, are not abandoning their views. And why should they? Shall we go back to the idiocy and self-contradictory life of worshiping the state? Of pretending that robbery is somehow – magically – not robbery when the government does it?

Our minds have been removed from the state’s intimidation and conditioning. Shall we go back to believing lies and repeating vapid slogans for the rest of our lives?

There are real reasons why individuals move from bondage to liberty, but very seldom the reverse.

The Bottom Line Facts

At the end of all the discussions, all the fears, all the questions, all of the explaining to newbs and concerned friends, stand these facts:

Our philosophy is better than theirs. We offer men and women truth, understanding, compassion (the real kind), and strong, direct relationships. The state offers punishment, fear, an occasional promise of plunder, and intrusion into every relationship in your life.

Our people are better than theirs. Not because we were born better, but because finding and living according to truth produces better people than blind obedience and fear of the lash.

We are not quitting. We can’t. We won’t.

Yes, there may be bruises and even blood along the way, but like the first Christians, our people do not turn back – they continue regardless.

We’ve come out of the state’s cultivated darkness, and we are moving into more and more light. Why would we want to go back to where we were? Even if we tried to do it, could we really stick with it? Could our minds really fit back into their old restraints?

This is why freedom will win, my friends: The genie is out of the bottle, and the Internet has spread the message to the four corners of the Earth. It’s a better message. It produces better people.

And in the end, we will win.

[Editor’s Note: Paul Rosenberg is the outside-the-Matrix author of FreemansPerspective.com, a site dedicated to economic freedom, personal independence and privacy. He is also the author of The Great Calendar, a report that breaks down our complex world into an easy-to-understand model. Click here to get your free copy.]

D.C. SHOOTER’S MOTIVE

Pandemonium in Washington DC. The Secret Service had to make Obama leave the 16th green while attempting a 50 foot putt. One of the brilliant Zero Hedge analysts has already figured out the motive of the shooter. The first victim of Obamacare.

“Looks like someone already got their 1st Obamacare Bronze Plan co-pay bill and simply lost it.”

GODDAMN IT !!! 3 FUCKING DAYS ON THE COMPUTER with nothing to drink and eat but Red Bull and Meth AND WHEN I FINALLY GET THROUGH I HAVE TO PAY FOR IT ??????……and to make it worse…..NO FREE iPHONE THAT RUBS MY BALLS AND MAKES ME WAFFLES????

WHERE’S MY GUN ????

- CAPITOL IS OPEN; LOCKDOWN ENDS AFTER SHOOTING

- FEMALE SUSPECT REPORTED DEAD ON SCENE AT US CAPITAL: SOURCE

- CAPITOL SHOOTING STARTED WHEN WOMAN TRIED TO RAM GATE AT WHITE HOUSE, THEN FLED. WAS SHOT WHILE TRYING TO HIT OFFICER. CBS.

- Pete Williams: Driver in black car tried to breach White House gate, was pursued to Capitol Hill, shots exchanged near 2nd / Constitution

BUY A TESLA, GET A FREE CASE OF MARSHMELLOWS & A FIRE EXTINGUISHER

Let the spin begin. You gotta love $70,000 Obama subsidized green machines that spontaneously burst into flames and can’t be put out with water. What’s not to like? I’m sure those batteries are wonderful for the environment. At least you’ll feel good about the earth as you and your family are incinerated. CNBC with breaking news from Jimmy Cramer. This is a buying opportunity. They are selling 20,000 cars per year and the stock should surely be selling at $200 per share. Wait until they make profits. Meanwhile, you can roast those marshmellows on the turnpike.

Car-B-Q: Tesla Admits Model S Inferno Started In Battery Pack

Submitted by Tyler Durden on 10/03/2013 07:54 -0400

In what can hardly be encouraging news to all the cult members holding the priced to immaculate conception Tesla stock, the unverified YouTube video clip posted yesterday showing the Tesla Model S aka “the safest car in America” (how is that kickbacks-for-awards thing at NHTSA going anyway?) engulfed in a flaming inferno, has just been authenticated by Tesla, and what’s worse not only was there indeed a fire but it originated in the worst possible place: the battery pack. Where it goes from worse to worst is that once on fire (the car, not the stock) “water seemed to intensify the fire.” It remains to be seen if the new and free car option: “Spontaneous Combustion” will have a similar effect on the company’s stock.

A fire that destroyed a Tesla electric car near Seattle began in the vehicle’s battery pack, officials said Wednesday, creating challenges for firefighters who tried to put out the flames.

Company spokeswoman Liz Jarvis-Shean said the fire Tuesday was caused by a large metallic object that directly hit one of the battery pack’s modules in the pricey Model S. The fire was contained to a small section at the front of the vehicle, she said, and no one was injured.

Shares of Tesla Motors Inc. fell more than 6 percent Wednesday after an Internet video showed flames spewing from the vehicle, which Tesla has touted as the safest car in America.

The liquid-cooled 85 kilowatt-hour battery in the Tesla Model S is mounted below the passenger compartment floor and uses lithium-ion chemistry similar to the batteries in laptop computers and mobile phones. Investors and companies have been particularly sensitive to the batteries’ fire risks, especially given issues in recent years involving the Chevrolet Volt plug-in hybrid car and Boeing’s new 787 plane.

It gets better: just as the Fisker Karma was found to have a Gremlin-like attavism toward water, especially in the aftermath of Superstorm Sandy when underwater cars would suddenly catch fire, so the Tesla S

In an incident report released under Washington state’s public records law, firefighters wrote that they appeared to have Tuesday’s fire under control, but the flames reignited. Crews found that water seemed to intensify the fire, so they began using a dry chemical extinguisher.

Yeah, when water “intensifies” a fire, you have a big problem, safest car in the world award notwithstanding. The bad news continues:

Firefighters arrived within 3 minutes of the first call. It’s not clear from records how long the firefighting lasted, but crews remained on scene for 2 1/2 hours.

Tesla said the flames were contained to the front of the $70,000 vehicle due to its design and construction.

“This was not a spontaneous event,” Jarvis-Shean said. “Every indication we have at this point is that the fire was a result of the collision and the damage sustained through that.”

Ironically, every one has already made up their mind about what caused the fire, even though “There was too much damage from the fire to see what damage debris may have caused, Webb said.”

In other words, let’s come up with anything that prevents the stock from getting obliterated now that the most overpriced car company in the world is suddenly the recently bankrupt Fisker Carma.

Why Don Coxe Expects Gold to Soar on Good Economic News

Why Don Coxe Expects Gold to Soar on Good Economic News

By The Gold Report

The standard wisdom on gold is that it does well in times of economic bad news such as in the 1970s, a period of stagflation and recessions, when the yellow metal rose from $35/oz to peak at $850/oz in 1980. But this time, Don Coxe, a portfolio adviser to BMO Asset Management, believes, things are different. In this interview with The Gold Report, Coxe explains why gold will rise when the economy improves.

The Gold Report: Are the days of easy money drawing to a close?

Don Coxe: I don’t think so. Even if the Federal Reserve begins to taper quantitative easing, the front of the curve is going to stay at zero interest rates. A trillion dollars is going through the Fed’s balance sheet, which works its way through the system. As long as the Fed keeps interest rates at zero, it’s easy money.

TGR: Will overt monetary inflation return any time soon?

DC: It will return when we have sustained economic growth. The Eurozone has been the big drag. It is definitely stronger than it was a year ago. The Eurozone has lots of problems, but it is experiencing economic growth despite the European Central Bank reducing its balance sheet in the last 12 months by almost exactly the same percentage amount that the Fed increased its balance sheet. This says that it has lots of firepower if it needs it. In addition, the Eurozone government deficits are lower than ours in terms of percentage of GDP. The Eurozone actually, despite all its highly publicized problems, has improved its financial shape relative to ours.

Also, in the last 12 months, Japan, the world’s third-biggest economy, has gone from negative growth to strongly positive growth. It is doing that by printing yen at a prodigious rate. The days of easy money are going strong.

TGR: If inflation returns, will it first appear in goods or services?

DC: In goods. If I had to pick the one point at which we’ll start to see the change, it’s when the razor-thin inventory-to-sales ratio comes under strain. Corporations are controlled by people who learned in business school over the last 20 years that the first thing to manage is inventories. This way they don’t have to worry about prices going up and don’t use corporate cash to finance an inventory that may decline in value. Therefore, when things change, it will show up in the pressure that comes because companies have so little inventory on hand. Corporations will decide that they’ve got to invest in more inventory because they’ve got more demand.

TGR: Do you think that will shake loose the vast amount of capital that’s being retained by the multinationals?

DC: It will shake loose some of it, but the big thing is it will come because prices are starting to rise. The two reinforce each other.

TGR: What do increases in monetary inflation and capital growth mean for gold?

DC: Gold rose along with the Fed balance sheet for years. The two have decoupled in the last two years. I believe the reason is people have just thrown in the towel that there will ever be inflation. If you’re “Waiting for Godot,” at some point you can reach the conclusion that Godot may never come.

TGR: Should investors bet on gold’s return to previous highs or something in that direction?

DC: I don’t think we’re going to see anything like the double-digit inflation that we saw back in the 1970s. The big difference was the tremendous power of unions then. They all had cost of living adjustments in their contracts; the Consumer Price Index (CPI) would rise in a quarter, then automatically wage rates would increase, and the two fed off each other. The weakened power of unions today has meant that we don’t have an automatic reinforcement right at the core of the system.

TGR: Let’s talk about monopolies and competition and why does the focus of big investors shift from growth to income?

DC: I’m not convinced that we’ve got a lot of monopolies out there. OPEC is no longer able to control oil prices, for example, because its share is no longer large enough to give it freedom on pricing. I believe that oil fracking will gradually start spreading from the US to other parts of the world. We don’t have that monopoly, which was the big one back in the 1970s that made it possible for OPEC to quadruple the price of oil. A quadrupling of the price of oil here is impossible because the global economy would collapse with a doubling of oil prices.

TGR: Are companies borrowing money at cheap rates to increase dividends and buy back stock? And, if so, how does that affect the system?

DC: Yes, companies are basically removing from the system what I believe is the core of capitalism, that corporate cash is used to grow a business. Investors pay a high price-earnings ratio for companies because they believe the companies can reinvest that cash and sustain their growth. When we see that corporate cash is being used to buy back stock and pay dividends, the decision-making force in the system becomes stockholders redeploying cash. In the past it was the corporations themselves through their retained earnings and effective reinvestment that drove the system.

If money that people got in dividends was invested in shares of companies that were issuing new stock in order to grow their business, then the whole system would not be losing the money. When you have a system where corporate treasurers do not assume strong future growth and they assume that these zero interest rates are going to continue for a long time, the incentive to retain earnings and plan on capital expenditures (capex) goes away.

Capex is putting money out at great cost, where companies get no immediate returns from it, whether it’s building a new building or opening up a whole area of the country. When you take that out of the system, the result is that you turn the system on its head. It used to be that the companies would, when they had the cash, decide how much was needed for capex; after that they figured out how much they would payout in dividends. The decision makers within the companies are no longer focused on creating overall economic growth through capex and expanding production.

TGR: Are we in a triple-dip or a quadruple-dip recession here?

DC: No, I think we’re coming out of it, but we’ve come out of it at a gigantic cost. The Fed had to quadruple its balance sheet, which raises all sorts of problems. We have no precedent in history of this kind of expansion of the Fed’s balance sheet.

The ratio of paper wealth to GDP is so high at a time when it’s going to be difficult for corporations to expand because, as I said, they will need a large amount of capex to meet rising demand at a time when there’s all that money out there. I would regard that as a virtual guarantee that at some point we’re going to see inflation.

This time inflation won’t come from rising wages. It will come from rising demand and the inability of corporations to swiftly respond to that demand. The technology industry can expand in a hurry because it keeps coming out with new products, but for most of the rest of the economy, it takes a while to build a plant and get the machinery ready and test it out before there actually is any production. That period of time, if you’ve got strong demand because there’s so much paper money, is the moment at which you will see inflation coming.

TGR: How will that affect gold?

DC: It will deal with the problem of faith in gold. When gold tracked the growth in the monetary base, which it did so well, there was a general conviction based on Milton Friedman’s theories that expanding the monetary base too fast eventually translates into inflation. Inflation is harder to stop than it is to just watch start growing.

We will see that interest rates will have to rise because of another group that has not been heard from in a long time: bond vigilantes. They are threatened with extinction. It will be a combination of rising interest rates and rising prices that will get people to say, “Ah ha! Milton Friedman was right after all—if you print the money, eventually you’re going to have the inflation.”

TGR: When you talk about bond vigilantes, are you talking about junk bonds or what’s known as private equity?

DC: The bond vigilantes work primarily on government bonds because they are the ones they can trade most effectively. Junk bonds are a small part of the market. With inflation the bond vigilantes sell off their 30- and 10-year bonds and move down to the 2-year note. At that point the cost of capital for expansion rises through the system because corporations can use short-term cash for some of their work, but they tend to use long-term borrowing from banks and the bond market for major projects. The cost of building those projects increases because of the steep yield curve.

TGR: Do you consider yourself to be a bear or a bull on gold?

DC: I am neutral in the short term. I’m not a bear. I’m a bull in the long term because I believe it’s not a question of if but when all this money printing eventually comes to haunt us. Gold as an asset class is so tiny in relation to the vast expansion of money around the world. With the printing that’s gone on, China has had to expand its renminbi supplies to prevent the currency from soaring relative to the dollar.

TGR: You are appearing at the upcoming Casey Fall Summit. Are you going to talk about gold there and will it be more or less what you just said?

DC: Yes. I am going to point out that the big story for gold is up until now gold has been only a bad news story. The reason why it’s in trouble right now is there always seems to be bad news in terms of inflation. People say if inflation hasn’t come now with the quadrupling of the Fed’s balance sheet, it’s never going to come, and the Fed is going to have to keep on pouring out more money because the economy isn’t growing.

When the economy starts to grow all of a sudden because, as I said earlier, of the inventory cycle, we are going to start to see inflation. Gold will become a good news story in the sense it will be responding to strong economic news at a time of massive liquidity, which translates into inflation. The fact that we’ve had all that money printing, which has only prevented us from going down into a pit, at such time as this actually leads to good economic growth. That is the point at which we’re going to see people wanting to have gold. It’s because we didn’t get the direct pass over of the money printing into rising prices that gave people a loss of faith saying, “Well, if it hasn’t come with quadrupling the Fed’s balance sheet, it’s never going to come.”

TGR: Given that, is it a good idea for investors to buy gold stocks while they’re available at basement prices?

DC: I believe that everybody should have gold insurance now. The question varies from investor to investor. What we have is an extremely high-risk central bank policy in the world, and it’s high risk based on monetarism. I believe monetarism will prove to be right because all past experiments with paper money eventually led to inflation and monetary collapse. At some point the fear of that will come. You need gold for insurance, but this time the payoff will come when the economy improves; in the past when everything was falling all around you, commodity prices were soaring out of sight. We had three recessions in the 1970s and gold went from $35 an ounce to $850. But this time, gold is going to appreciate when we start getting 3% GDP growth.

TGR: Thank you for your insights.

Don Coxe has 40 years of institutional investment experience in Canada and the US. As a strategist and investor, he has been engaged at the senior level in global capital markets through every recession and boom since the onset of stagflation in 1972. He has worked on the buy side and the sell side in many capacities and has managed both bond and equity portfolios and served as CEO, CIO, and research director. From his office in Chicago, Coxe heads up the Global Commodity Strategy investment management team, a collaboration of Coxe Advisors and BMO Global Asset Management. He is advisor to the Coxe Commodity Strategy Fund and the Coxe Global Agribusiness Income Fund in Canada, and to the Virtus Global Commodities Stock Fund in the US. Coxe has consistently been named as a top portfolio strategist by Brendan Wood International; in 2011, he was awarded a lifetime achievement award and was ranked number one in the 2007, 2008, and 2009 surveys.

The Casey Research Summit has sold out, as they always do. With important political figures such as keynote speaker Dr. Ron Paul and Catherine Austin Fitts contributing, along with investment experts including John Mauldin and Rick Rule and Casey Research founder and contrarian legend Doug Casey himself, the Summit is a must-attend event for many. And with healthcare and legal and privacy issues on the docket for the upcoming conference, it’s even more timely.

There is a way you can “be there” for every session… every panel discussion… every workshop… in order to glean the most information possible from the blue-ribbon panel of experts, most of whom have agreed to stay and participate as audience members for the duration of the Summit. By preordering the Casey Summit Audio Collection, you will give yourself the next best thing to being there—and if you order today, you’ll lock in a special reduced rate. Learn more about the Summit and the Audio Collection, and reserve your copy now.

WHY IS OBAMA MEETING WITH WALL STREET CRIMINALS?

Do you need any more proof about who is calling the shots in this country than the fact that the CEOs of the TOO BIG TO TRUST Wall Street are meeting face to face with Obama in the midst of a government shutdown “crisis”?

Why isn’t he meeting with the CEOs of some small credit unions and local home town banks from Iowa? Why isn’t he meeting with some unemployed middle class workers or millenials up to their eyeballs in student loan debt?

He isn’t meeting with the little people because they aren’t running the country. We don’t live in a Republic or a Democracy. This country is run by bankers, mega-corporation CEOs, and shadowy billionaires.

Doesn’t it give you a warm feeling inside that the very same evil motherfuckers that crashed the worldwide financial system in 2008, stole $700 billion from the taxpayers, created the huge debt problem that has caused this debt ceiling crisis, and are now making record profits due to Bernanke’s ZIRP and QEternity policies, are the first people Obama consults regarding the government shutdown?

The men strolling into the White House this morning should be in the same prison as Bernie Madoff. They are criminals who have stolen trillions from the American people. Their leader is none other than Jamie Dimon, the head of the criminal enterprise known as JP Morgan. Calling them a criminal enterprise is not hyperbole. They have been forced to pay $7 billion of fines in the last two years for their criminal exploits.

http://www.zerohedge.com/news/2013-07-30/jpmorgan-7-billion-fines-just-past-two-years

The Department of Housing and Urban Development is in the process of fining them $20 billion for the largest mortgage fraud in world history. Jamie Dimon has been in charge of this criminal enterprise for over a decade.

How could the president of the United States allow criminals into the White House to give him guidance? Maybe it is because they bankrupted their own organizations and creatively used accounting gimmicks, fraud, and threats to bring down the financial system as their method to stay open and continue pillaging the muppets. Obama wants to know their tricks.

Inviting Jamie Dimon to the White House for guidance on handling this financial crisis would be on par with Franklin Delano Roosevelt inviting Al Capone to the White House for guidance about prohibition.

In case you weren’t sure yet, YOUR OWNERS ARE IN THE HOUSE!!!!

Wall Street CEOs to Meet With Obama as Budget Crisis Continues

HOW WILL WE SURVIVE A GOVERNMENT SHUTDOWN? ANYONE?

Tomorrow is Tuesday. I will get up at 5:15 am, shower, shave, feed the cats, make a pot of coffee, get my kids up for school, make my lunch, get in my car, drive to work, curse at a few assholes on the Schuylkill Expressway, say no to people asking for more money all day, warn my boss about impending doom, get back in my car and drive home, curse a few more assholes in West Philly, eat dinner, watch a couple Seinfeld reruns, pick up my son from his driver’s ed class, browse the comments on TBP, and go to bed between 10:00 and 10:30.

If the government is shutdown, how will I possibly get through my day?

Remember the fear mongering stories in the MSM about the horrible impact of the sequester? The world would end if spending was slowed by a fraction of a percent. The country was going to be overrun by our foreign enemies. White House tours had to be cancelled. Air traffic controllers would be fired and planes would be crashing around the country. Has the sequester impacted your life one iota? It did keep the annual deficit from surpassing $1 trillion again, which Obama is now taking credit for.

I do have a few questions about this doom scenario of government drones not spending my money for a few days.

- Does a government shutdown mean the NSA won’t be spying on us while the government is closed?

- Will we have to ground our predator drones and not kill innocent women and children for a day or two?

- Will we make our troops stand down in all the countries we are currently attacking?

- Will the recharging of EBT cards not take place tomorrow in West Philly? If so, I will take a different route to work.

- Will they stop taking Federal income taxes, SS taxes, and Medicare taxes out of my paycheck because the government won’t be processing them anyway?

- If a government drone doesn’t go to work, does anyone notice?

I sure hope I can sleep tonight knowing that my government won’t be watching over me and protecting me from terrorists tomorrow.

Do you think anyone cares? anyone? anyone? Bueller?

QUOTES OF THE DAY

“An impasse over the federal budget reaches a stalemate. The president and Congress both refuse to back down, triggering a near-total government shutdown. The president declares emergency powers. Congress rescinds his authority. Dollar and bond prices plummet. The president threatens to stop Social Security checks. Congress refuses to raise the debt ceiling. Default looms. Wall Street panics.”

The Fourth Turning – Strauss & Howe – Page 273 – Written in 1996

“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe

“Imagine some national (and probably global) volcanic eruption, initially flowing along channels of distress that were created during the Unraveling era and further widened by the catalyst. Trying to foresee where the eruption will go once it bursts free of the channels is like trying to predict the exact fault line of an earthquake. All you know in advance is something about the molten ingredients of the climax, which could include the following:

- Economic distress, with public debt in default, entitlement trust funds in bankruptcy, mounting poverty and unemployment, trade wars, collapsing financial markets, and hyperinflation (or deflation)

- Social distress, with violence fueled by class, race, nativism, or religion and abetted by armed gangs, underground militias, and mercenaries hired by walled communities

- Political distress, with institutional collapse, open tax revolts, one-party hegemony, major constitutional change, secessionism, authoritarianism, and altered national borders

- Military distress, with war against terrorists or foreign regimes equipped with weapons of mass destruction”

The Fourth Turning – Strauss & Howe

SPIN BABY SPIN

The consumer is back baby. The MSM is gaga over the “surge” in August spending, driven by subprime 7 year 0% auto loans to pimps and hos in West Philly. Maybe the University of Phoenix dropouts are using their student loans to buy iGadgets and bling. Here is a link to the “fantastic” data:

http://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm

I just can’t help myself. Let me take a look at the data and give you a few FACTS you may not see in the MSM spinfest:

- Real disposable personal income, using the fake BLS inflation numbers, is up a HUGE 1.6% in the last year. In reality, using inflation numbers from the real world, real disposable income has declined. This is consistent with the FACT that retailers are reporting negative or flat comp store sales.

- Real disposable income per capita was up an even more pathetic 1% in the last year, as the country’s population grew by 2.2 million people.

- To give you some perspective on how the average person (not a Wall Street asshole) has progressed in the last five years, the real disposable personal income per person in May of 2008 was $37,584. Today it is $36,357. The average American, after the four year Obama recovery, has 3.3% LESS disposable income.

- Americans have been forced to REDUCE their savings by $22 billion in the last year to just make ends meet in this fantastic economy. Three cheers for a near record low savings rate.

- Personal income is up $500 billion in the last year, but in this warped Orwellian world we live in, only 50% of this is generated by wages paid by businesses to workers. The $2.4 trillion per year taken out of your pocket or borrowed from future generations and handed out to the non-producers in this country is hysterically counted as personal income.

- You’ll be thrilled to know that dividend income paid to the .1% is up by $71 billion in the last year, while interest income paid to senior citizens and savers is virtually flat and down $150 billion since August 2008. Over this time, Bernanke has stolen over $400 billion from savers and handed over to his puppet masters on Wall Street.

- Great news for Obama and the government drones in DC. They have sucked $172 billion more in taxes from you compared to last year. Bye Bye payroll tax cut. I’m sure they’ll put the money to good use funding more IRS agents to enforce Obamacare.

- The American consumer is back. Their disposable personal income was up $336 billion in the last year and they spent $359 billion of that. Oops!!! How long can you continue to spend more than you have? I guess we’ll find out.

Good bye from the NO SPIN zone. I hope you liked my daily dose of reality.

Consumer spending bounces back in August

Faster pace of outlays suggests economy hasn’t slowed all that much

By Jeffry Bartash, MarketWatch

WASHINGTON (MarketWatch) — Consumers opened up their wallets in August and spent more in July than previously reported, suggesting that U.S. growth might not soften quite as much in the third quarter as economists had forecast.

Consumer spending rose a seasonally adjusted 0.3% last month, marking the third-fastest increase of the year, the Commerce Department said Friday. And spending in July rose twice as fast as initially estimated –— 0.2% instead of 0.1%.

Economists surveyed by MarketWatch had forecast a 0.3% increase in consumer spending and a 0.4% rise in personal income.

The larger increase in incomes allowed Americans to salt away a bit more cash. The savings rate of Americans rose to 4.6% from 4.5%. The savings rate, however, hasn’t topped 5% since late last year.

Consumer spending represents as much as 70% of the U.S. economy and is the biggest influence on growth. The bounce-back in spending could generate faster growth in the third quarter than economists had been expecting. Gross domestic product is forecast to rise 1.9%, down from 2.5% in the second quarter, according to the latest estimates.

Consumers boosted purchases of autos in August to the highest rate in more than six years, and the month is always big for back-to-school purchases. Americans spent more on durable goods and services, but purchases of everyday items was basically unchanged.

Inflation, meanwhile, edged up 0.1% in August based on the latest reading from the personal consumption expenditure price index. The core rate, which omits food and energy, rose a slightly faster 0.2%.

Both PCE indexes have risen a scant 1.2% over the past 12 months, indicating that inflation remains contained. That gives the Federal Reserve the room to continue its a massive bond-buying program meant to stimulate the U.S. economy.

The Fed surprised Wall Street earlier this month by maintaining its current rate of purchases. A big reason was the apparent slowdown in economic growth and hiring toward the end of the summer.

Yet a slew of recent indicators, including the consumer spending report, suggest the economy has not slowed all that much from the spring. The U.S. grew at a 2.5% rate in the April-to-June period

The Real Reason We Don’t Yet Live Among the Stars

The Real Reason We Don’t Yet Live Among the Stars

By Paul Rosenberg, FreemansPerspective.com

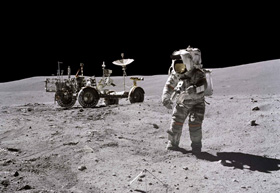

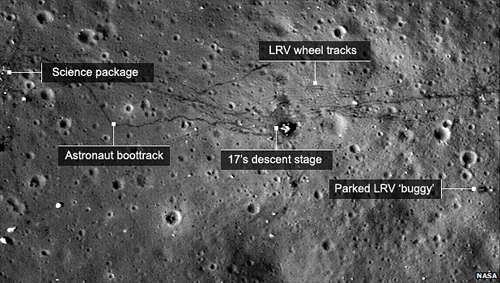

The man in the photo above is Gene Cernan, the last human to walk on the moon. Cernan left the moon in December of 1972 – more than forty years ago – and no one has gone back.

To understand how far we went forty years ago, on how little technology, consider this: Our modern smart phones have 200,000 times more power than the computers that took men to the moon.

Let me restate that: Space travel can be accomplished with forty-year-old technology.

Lamentations Are In Order

It is tragic beyond measure that human exploration has been neutered since 1972. Sure, we’ve sent out a few probes and placed a good telescope in orbit, but we have done nothing brave, nothing bold, nothing daring. Productive humans have been delegated to mute observance as their hard-earned surplus is syphoned off to capital cities, where it is sanctimoniously poured down a sewer of cultured dependencies and endless wars.

We remain locked onto this planet, not because we lack the ability to leave, but because so few of us are able to do anything about it.

What we have lost can be measured only in the billions of unactivated lives. Fifty years ago humanity was shocked to realize that they could go to the stars. After untold millennia of looking to the heavens, of wondering, dreaming and mourning the impossibility, we saw that we could go to the stars. And for ten years we took our first brave steps, successfully!

But after our first major step away from our crib, we were thrown back and surrounded with double-height rails. Since then, we have stagnated, and human culture has undergone a widespread rot. We watch science fictions about going to space, living in space and even fighting in space, but we have given up all hope of going ourselves… even though we did it just one generation ago.

Humanity – having recently discovered the ability to expand without limit – wanders aimlessly, with no challenging goal, no elevated purpose, and no path of escape. Space travel has leapfrogged us: it was done by our fathers; we imagine that it will be done by our sons; but we dare not think that it is possible to us.

They Were Men Like Us

We have more than enough ability to explore space right now. The men who did so a generation ago were not supermen, regardless of how the promotions made them appear.

I’ve met some of the people who did this forty years ago, including one of the men who walked on the moon. I found them to be reasonably decent and competent men (the astronaut struck me as especially capable), but I’ve known other men and women who were of equal or greater decency and competence.

The fault of our earth-bound lives lies not in our abilities. The spacemen were men like ourselves.

Now, please take a look at this photo:

You are observing a workman building a Mercury capsule. Look at the metal work: It is fine construction, and it was advanced for its day, but there are shops in every large city in America that could do the same job, faster, cheaper, with closer tolerances. Like every other technology, metal working has massively improved over the last forty years.

Now look at this Gemini launch. What in this picture is particularly hard to build?

We see concrete, metal frameworks and sprinklers. None of those things are remotely hard. Even the rocket is simple by modern standards.

In other words, this technology is simple to reproduce. None of it is beyond the grasp of journeyman craftsmen.

Leibniz, Newton and Aldrin

Originating is hard; second and third uses are not.

It took brilliant men like Leibniz and Newton to invent calculus, but now, millions of schoolchildren learn it every year.

It took a brilliant engineer like Buzz Aldrin to invent the technologies of space rendezvous, but there are millions of bright young men, right now, who are more than capable of using his discoveries.

Again, none of this is beyond us. And, by the way, we have lots of real geniuses in our time too… it’s just that they have been forced into systems that punish them for their brilliance, rather than rewarding them, or at least just leaving them alone.

Why Haven’t We Gone Back?

There are several ways to answer this question. Here are the answers that I think matter most:

#1: Space is Against the State’s Interest

Can you imagine what would happen to government in space? Once beyond Earth’s gravity well, the spacefarers would be gone forever: no more taxes, no more obedience, and heaps of scorn for the distant barbarians who demanded money and attempted violence to get it. Space would be the 17th century American wilderness on steroids. Politicians and tax gatherers would have no hope of keeping up.

The reason I’m so sure of this is simple mathematics.

Space is a territory that expends exponentially (as a cube of the distance) and endlessly. The numbers look like this:

- At one million miles, government requires 4,188,000,000 billion cubic miles of dominance.

- At two million miles it is 33,504,000 billion cubic miles of dominance.

- At three million miles it is 113,076,000,000 billion cubic miles of dominance.

- At four million miles it is 268,032,000,000 billion cubic miles of dominance.

And so on. The people who left could never again be contained and have their money removed by force. Those cows would never be milked again.

I should add that one million miles in space is almost trivial. At the speeds used forty years ago, that’s only 38.5 hours of travel.

17th century voyages across the Atlantic took weeks, and there was no lack of paying passengers. So, there is no hope of governments getting us back to space. To do so would be to shoot themselves in the chest, and they probably understand that.

#2: The Culture Has Gone Conformist

Consider what became of the past forty years: There has been no striving, no searching, no becoming. Instead, we’ve had:

- 24/7 entertainment, which made billions of otherwise-productive hours worthless.

- An obscene level of advertising that replaced authentic dreams with scientifically implanted manipulations.

- A success ethic that addresses the animal aspects of human life while utterly ignoring its higher aspects.

- Fame for the basest, weirdest and most lurid men and women; conformity for everyone else.

- The glorification and unlimited empowerment of the institution.

As a result, we’ve had boring, washed-out decades, focused on anything but the awe-inspiring, the good, and the truly heroic. These years have been stripped of the greatest excitement, discovery and growth that have ever been possible to our species.

Our current decade features no goals save bodily comfort, and no aspirations save existence and status. Underlying it all is a palette of manufactured fears that can only be salved by buying the right products or electing the right politicians. We are living through the triumph of manipulation and the disappearance of vigorous individuals.

The 1950s are considered a time of mass conformity, but they look like radical experimentation compared to the fully-scripted lives of today’s ‘successful’ people.

The men who went into space knew that death was a possibility, but they valued more than just animal rewards; they wanted to excel, to touch the heavens, to expand, to become more. In the broader cultures of the West, that attitude has been suppressed and nearly lost.

It may be that the next generation will demand more out of life than animal gratifications. Such changes have occurred in the past. Would to God that they come again soon.

#3: Our Money Is Taken from Us

We are taxed on our income at national, state and even local levels. We are taxed on what we spend. We are taxed on Ponzi retirement programs. We are taxed on property we own, and on gasoline we buy, and hundreds of other things.

We have no money left over for things that matter.

The taxation systems of the West are designed to rob us of every dollar we get, right up to the point where we’d be tempted to rebel. This is a science.

If you are a productive person, working in any sort of normal job, roughly half of your earnings are taken from you every year, leaving you just barely able to hang on to an acceptable lifestyle. Understand this: You are already rich, but your money is stolen from you, generally before you ever hold it in your hands.

If we actually held our own money, reaching space again could be done, easily, from a small percentage of our surplus. No coercion would be required, only a bit of excitement.

Photo: The relics of the last moon mission

What has been lost to us?

What happens to humans themselves (and by that I mean internally) once we get to space and have a few moments to “consider the heavens”?

Preliminary evidences are that humans in space think more deeply, more expansively, and more spiritually… that their consciousness opens up and expands.

Consider just these passages from astronauts on the first and last moon missions. (And I have many others.)

As Neil and I first stood on the surface of the moon looking back at Earth – a bright blue marble suspended in the blackness of space – the experience moved us in ways that we could not have anticipated.

– Buzz Aldrin, Apollo 11

Out there on another planet, I was looking back at the Earth, or I was looking back at the other stars in the universe – science and technology could no longer explain to me what I was feeling. Not just what I was seeing, it’s what I was feeling. And I kept thinking, above all religions, there has to be a creator.

It was to me like I was just sitting on a rocking chair on a Friday evening, looking back home, sitting on God’s front porch, looking back at the Earth; looking back home. It was really that simple, but it was an overpowering experience.

I’m sure that viewing the world from the moon only enriched me spiritually and also gave me a new vantage point on life… Anyone who walked on the moon had such a spiritual experience, similar to it or stronger.

– Gene Cernan, Apollo 17

When we lost the moon we lost our bearings; there was no distant star to guide us, no magnificent vision to pursue. Four decades on, we remain in a kind of stasis, mollified with streaming vanities and base satisfactions.

Perhaps we should have known that this would be the result. But when shall we return to the stars?

It isn’t rocket science anymore.

[Editor’s Note: This article is an excerpt from our flagship newsletter Freeman’s Perspective Issue #20: “Forty Years Gone: A Lamentation.” If you liked it, consider taking a risk-free test drive. Not only will you gain immediate access to the rest of the issue, but you’ll also be able to enjoy the entire archive – more than 520 pages of research on topics of importance and inspiration to those looking for freedom in an unfree world. Plus valuable bonus reports and all new issues as well. Click here to learn more.]

By Paul Rosenberg, FreemansPerspective.com

WHAT WOULD WE DO WITHOUT THE DEPT OF EDUCATION?

These are the scores of the kids who think they are capable of going to college. Can you imagine how stupid the kids are who don’t take the SAT test? The Department of Education has been around for 33 years. We pay $80 billion per year in taxes so these government drones can produce this result? How come scores were 28 points higher in 1972 when we didn’t have a Department of Education and student to teacher ratios were 30% higher? Do you think government teacher’s unions really care about educating your children?

This is the consequence of decades of liberal educational policies that teach kids how to feel rather than think. Why teach kids to read when you can show them movies in class? Yeah, they can text better than kids from 1972. Politicians use kids to sell any bullshit policy they want to jam down our throats. Obama poured an extra $200 billion of your tax dollars into Education between 2009 and 2012 as part of his $800 billion porkulus plan. I’m guessing the payoff will come next year. He didn’t just hand your money to teacher’s unions as a payoff for voting Democrat. Right?

Obama and his minions will use these results to reach further into your pocket. Do it for the children.

Uttin’ on the Itz

Outside the Box: Uttin’ on the Itz

By John Mauldin

Last Thursday, prior to the FOMC announcement, I was having an early lunch with Kyle Bass so he could get back to the office in time for the announcement. As we were finishing up, I was invited to come sit with another group of friends and traders who also happened to be in the same restaurant. Everyone was sure there would be some type of tapering. That message had been clearly communicated to the markets. When the announcement came, the telephones went off and everyone erupted with various forms of surprise. I fully admit to being speechless. I kept waiting for some kind of explanation, and none came. The more we talked about it and the more I thought about it later, the more convinced I became that this was one of the more ham-handed policy announcements from the Fed in a very long time. Why would you go to the trouble of getting the market all ready for the onset of tapering, build expectations, and then jerk out the rug? What in the wide, wide world of sports is going on?

I’ve been with Louis Gave and David Rosenberg this weekend here in Toronto. Everyone is searching for an answer on the FOMC’s move. Louis came up with what I’m affectionately calling his conspiracy theory. He thinks Obama is quite upset that he can’t have Summers as Fed chair and that his staff is crossways with Yellen. Reports suggest she has not even been interviewed yet. Really? If that’s the case then perhaps Obama would rather stick with Bernanke for another two years and then make another try for Summers or maybe even a rested Geithner. Steve Cucchiaro (of $18.5 billion-under-management Windhaven fame) asked if Summers had maybe communicated through back channels to Bernanke that he wanted to end the tapering, and Bernanke was helping him out; but then when he was no longer in the running for Fed chair, Janet Yellen came and said, “Ben, I’m not ready to end tapering yet,” so Bernanke took one for the team.

I heard directly from another friend that he was in the offices of one of the world’s largest bond managers, and they had actually been at the Fed the previous week and were confident there would be a small tapering. Did you see the way bonds got ripped after the announcement? These bond managers were pissed (that’s a technical economics term). Can we trust the Fed now? Years of work building transparency and a confidence in the narrative, and then they blow it on a meaningless non-taper?

This week’s Outside the Box is from Ben Hunt. It echoes some of my own concerns about the Fed and raises others. Quoting:

Two things happened this week with the FOMC announcement and subsequent press conferences by Bernanke, Bullard, etc. – one procedural and one structural. The procedural event was the intentional injection of ambiguity into Fed communications. As I’ll describe below, this is an even greater policy mistake than the initial “Puttin’ on the Ritz” show Bernanke produced at the June FOMC meeting when “tapering” first entered our collective vocabulary. The structural event … which is far more important, far more long-lasting, and just plain sad … is the culmination of the bureaucratic capture of the Federal Reserve, not by the banking industry which it regulates, but by academic economists and acolytes of government paternalism. These are true-believers in too-clever-by-half academic theories such as management of forward expectations and in the soft authoritarianism of Mandarin rule. They are certain that they have both a duty and an ability to regulate the global economy in the best interests of the rest of us poor benighted souls.

This is one of the more incendiary OTBs in a while, and I think you should set aside some time to think on the implications Ben is writing about.

One of the important things the Federal Reserve provides when there is a crisis is that sense that “daddy’s home.”. Whether or not you personally believe the Fed has any significant power to actually do anything, the general market does believe it, and that’s the important thing. Now the Fed is at significant risk of damaging its reputation for decisiveness and clarity. We can only hope there is not another crisis coming out of Asia or Europe in the next few months that would require Federal Reserve action. What could they do now that would actually be credible? And while I don’t see a crisis developing in a short timeframe, it is the things that we don’t see, the Lions in the Grass, that create so many problems. Just saying…

I am at the airport in Toronto as I write this note. Tonight I get to have dinner with my friends Art Cashin, Barry Ritholtz, Barry Habib, Rich Yamarone, Christian Menegatti, and David Rosenberg; and Jack Rivkin may show up a little later. Ian Bremmer is supposed to drop by for early drinks before he heads off for dinner with Prime Minister Abe of Japan. It looks like it will be a spirited evening, with lots to talk about. I am not sure what I will write about this weekend, but I bet I’ll get a few ideas this evening.

And speaking of the venerable Art Cashin, I will not be the only one at the table tonight who is mystified by the Fed’s action. And apparently some members of the FOMC agree with Art and me. Art wrote this morning:

Candor With A Capital C – Yet Again – One of the Fed speakers yesterday was the President of the Dallas Fed, Mr. Richard Fisher. Mr. Fisher is a favorite of floor traders since, when he speaks, the message is clear, not couched in monetary argot. He didn’t deviate from that habit at all yesterday.

His speech was on current banking trends and a post-Lehman review. He said that too big to fail banks were “a dagger pointed at the heart of the economy.” At the end of his speech he said:

A Deliberate Deflection

As I said at the beginning of my remarks, I am going to try to avoid answering questions you might have about last week’s FOMC meeting and what some in the press have now labeled “the taper caper.” Nearly every Federal Reserve Bank president and his or her sister will be speaking to this topic this week, so you will be getting an earful of cacophonous comments on this subject.

Today, I will simply say that I disagreed with the decision of the committee and argued against it. Here is a direct quote from the summation of my intervention at the table during the policy “go round” when Chairman [Ben] Bernanke called on me to speak on whether or not to taper: “Doing nothing at this meeting would increase uncertainty about the future conduct of policy and call the credibility of our communications into question.” I believe that is exactly what has occurred, though I take no pleasure in saying so.

While he may have deflected further questioning on the “taper caper,” he did not deflect all questions. Again his candor brought headlines. Here’s a bit from Bloomberg on the Fed Chair succession:

“The White House has mishandled this terribly,” Fisher said today in response to a question from the audience after giving a speech in San Antonio, Texas. “This should not be a public debate,” he said, adding that the Fed “must never be a political instrument.”

On another question, Mr. Fisher apparently said that although Janet Yellen was dead wrong in her policy direction, she would make a great Chair.

We doubt that Mr. Fisher ever hears the question, “What exactly do you mean by that?” We could use more such candor elsewhere.

You have yourself a good week, and I’ll report back. And now sit down while we hear from Ben Hunt.

Your wishing he knew what was going on in Bernanke’s head analyst,

John Mauldin, Editor

Outside the Box[email protected]

Uttin’ On the Itz

By Ben Hunt, Ph.D.

High hats and arrowed collars, white spats and lots of dollars

Spending every dime, for a wonderful time

If you’re blue and you don’t know where to go to

Why don’t you go where fashion sits,

Puttin’ on the Ritz.

– Irving Berlin

Hegel remarks somewhere that all great, world-historical facts and personages occur, as it were, twice. He has forgotten to add: the first time as tragedy, the second as farce.

– Karl Marx

I never could bear the idea of anyone expecting something from me. It always made me want to do just the opposite.

– Jean-Paul Sartre, “No Exit”

Every time I hear a political speech or I read those of our leaders, I am horrified at having, for years, heard nothing which sounded human.

– Albert Camus

The structure of a play is always the story of how the birds came home to roost.

– Arthur Miller

In Young Frankenstein, Mel Brooks and Gene Wilder brilliantly reformulate Mary Shelley’s Frankenstein; or, The Modern Prometheus, a tragedy in the classic sense, as farce. The narrative crux of the Brooks/Wilder movie is Dr. Frankenstein’s demonstration of his creation to an audience of scientists – not with some clinical presentation, but by both Doctor and Monster donning top hats and tuxedos to perform “Puttin’ on the Ritz” in true vaudevillian style. The audience is dazzled at first, but the cheers turn to boos when the Monster is unable to stay in tune, bellowing out “UTTIN ON THE IIIITZ!” and dancing frantically. Pelted with rotten tomatoes, the Monster flees the stage and embarks on a doomed rampage.

Wilder’s Frankenstein accomplishes an amazing feat – he creates life! – but then he uses that fantastic gift to put on a show. So, too, with QE. These policies saved the world in early 2009. Now they are a farce, a show put on by well-meaning scientists who have never worked a day outside government or academia, who have zero intuition for, knowledge of, or experience with the consequences of their experiments.

Two things happened this week with the FOMC announcement and subsequent press conferences by Bernanke, Bullard, etc. – one procedural and one structural. The procedural event was the intentional injection of ambiguity into Fed communications. As I’ll describe below, this is an even greater policy mistake that the initial “Puttin’ on the Ritz” show Bernanke produced at the June FOMC meeting when “tapering” first entered our collective vocabulary. The structural event … which is far more important, far more long-lasting, and just plain sad … is the culmination of the bureaucratic capture of the Federal Reserve, not by the banking industry which it regulates, but by academic economists and acolytes of government paternalism. These are true-believers in too-clever-by-half academic theories such as management of forward expectations and in the soft authoritarianism of Mandarin rule. They are certain that they have both a duty and an ability to regulate the global economy in the best interests of the rest of us poor benighted souls. Anyone else remember “The Committee to Save the World” (Feb. 1999)? The hubris levels of current Fed and Treasury leaders make Rubin, Greenspan, and Summers seem almost humble in comparison, as hard as that may be to believe. The difference is that the guys on the left operated in the real world, where usually you were right but sometimes you were wrong in a clearly demonstrable fashion. A professional academic like Bernanke or Yellen has never been wrong. Published papers and books are not held accountable because nothing is riding on them, and this internal assumption of intellectual infallibility follows wherever they go. As a former cleric in this Church, I know wherefore I speak.

There’s frequent hand-wringing among the chattering class about whether or not the Fed has been “politicized.” Please. That horse left the barn decades ago. In fact, with the possible exception of Paul Volcker (and even he is an accomplished political animal) I am hard pressed to identify any Fed Chairman who has not incorporated into monetary policy the political preferences of whatever Administration happened to be in power at the time.

Bureaucratic capture is not politicization. It is the subversion of a regulatory body, a transformation in motives and objectives from within. In this case it includes an element of politicization, to be sure, but the structural change goes much deeper than that. Politicization is a skin-deep phenomenon; with every change in Administration there is some commensurate change, usually incremental, in policy application. Bureaucratic capture, on the other hand, marks a more or less permanent shift in the existential purpose of an institution. The WHY of the Fed – its meaning – changed this week. Or rather, it’s been changing for a long time and now has been officially presented via a song-and-dance routine.

What Bernanke signaled this week is that QE is no longer an emergency government measure, but is now a permanent government program. In exactly the same way that retirement and poverty insurance became permanent government programs in the aftermath of the Great Depression, so now is deflation and growth insurance well on its way to becoming a permanent government program in the aftermath of the Great Recession. The rate of asset purchases may wax and wane in the years to come, and might even be negative for short periods of time, but the program itself will never be unwound.

There is very little difference from a policy efficacy perspective between announcing a small taper of, say, a $10 billion reduction in monthly bond purchases and announcing no taper at all. But there is a HUGE difference from a policy signaling perspective between the two. Doing nothing, particularly when everyone expects you to do something, is a signal, pure and simple. It is an intentional insertion of uncertainty into forward expectations, a clear communication that the self-imposed standards for winding down QE as established in June are no longer operative, that the market should assume nothing in terms of winding down QE.

Think of it this way … why didn’t the Fed satisfy market expectations, their prior communications, and their own stated desire to wait cautiously for more economic data by imposing a minuscule $5 billion taper? Almost every market participant would have been happy with this outcome, from those hoping for more accommodation for longer to those hoping that finally, at last, we were on a path to unwind QE. Everyone could find something to like here. But no, the FOMC went out of its way to signal something else. And that something else is that we are NOT on automatic pilot to unwind QE. A concern with self- sustaining growth and a professed desire to be “data dependent” are satisfied equally with either a small taper or doing nothing. Choosing nothing over a small taper is only useful insofar as it signals that the Fed prefers to maintain a QE program regardless of the economic data. And that’s a position that almost every market participant can find a reason to dislike, as we’ve seen over the past few days. I mean … when even Fed apologist extraordinaire Jon Hilsenrath starts to complain about Fed communications (although his latest article title remains “Market Misreads Signals”), you know that you have a Fed whose preference functions are not identical to the market’s.

Moreover, Bernanke and his team are taking steps to prevent future FOMC’s or Fed Chairs from reversing this transformation of QE from emergency policy to government program. In addition to the implicit signal given by choosing no taper over a small taper, there was an explicit signal in both Bernanke’s comments on Wednesday and in Bullard’s interviews on Friday – the Fed is adding an inflation floor to its QE linkages, alongside the existing unemployment linkage. Previously we were told that QE would persist so long as unemployment is high. Now we are told that QE will also persist so long as inflation is low. Importantly, these are being presented as individually sufficient reasons for QE persistence. If unemployment is high OR inflation is low, QE rolls on. Precedent matters a lot to any clubby, self- consciously deliberative Washington body, from the Supreme Court to the Senate to the FOMC, and by setting multiple explicit macroeconomic linkages to QE – all of which are one-way thresholds designed to continue asset purchases – this Fed is making it much harder for any future Fed to reverse course.

But wait, there’s more …

Given the manner in which inflation statistics are constructed today – and just read Janet Yellen’s book (The Fabulous Decade: Macroeconomic Lessons from the 1990’s, co-authored with Alan Blinder) if you think that the Fed is unaware of the policy impact that statistical construction can achieve … changing inflation measurement methodology is one of the key factors she identifies to explain how the Fed was able to engineer the growth “miracle” of the 1990’s – inflation is now more of a proxy for generic economic activity than it is for how prices are experienced. In a very real way (no pun intended), the meaning and construction of concepts such as real economic growth and real rates of return are shifting beneath our feet, but that’s a story for another day. What’s relevant today is that when the Fed promises continued QE so long as inflation is below target, they are really promising continued QE so long as economic growth is anemic. QE has become just another tool to manage the business cycle and garden- variety recession risks. And because those risks are always present, QE will always be with us.

In Pulp Fiction the John Travolta character plunges a syringe of adrenaline into Uma Thurman’s heart to save her life. This was QE in March, 2009 … an emergency, once in a lifetime effort to revive an economy in cardiac arrest. Now, four and a half years later, QE is adrenaline delivered via IV drip … a therapeutic, constant effort to maintain a certain quality of economic life. This may or may not be a positive development for Wall Street, depending on where you sit. I would argue that it’s a negative development for most individual and institutional investors. But it is music to the ears of every institutional political interest in Washington, regardless of party, and that’s what ultimately grants QE bureaucratic immortality.