Authored by Charles Hugh Smith via OfTwoMinds blog,

Absent demand from tens of millions of wealthy, high-income buyers, asset valuations will fall as Boomers sell off assets to fund their retirement.

There’s a peculiarly flawed logic behind the widely held view that the Baby Boomers will seamlessly transfer tens of trillions of dollars of their wealth to the Gen-X and Millennial generations as they exit stage left. This is flawed for a very basic reason: the extremely overvalued assets that will be transferred–real estate and stocks–only reached such extreme overvaluation because there is a surplus of buyers who are sufficiently wealthy (and willing) to pay bubble-inflated prices.

Since the ownership of both real estate and stocks is concentrated in the hands of the wealthiest 10% who tend to be older, how many Gen-Xers and Millennials have the means to buy million-dollar bungalows and overpriced portfolios? If buyers are scarce due to entrenched wealth-income inequality, then once Boomers start selling their vast holdings of stocks and millions of overpriced homes, prices will plummet if sellers outnumber qualified and willing buyers.

In other words, the bloated valuations Millennials hope to inherit will only remain at the currently overvalued levels if millions of qualified buyers emerge to snap up every Boomer bungalow at today’s bubble prices. If there are fewer buyers than sellers, prices will decline accordingly.

Younger generations hoping to inherit million-dollar McMansions and stock portfolios overlook that many aging Boomers are planning to sell their stocks and homes to fund their retirement. Boomers who are wealthy on paper are wealthy due to their ownership of stocks and real estate; they need to liquidate these assets to afford to retire at their desired level of comfort.

Another overlooked factor is inheritances often require selling the house to split the money between heirs. Once again, the inheritance depends on buyers emerging like locusts to buy up every house being sold at absurdly overvalued prices. How many younger people will have the means or willingness to buy the millions of overpriced bungalows being dumped on the market?

Hopeful heirs also overlook that prices are set on the margin. Take a neighborhood of 100 homes. If every home that sells fetches fewer dollars, the sale of only 10 homes can cut the valuations of the other 90 houses in half in a few years.

People are living longer nowadays, and since few retirement / nursing homes are being built, many Boomers will have to stay in their own home as they grow old. Assisted living / nursing home fees run around $10,000 to $12,000 or more a month; private nursing care in residential homes typically runs between $6,000 to $9,000 a month. Few can afford these options unless they sell their house. It’s far more affordable to continue living at home until the end of one’s life.

That can either consume the inheritance or extend the transfer of assets to the point the heirs are in their 70s. For example, my Mom is 95 years old, bless her heart, and she sold her house 17 years ago to fund her retirement in an assisted living complex. Her house proceeds funded her retirement years; there will be little left (if any) for her heirs.

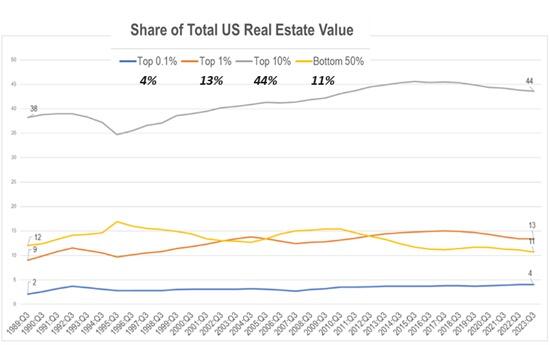

If we consider the vast concentration of wealth in the top 10% (typically the wealthiest Boomers), it’s clear there aren’t enough young people who can afford to buy assets at today’s valuations to keep the prices at nosebleed levels. As this chart shows, the top 10% own 44% of all real estate in the US, while the bottom 50% of households own a meager 11%.

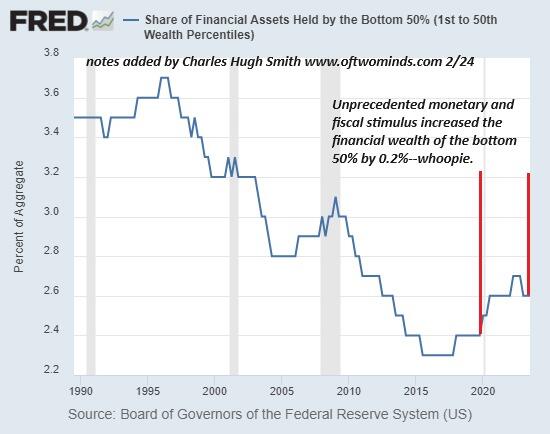

That’s much more than their share of the nation’s financial wealth, which is a rounding-error 2.6%:

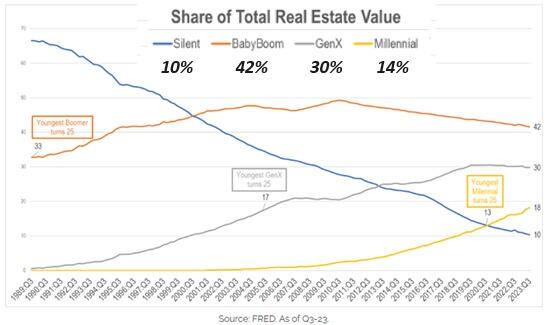

Boomers own 42% of all real estate value, with Gen-Xers holding 30% and Millennials owning 14%. We can surmise that the majority of Gen-Xers who can afford to buy a home have already done so. Given their relatively modest numbers and age, counting on Gen-Xers to soak up millions of Boomer Bungalows for $1 million does not reflect generational / financial realities.

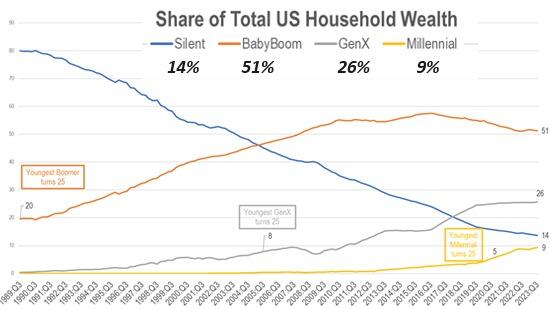

That leaves the buying of millions of Boomer Bungalows for $1 million each to Millennials, who have the numbers but not the wealth to do so. Boomers hold 51% of household wealth, while Millennials hold a mere 9%.

So the expectation that nosebleed valuations for houses and stocks will remain at a “permanently high plateau” is based on flawed reasoning that Millennials will be buying millions of homes being dumped by Boomers to fund their retirement at today’s prices, and this buying by Millennials will maintain the high valuations of homes and stocks they will eventually inherit–possibly far later in their own lives than they anticipate.

This doesn’t add up. The concentration of wealth in the top 10% and the Boomer generation means there cannot possibly be enough buyers in the ranks of those with few assets, high debt loads and modest incomes with sufficient wealth and income to buy Boomer assets at today’s bubble prices.

Since the top tier of older, wealthier folks own 50% of all wealth, there is no way those with lesser means can afford to buy all those assets at today’s bubblicious valuations. It simply doesn’t compute.

Absent demand from tens of millions of wealthy, high-income buyers, asset valuations will fall as Boomers sell assets to fund their retirement. In many cases, the wealth younger people hope to inherit will be consumed by costly nursing home fees.

This is the price of enabling a concentration of wealth in the hands of the top 10% and the older generations who bought assets at pre-bubble prices and have enjoyed the appreciation created by stupendous bubbles.

But those valuations will only be reaped by the first sellers. Everyone selling as demand falters due to insufficient numbers of buyers who can afford to pay today’s prices will find valuations will fall once selling overwhelms demand.

The expectation that tens of trillions of dollars in assets whose value is set on the margins will magically retain their bubble valuations as aging Boomers liquidate their assets en masse in an economy where only 20% of the populace can afford to buy a house at today’s prices is not grounded in demographic or financial realities.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Seriously? They ain’t gonna buy them. They are gonna inherit them.

Ain’t no inheritance after the medical industrial complex is done.

I should have said medical insurance complex.

Regardless, that grandma even stated herself that they were “vagabonds”, moved about every 5-7yrs. The only pause in that was when me and my bros were young (they stayed put for the first dozen years of my life). I’m not sure how much they had built up over those years.

The only thing I miss? The faux grandfather mantle clock that grandpa got when he retired after 32 years as the head mechanic for the local Chrysler dealership.

It sounds like you had loving parents that cared enough for you and your siblings to have those 12 years of stability….and you miss a clock?

It’s already long gone. Something as small as a clock I might have been able to save. It’s the one thing I miss.

Just by Google, and then start a rumor googles going to rename itself google.ai And let the money roll in

The property taxes will nix that and the homes get sold under- valued anyway.

Of course, who ever said Black Rock rolls differently?

If there are any outstanding bills,PROBATE will take care of that……

I ain’t gonna keep paying to insure it or pay taxes on it.

I may end up selling to one of those WeBuyHouses scumbags ya see onnteevee.

Especially if in one of those older shitty parts of Houston. 🙂

You could always do the reverse mortgage thing. Not ideal but it can work for some people, if you don’t give a shit your heirs.

You can consider the inheritance taxes a purchase price.

On kid okay, two three or more kids, they will sell.

Beyond “buying them”, what would make anyone think they would even want a Mc Mansion if free? I’ve been harping about this for years.

2 people in a 3500 sq ft monster, the maintenance, insurance, utilities, etc….forrgettaboutit.

Stock with PEs of 35, Bonds paying 3%….forrgetaboutit.

Without even the threat of “the great taking”….forrgeta…..

Except some do. A young relative was recently approved for a $200k loan. The attitude was an eyeroll and, “What kind of house can this buy?” I responded that a starter house would be perfect and even went on zillow. She wasn’t having any of it. She wants the first two houses she grew up in the first 8 years of life, which were McMansions. I just looked at her like wtf because other than that, she has plenty of common sense. Either that or I don’t know her that well.

$200k loan will get you a two bedroom, 1400 sq ft ranch built in the 70’s-80’s where I live and property values here are very cheap compared to most other places in the USA.

That isn’t shabby. I don’t get it.

Status, many people want status. I live in that great big home. We drive to big rented luxury vehicles. I wear fancy designers clothes bought with our credit cards, We are members of the trendiest gym in town.

It starts early, too. Another Mom told me yesterday that her 9 year old daughter is not part of the hip crowd at school because she doesn’t own the right Stanley cup.

They won’t be able to afford the taxes if the homes were just given to them. Corporations will scoop them up and turn them into rentals. It’s tough out there trying to find any kind of affordable housing.

Yeah that’s what I said in an earlier comment about this. Taxes are turning ownership into rentals.

Yes, most of the Grand old Victorians have been divided into rentals because they were in the center of town not the suburbs. I helped a guy move from one that was once a lumber baron’s home.

The author has a narrow focus on first sellers win and everyone else loses. The narrow focus assumes all assets will he sold and bought in the open market. Hordes of family asset transfers are closely controlled.

Then he illustrates his exemption to the scenario he paints as if his is a rare occurrence. Does he blindly bounce off walls where he walks?

He addresses this in the paragraph about prices being set in the margins.

There’s a booming squatter market waiting to happen.

Each trip to the farm I clear the house. I walk the perimeter to check doors and windows before I enter. No squatters so far but stay vigilant.

Don’t just check the building(s). Walk the entire property at least once a year.

I grew up on about 7.4 acres, but had neighbors with 40+.

Once a year? What is that going to do?

If you’re only there once a year, you might have a title but you don’t own it.

Once a year? I walk 16 several times per week. If they can squat in swamp , hey, only for a short period of time.

Took this earlier when the storm was rolling through:

Makes for a nice background (tested on 2 different sized screen devices). Did 6+ more in the hour leading into that, but it takes the cake.

You got that right. If they hit your home, break into it and hold all prisoner…get help to make this happen if need be, then call the police and report you have captured burglars.

Never use the VAGRANT/ SQUATTER words in your conversations with the authorities and have the tax assessors website called up on yer smartphone to show ownership.

H/T Two if by Sea

lmao

who do you think the cops are there to protect?

Themselves…hopefully while making some side Bennies in the process.

Wise advice, joe!

I hope you do it from a distance.

Bizarre thing is- back in the day people would work their entire lives to build something and when time comes, pass it on to the children. But the society has progressed so far that we speak as if funding a comfy retirement is more important than passing anything on. But then again, public schooling and the rat race ensures that western families don’t really know one another and are focussed on careers and stuff and whatnot. Instant gratification and me-me-me.

seems like what is happening today has been in the making for a long time- decades, if not the last century or two.

The “Me” Generation.

How many of the younger generation say in the same area? If your kid move across the country for jobs they are no longer interested in your home, only it’s worth.

But is that not exactly the problem? The family unit is no more- just like their parents, the kids do not care about anyone but themselves, their careers and stuff they can accumulate in faraway big city. And getting the worth out of the parent’s home to put forward a larger mortgage for an even greater mansion the moment the parents pass away. It just seems so broken.

In a multicultural empire they will be sold to whomever has the capital; cartel children, Chinese manufacturers, the offspring of Internet influencers, investment companies, hip-hop moguls.

Or…

The mandarins and political officers of the revolutionary counsels will simply seize them all and use them to house the migrant hordes that have displaced the infertile millennial heirs.

Or they will fall into disuse and the land and time will reclaim them.

Have we fallen so low?

Yeah.

Experienced exactly what the author wrote in 2011/12 when mother passed and her 300K plus valued property was FINALLY sold for effectively less that what she paid for it 20 years earlier.

Not only that but how many boomers are going to spend a substantial portion of their wealth on sick care, assisted living and nursing homes before they exit.

At least my plot is free.

The cost of in-home care for those who stay at home will wipe them out anyway. Assisted living and retirement communities at least have efficiencies of scale, which theoretically should lower their price.

Sending skilled nursing, and elderly assistance personnel across scattered homes is time consuming and costly.

Google is changing its name to google.ai