The Greatest Bankster-Run

Scam Of The Third Millennium

Submitted by A Former Financial Planner, Investment Broker, Commodities Trader & Business Consultant

Let’s start with the alleged developer of Bitcoin—Satoshi Nakamoto.

Really, Satoshi Nakamoto or his clandestine group of bitcoiners created the first decentralized cryptocurrency where nodes in the peer-to-peer bitcoin network verify transactions through cryptography and then record them in a public distributed ledger called a blockchain.

What an incredibly stupid but very dangerous financial joke!

Who the fuck is CIA agent or NSA operative or DARPA asset Satoshi Nakamoto? Oh, that’s who he/they really is/are?!

And yet so many blockchain blockheads fall for this transparent scam of the millennium.

First of all, Bitcoin is anything but a currency since bonafide currencies cannot exhibit such crazy price volatility …. but don’t try t tell a bitcoiner that.

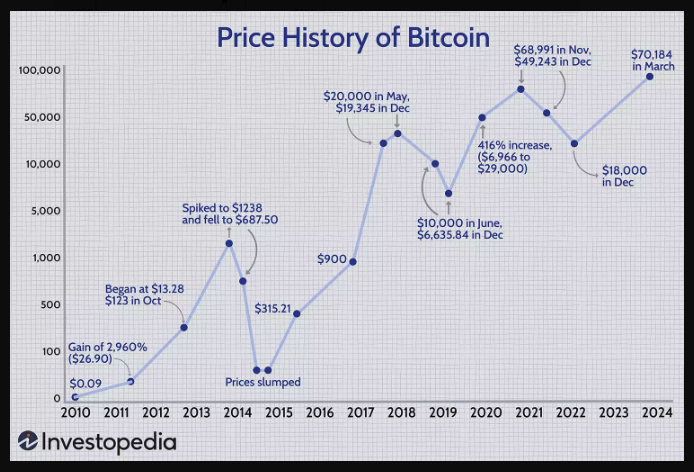

Secondly, Bitcoin is anything but an asset which could be considered a store of wealth. Again, given the insane roller coaster ride it has taken its owners on, to consider it a good store of value is as absurd as it is stupid (see chart below).

Next, Bitcoin is wholly dependent on the existence of the Internet. As though cyberspace is a reliable entity going forward. In other words: no Internet, no Bitcoin transactions. And, your millions are locked up in your Bitcoin coins; that is, if you even have possession of them.

Then there is the stark reality that Bitcoin was created as a highly speculative investment vehicle. As such, it is based on a classic Ponzi-Pyramid scheme. Those who entered the scheme first and to the greatest degree, stand to make the most. The most recent suckers to enter the game get hosed. In point of fact, what we are seeing at this very moment is a ginormous extended Sucker’s Rally (see graph below from Dec. 2021 thru March 2024).

We’re told that Bitcoin hit 68,453.60 today after dropping from $72,384.00, which is 5.5% of it’s total value—IN ONE FRIGGIN’ DAY! How’s that for stability?!?!?!

Global Gambling Casino

The Global Gambling Casino has all kinds of games to play these days, but Bitcoin is, by far, the favorite one at the moment. And that’s exactly the way the banksters want it.

Why exactly?

Because it keeps everyone focused on a totally worthless cryptocurrency instead of them buying a very real hard

asset such as gold and silver—THAT’S WHY!

The last thing the banksters want in 2024 and beyond is folks stockpiling those time-tested assets which have proven to be recession-proof, depression-proof and collapse-proof. A good mix of gold bullion and silver coinage can provide the hard currency necessary to get through the inevitable bankruptcy of the US Corporation.

Given all the fake Bitcoin tokens now in circulation, who would ever even go there except a hopeless blockchain blockhead?

However, it’s the role of Bitcoin as an object of pure unadulterated gambling which makes it a true curse. Because who doesn’t know that when you make money fast, you lose it fast … some how, some way. As quickly as fake wealth comes, it goes.

Folks really need to sit back and contemplate this universal principle of money. Because it goes to the very heart of the Bitcoin scam. Making money out of nothing in an obsessive or compulsive manner is NOTHING BUT GREED. And greed is not good—FOR ANYONE.

When anyone makes so much money by doing nothing, it represents a gross imbalance in the cosmic cycle of giving and receiving. First, it’s vital to comprehend that Bitcoin is NOT an investment. It makes nothing, produces nothing, and reflects no effort or genuine industry of any kind except the extraordinarily cost-ineffective and environment-damaging mining of the stuff.

The Bitcoin miners

As a matter of fact, Bitcoin consumes enormous resources in the process of crypto-mining. As follows:

It’s estimated that Bitcoin consumes electricity at an annualized rate of 127 terawatt-hours (TWh). That usage exceeds the entire annual electricity consumption of Norway. In fact, Bitcoin uses 707 kilowatt-hours (kWh) of electricity per transaction, which is 11 times that of Ethereum.

(Source: Why Does Bitcoin Use So Much Energy?)

Not only is there an immense amount of energy usage throughout the entire process of Bitcoin transactions, there is this complicated and protracted period of transaction verification which must take place for each and every Bitcoin transaction.

But it’s Bitcoin’s decentralized structure that drives its huge carbon emissions footprint.

To verify transactions, Bitcoin requires computers to solve ever more complex math problems. This proof of work consensus mechanism is drastically more energy-intensive than many people realize.

“In the case of Bitcoin, this is done by having many different competitors all conduct a race to see how quickly they can package the transactions and solve a small mathematical problem,” says Paul Brody, global blockchain leader at EY.

The miner who completes the mathematical equation the fastest not only certifies the transaction but also gets a small reward for their trouble in the form of a Bitcoin payment.

In Bitcoin’s early days, this process didn’t consume nation-state amounts of electricity. But inherent to the cryptocurrency’s technology is for the math puzzles to become much, much harder as more people compete to solve them—and this dynamic will only accelerate as more people attempt to buy into Bitcoin.

Multiple miners are using electricity in competition for rewards. Even though there may be hundreds of thousands of computers racing to solve the same problem, only one can ultimately receive the Bitcoin honorarium.

“Of course, this is wasteful in the sense that 99.99% of all the machines that did work just throw away the result since they didn’t win the race,” says Brody. While this process produces a fair and secure result, it also creates a ton of carbon emissions. “I very much doubt [whoever founded] Bitcoin anticipated such enormous success in the future and, consequently, the enormous amounts of power we’re talking about,” Brody says.

This process also takes an immense amount of time: Upwards of 10 minutes per Bitcoin transaction. That’s the time it takes for a new block to be mined.

(Source: Why Does Bitcoin Use So Much Energy?)

And bitcoiners love to brag about this blockchain technology. Talk about stupidos! Just re-read the preceding excerpt about the Bitcoin mining process to grasp just how preposterous this whole Bitcoin scam truly is. What an epic swindle mixed with naked fraud on top of a ripoff by the biggest bankster racket in financial history!!!

Oh, and by the way, the enviro impacts alone will end up consuming the planet if a solar flash doesn’t fry the whole place first.

Wait, there’s more … much more.

For instance, there’s absolutely no privacy in the Bitcoin transaction process.

Anyone can see the balance and all transactions of any Bitcoin address. Since users usually have to reveal their identity in order to receive services or goods, Bitcoin addresses cannot remain fully anonymous.

Oh, that’s just great! In this age of no privacy about anything, ever, along comes Bitcoin that has no privacy whatsoever as follows:

Bitcoin transactions are traceable because Bitcoin’s blockchain is completely transparent and every transaction is publicly stored on a distributed ledger. Because of this transparency, transactions are traceable and you can think of the blockchain as a kind of open database full of Bitcoin transactions.

(Source: Are Bitcoin transactions anonymous and traceable?)

Look it, we can go on with this exposé of the Bitcoin super scam but the following piece lays bare all you really need to know before you dump all of your 401K or IRA or Keogh retirement money into it. The link below covers the critical Great Reset aspects of this bankster-conceived conspiratorial plot to steal what little they have not already stolen from US.

CRYPTO CON:

The Trojan Horse

for the GREAT RESET

Finally Exposes Itself

Conclusion

Bitcoiners are perhaps the most deluded and obsessed group of addicts in world financial history. They are similar to the gold bugs of the second half of the 19th century, except that they operate on greed-surging super steroids and are throwing their money at bogus and valueless tokens not hard precious metal. Such a preoccupation with and pursuit of what is nothing but empty air has all the makings of a coming industry-wide catastrophe.

Incidentally, there have been more cryptocurrency scams, where billions upon billions have been lost by cryptobugs since their inception and all of them with virtually no justice, that it’s quite challenging to keep track of them all. The law enforcement agencies know that all crypto is nothing but a CON game of the highest order so they let the thieves have at it. That’s one less billion to buy gold with that would otherwise make it more difficult for the banksters to artificially suppress the gold (and silver) price.

But the biggest aspect of this CRYPTO CON commenced when the banksters decided to issue Bitcoin EFTs. This is where the manipulation of the Bitcoin marketplace will get real interesting, real fast, as Bitcoin shot up to $73,620.oo at 6:30 AM on March 14th. This is where the banksters will have a heyday transforming Bitcoin into a total laughingstock while transferring wealth into their bank accounts at the expense of everybody. Talk about a mega inflation driver! See: Mystery Whale? Really, when this is exactly how they have been manipulating the utterly fake Bitcoin market practically forever.

CAVEAT!!! However, at the end of the day, Bitcoin will be used by the banksters to normalize CBDCs worldwide in a way that nothing else could have accomplished that civilization-destroying NWO scheme. This is the real tragedy of Bitcoin; and the countless addicts who embraced the blockchain technology to liberate themselves from the nefarious BEAST System will have only themselves to blame when they wake up one day chained to CBDCs. See: CRYPTO-CON! It’s all about Khazarian banksters buying Bitcoin and Ethereum to manipulate price & normalize the coming CBDCs.

BOTTOM LINE

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Hhaha no. Currencies go up and down all the time. So that assertion is just plain wrong. Didn’t bother reading the rest.

Satoshi NSAmofo weighs in. Thanks for playing, glowbot.

currencies dont go ‘up and down’. historically speaking, currencies are very stable … especially the western banking currencies – US dollar, Canadian Dollar, Aussie Dollar, Yen, Euro, Pound etc…

you have no idea what you speak of and are the prime example of sheeple behavior stemming from arrogant ignorance

Actually, currencies vary much more slowly than the cryptos. It’s the volatility of the cryptos that attract the get-rich-quick speculators, which give them the appearance of value. Otherwise, they have nothing.

That being said, as long as they retain value, they would be useful for a one time escape with your wealth from whatever country you’re stuck in.

Wow, this is what I wrote 2 days ago in another article.

I still believe even more firmly, the whole BitCoin scam was a Beta test for CBCDs. “They” watched for over 10 years how it worked, found the bugs, acclimated people to the thought of CBDC, etc.

The privacy is ABSOLUTE they will tell you, when nothing could be further from the truth….backdoors in it for sure.

“BitCoin to infinity, and AWAY!!!!”

Anyone else remember when the old fake and gay fedbot fag, SSS informed me that the CIA never ran domestic ops…yeah, about as true then as now.

“Newly unearthed communications records show for the first time that the CIA played limited but key roles during the Jan. 6 Capitol riots.

Some 88 pages of documents that Judicial Watch shared with Secrets reveal the spy agency put “several” dog teams on alert near the Capitol and that it assigned “bomb techs” to the House side neighborhood where explosive devices were found at Republican National Committee and Democratic National Committee headquarters.”

Anonymous author just pissed he didnt buy some early on

He surely must carry a couple large gold bars with him at all times…just in case the grid goes down

Good luck with those magic beans, Jack!

so how exactly are you going to use your DIGITAL system without a system or electricity?

you do understand that it isnt simply a network that is needed for Bitcoin to work correct? You must have nodes holding the TOTAL LEDGER to verify the transaction. It isnt simply internet access. It requires maintenance and upkeep and substantial computing power and storage.

Unfortunately, the same thing is true of all of our payroll, pension payments, bank holdings, stocks, and bonds. I know, I know….just exchange all of your dollars for gold, silver, food, water, and lead!

I prefer land and buildings, equipment, inventory, receivables, family.

Just more nonsense from CIA/Wall street.

The future is GOLD.

U gonna get some gold teef like your favorite people…..easy to transport hard to confiscate

Pliers

You complicate things, a small hammer will do just fine.

Wasn’t difficult to see this was a scam from the very beginning. Taking currency you can use to actually buy things and investing it into fake “money” that only has worth to a select few online.

It’s hilarious how some on the right will champion Bitcoin so hard as the ultimate alternative to fiat money, yeah investing money backed by nothing into digital fake money backed by nothing.

What is US currency backed with?

Multiple miners are using electricity in competition for rewards. Even though there may be hundreds of thousands of computers racing to solve the same problem, only one can ultimately receive the Bitcoin honorarium

Wait, you mean all miners are racing to find a unique solution, and then validate that solution against something before anyone else does? How do they know when the solution they were pursuing is now a dead end?

And this is why everyone’s buying NVIDIA?

JHFC

What do you buy Bitcoin with?

Better question…how do you buy anything with bitcoin?

You live under a rock?

With fingers (and eyes) crossed.

I think it is simply a trap for excess money for all the people that want to get out of the stock market and are looking for a tangible asset to store that excess cash. It is a release valve and takes buying pressure off of precious metals. Like those books “Eat this – not that”, Bitcoin is “Buy this – not that” for the Keynesian finance idiots, or a financial limited hangout if you want to call it that.

…looking for a tangible asset to store that excess cash.

I know that, but I think that the people who buy it think it is tangible asset. Like “I can touch my laptop, so that’s the same as touching my bitcoin, right”???

I challenge any Bitcoiner to prove to me it is useful, at all. You can’t buy hardly anything with it. Most business that do accept it for “payment” immediately convert it to the local currency. You can take $1B worth across a border with you and then you can’t do anything with it really, so it’s really worthless. The only real way to convert large sums of Bitcoin is via exchanges, which are all government controlled. Except the worthless, scammy decentralized ones. It’s hard for most people to understand, since it is a tech product.

Just like the covid plandemic, it is just another IQ test. The only difference is it’s motivated and amplified by GREED instead of FEAR. Those are the two basic drivers of all markets and most human action. Didn’t take long to figure that out either.

BAM……………you nailed it !

Bitcoin is for the rubes.

We invested millions in Tulip bulbs.

No way will the Dutch market crash this time.

O, ye of little faith.

/s

All the people I know that have bitcoin hate

The idea of CBDCs most have gold and silver too

Sounds like Eliibeth Warren wrote the article

People buying and selling on bitcoin for years know this guy doesn’t know what he is talking about. It bothers him that the fed can’t control it.

As soon as they bring carbon emissions and climate into the conversation you know they are not serious. I don’t give a shit about bitcoin but don’t waste my time with MuY climate change, fing smooth brain genius.

Satoshi NSAmofo

The point of Fairy Tales is an allegory and lost on most: Jack bought magic beans (Bitcoin} and climbed to great heights where he found the “golden goose”…but he angered a giant (CIA) and in the end it was destruction and death.

Grimm fairy tale.

Just bought a cup of coffee wit my gold

Try again, glowbot.

There’ll be silver dimes, real nickels, and real pennies, too.

Yep if you disagree with my point

Ima glowbot nickels are the only real money made by the us treasury

Today’s melt value is about .0553 or so

Mabey you are the globot

I admit to a nickel fetish, filling books and collecting.

Perhaps my grandchildren will be buying substance with them.

This author is like those people who suffer TDS about Trump. But with Bitcoin. There were many wrong statements.

Barnum had it. There’s a sucker born every minute.

I’m Uncle Sam, that’s who I am

Been hidin’ out in a rock and roll band

Shake the hand then shock the hand

Of P. T. Barnum and Charlie Chann

Shine your shoes, like a fuse

Can you use them old U.S. Blues?

I’ll drink your health, share your wealth

Run your life, steal your wife

Bitcoin is not a currency, nor an investment. It’s no more a scam than fiat currency though. It does offer opportunities for trading gains if you know the risks.

There is so much wrong with this article, that I won’t waste my time going over everything.

First of all, Bitcoin and cryptocurrency are NOT the same thing. The source code for Bitcoin is open source.

Any group of people of any size can make their own currency, fix it to a specific value, and use it. This is what really scares the bankers.

Second, the volatility of Bitcoin is NOT the same as all cryptocurrencies. Some have very stable values.

Third, Bitcoin and all the cryptocurrencies are just a software program (modified giant accounting program to be specific) dispersed among multiple computers.

this isnt actually true.

of course people could decide to use monopoly money, but the issue arises when more is needed to meet demands of an economy. monetary supply is an often overlooked issue with money systems and the distribution of money into a society comes with a cost.

the printing or creation of a money type is also a cost no matter the system. someone has to create it.

further issues arise when dealing with counterfeiting (something civilizations have had to battle since money was first used). counterfeit bills have been used to destabilize economies for centuries.

in dealing with ‘digital’ currencies, they are no different than the digital system used today in major banking firms. all digital transfers have tags and cryptography to hide data. all transfers are recorded on a ledger. the only difference is you dont have access to the ledger. but having access to a ledger is of littler consequence.

if all nodes are controlled by a single entity then you no longer have a distributed system or if a move is made to make it untenable to maintain a separate node, you begin to lose control. this doesnt even address that fact that these ‘digital currencies’ can be purchased by the never ending supply of dollars …

Your comments don’t make any sense.

Such as “more is needed to meet demands of an economy”. This is patently false. A monetary system can function just fine with a fixed amount of money.

Also “all digital transfers have tags and cryptography to hide data” This is also patently false. Bitcoin is entirely open and without hidden data. There are other cryptocurrencies that do hide data though.

but what is it backed by? answer “bullshit”

I’m gonna tell all my relatives I lost it all on bitcoin…just for shits and grins! I bet I’ll hear a lot of “I KNEW IT’s”. It’ll take the sting out of not leaving them anything!

CS, That’s the ole spirit! Never let an opportunity/catastrophe go to waste.

I’m bitcoin agnostic, but this guy loses all credibility (In my book at least) with this comment “While this process produces a fair and secure result, it also creates a ton of carbon emissions”. Carbon emissions? you mean plant food dumb fuck?!?!

Have a friend who cashed out over a million and a half on $22,000 initial purchase of 40 bitcoin that he purchased in early 2016 around the $540 mark. He sold it all at around $48G per coin during the run up in Jan-Feb 2021.

I on the other bought (5 grand for .441 BTC) at temporary top In Nov 2017 at about $12,ooo / BTC, sold it all for a 50% loss August of 2018 at about $6000 per BTC.

My friend is of the mindset of the money is gone anyway, never gonna sell (until he did). I always checked daily and the stress of losses made me throw in the towel.

Never take my financial advice.

That’s got the sound of straight talk.

Pay your taxes on the profit or expect a friendly IRS visit somewhere down the road.

I mentioned buying it here at 18.000 and now it is at about 70.000. Yeah, stay away from the freedom coin that bankers hate. Just wait for that Fed CBDC and hold almost useless shiny rocks in your hand. Yes, BTC is volatile and the price goes up and down a lot as people take profits. It’s a long-term investment thing with cycles. It actually takes some research and thinking to understand it. eeeww a new thing, I’m scared so I’ll hate on it.

I tried being a “miner” for bit coin years ago, when they gave you a bit coin to start. I never really was able to figure out how to make more, and lost the code I’d need to get the one I’m supposed to have. I’d think it would be harder to lose a gold coin, but don’t have any to find out for sure! LOL

Now I know why so many are Anonymous.

hey where’s my comment scumbag? Musta been some truth to what I said.

HFSP

Lol, this post and comment thread is hilarious (and of course the same convo for years now). Of course at some level bitcoin is a scam and unstable and depends upon new money flowing in over time. Of course the global power structure is involved in various ways.

That’s what secondary markets are. Bitcoin, gold, asset managers, Microsoft stock, etc.

If you think there is any financial asset in which you can invest fiat currency units that isn’t, that’s the real joke (psyop, whatever). There is an international financial system tied together through institutions with words like international, world, and united in their titles for a reason.

All us little people can do in personal finance is balance three roughly equal propositions: 1) prepare for MMT emissions of lots more currency units, 2) prepare for spurts of currency unit destruction in which overleveraged people get wiped out so that connected insiders can buy up and consolidate assets on the cheap with temporarily more valuable currency units (see the early 20th century and the rise of industrial scale agriculture for example), and 3) most importantly – “invest” in things totally outside the financial system like family, local connections, purpose, skills, popcorn, etc.

The people can buy productive assets.

To start, only a cowardly fraud would write such garbage and not even take credit for it by at least stating his name. Everything you wrote is trash and can be easily refuted. I had to check my calendar to make sure it wasn’t April Fool’s Day. Nope, two weeks early for that nonsense. Sorry fella, everything you posted is inaccurate, and more of a projection than the truth. Bitcoin is not a currency. Bitcoin is the only honest money in the universe. There is no second best money. The Ponzi Scheme and “melting ice cubes” called US$ dollars, have lost 98% of their purchasing power in the last 100 years through manipulation and lying, thereby making free markets impossible. That is due to corruption by banksters creating it out of thin air and then stealing it, along with the hamster wheel idiotic people give their work and time to only to see it debased by the kleptocrats who then steal a chunk through theft by taxation. There is only one most perfect money ever in history, Bitcoin. It is similar to digital gold (only orders of magnitude better in every way) which was Satoshi’s main objective when it was created.

Bitcoin is certain to go down in history as humankind’s greatest discovery and creation. More than fire, or the wheel of the earliest caveman times. More than the printing press over 600 years ago. More than gunpowder, electricity, oil, steamships, railroads, radios, telegraph, telephones, televisions, personal computers, transistors, the internet, iPhones, and yes, even the Great Stones of the Yap people.

One of the biggest gifts Satoshi gave us through Bitcoin was scarcity, which is deflationary in nature, the exact opposite of manipulated corrupt fake fiat money which is inflationary and steals your wealth over time through debasement. Eventually, everything will be repriced in Bitcoin as all 160 fake fiat monetary assets come crashing to the ground in spiral death/debt cycles. It is already happening. None of the 900+ Trillion in worldwide debt will ever be repaid. Bitcoin will consume all that fake fiat plus bonds, stocks, real estate, gold and silver, and become the world’s reserve asset. Everything will lose value, making your Bitcoin more valuable as it consumes the mispriced fiat assets. Bitcoin has rapidly moved up the chart passing Berkshire Hathaway, silver, Facebook and others. It is now #8 on the list of the world’s most valuable assets, and in a year or two it will be in range of Apple, Microsoft, Amazon, and #1 gold.

But the best thing Bitcoin does for the world is destroys nation-states, every single one of them immoral, illegal, and illegitimate. There won’t be warmongering and empire building corruption. The fiat fraudsters are liars, cheats, and thieves. All of them. They enslave the masses through time theft and taxation, all of which is simply robbing us of our wealth, savings, and most importantly, our time. If they can print fake money out of thin air, why do they have to steal our time and savings? Poverty is everywhere there is inflation of fake fiat which makes us think we have more than we do. Meanwhile the 1% or even moreso, the .1% now control over 60% of the world’s wealth. All because of fake fiat.

So what does Bitcoin do for our prosperity? It continually brings prices down. Think about now defunct Blockbuster when Netflix came along and made easier, cheaper and faster digital streaming possible. Think about digital cameras that Kodak developed at high prices, and then watch as the technology was included in the cellphones of today. This destroyed Kodak. There are many other examples. How about calculators and other apps on your phone. How much do they cost? I guess we take digital prosperity and abundance for all with a grain of salt. Everything will be going lower in price over time with perfect Bitcoin giving wealth and abundance to the entire world. Truth replaces fiat’s lies and propaganda. Peace replaces wars. Freedom replaces slavery to the statist system and theft of time and wealth. Hope replaces despair and poverty. And abundance and a better life is given to all the world. It is a new and exciting system of love for life and relationships. Goodbye to evil fiat fraud and confiscatory greed of nation states.

But you can be a doubter and watch as the world changes for the better. Morals, values, character, love, friendship, goodness, happiness and prosperity. You don’t have to partake. When you decide to swallow your pride, admit you were wrong and partake, Bitcoin will still be available 10 years, 100 years or 1000 years from now. Everyone comes to it at the price they deserve.

Jeff Greenlee / Phoenix, Arizona

P.S. I hope Jim Quinn / administrator didn’t write the shitty Bitcoin article. I really like The Burning Platform and check it daily. There are lots of smart people who don’t understand Bitcoin. It takes thousands of hours to get to where many of us true Bitcoin Maxis have gotten to. Martin Armstrong still doesn’t get it. Neither do Jordan Peterson (a little bit) and some others. And then there are the Peter Schiff’s and Peter Zeihan’s. Lost causes.

The article came from State of the Union .