Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at: BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK – FOCUS ON UNITED STATES ECONOMY

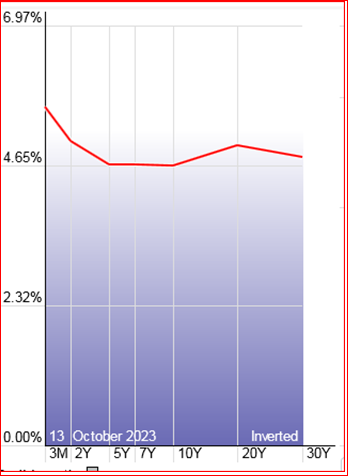

- US yield curve in better shape but mortgage rates at 23 year high

- US real m2 money stock falling

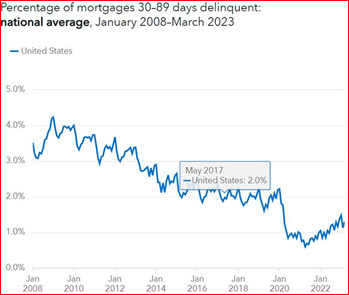

- US mortgage delinquencies at reasonable level historically

- US home prices strong

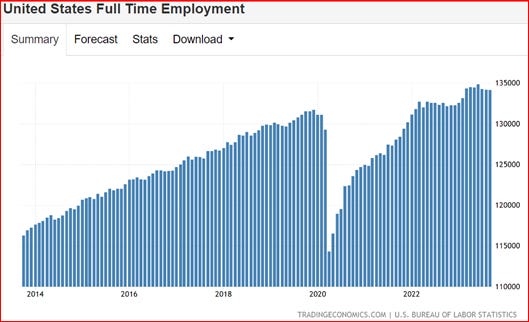

- US full time employment at historical highs

- Oil prices not yet greatly affected by middle east uncertainty

- Shares of Covid vaccine manufacturers continue falling US yield curve in better shape but mortgage rates at 23 year high

One year ago, in late October, the Yield Curve of US Treasuries from 3 months duration to 30 years duration was flat. By mid-November, it had started to invert with the 30 year bond yield being lower than the 3 month T Bill yield. On 30th November, it was clearly inverted. And in January of 2023, there was no doubt at all. The curve was inverted significantly and becoming more so almost every day.

During April, May, June and July of this year, the steepness of the inversion increased slowly but steadily. However, during August, the long term yields slowly began rising which reduced the inverted shape of the whole curve. And since then to present date, the process has slowly continued:

Yield Curve Inversion is regarded as one of the most alarming warning signs in economic theory. Although the curve is still inverted, it’s much less so than it was throughout June and July. The danger of Yield Curve Inversion appears to be slowly unwinding. Since August, the 30 Year Treasury Yield has increased from 3.9% to 4.9%. The 10-year yield has increased from 4.0% to 4.7%. The 10-year yield largely determines mortgage interest rates in the US.

US REAL M2 MONEY STOCK IS FALLING. We can observe all of this by looking at the change in absolute M2 Money Supply. However, a better and more sensitive methodology is to watch the change in Real M2 Money Supply (M2 adjusted for changes in Consumer Price Index CPI).

M2 is the US Federal Reserve’s estimate of the total money supply including all of the cash people have on hand plus all of the money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs). Retirement account balances and time deposits above $100,000 are omitted from M2 stats.

Fresh new money is created when a commercial bank makes a loan that ends up instantly as a deposit; it’s obvious if you think about it.

Let’s look at the Real M2 Money Stock figures for the United States – since the Global Financial Crisis of 2008 which triggered a long US recession and a responsive surge in money supply from the QE policy of the Federal Reserve (Quantitative Easing). Readers will note the recent persistent decline in Real Money Stock which began in January 2022.

US MORTGAGE DELINQUENCIES AT REASONABLE LEVELS HISTORICALLY. The large US banks which have large mortgage books appear to be performing well. JP Morgan shares rose 2% during the week, Wells Fargo gained 3.2 % and Citigroup surged 2.12 % after beating expectations on both earnings and revenue. This suggests that the default rate on their mortgage books is not at a concerning level.

A recently published graph for ‘Delinquent Mortgages from the National Mortgage Database’ is reassuring. It puts the current situation into a long term perspective. However, please note that the last plot on the graphs is for March.

US HOME PRICES ARE STRONG. The other reassuring aspect of the US economy is the strength of its home prices. BOOM predicted this six months ago. On 16th April 2023, BOOM wrote — “This suggests that US house prices may soon begin to rise in price”. At the time, nobody was making such statements. However, the Case Schiller National Home Price Index is following BOOM’s forecast.

According to the latest data from Case Schiller, US home prices rose for the 5th straight month in July jumping 0.9% Month on Month and shifting into the green (+0.1%) on a year-over-year basis for the first time since February.

On home prices, Craig Lazzara, managing director at S&P Dow Jones Indices, said in a statement recently, “On a year-to-date basis, the National Composite has risen 5.3%, which is well above the median full calendar year increase in more than 35 years of data. Although the market’s gains could be truncated by increases in mortgage rates or by general economic weakness, the breadth and strength of this month’s report are consistent with an optimistic view of future results”.

US FULL TIME EMPLOYMENT IS AT HISTORICAL HIGHS. US full-time employment statistics are close to all-time highs.

OIL PRICES ARE NOT AFFECTED BY MIDDLE EAST UNCERTAINTY. Many commentators have predicted a surge in oil and other energy prices from last week’s Middle East turmoil. However, Israel and the Gaza strip are not central to energy prices in the Gulf States.

The price of West Texas Light Crude rose over the last week by 5.92%. That sounds significant. However, when looked at in a five year price chart, such a price rise is well within weekly price ranges.

SHARES OF COVID VACCINE MANUFACTURERS CONTINUE TO FALL. BOOM has covered the whole Covid “vaccines” fiasco very closely. Regular readers will be familiar with BOOM’s extensive analyses on this subject. It is essentially a pharmaceutical disaster in real-time. And the mess just keeps getting bigger.

Last week, the share prices of the key 4 manufacturers continued to fall. Pfizer shares fell by 3.08 % on the week. This fall came after Pfizer slashed its revenue and earnings forecasts for the year amid collapsing demand for its Covid products.

Some estimates for current Covid Booster Uptake in the United States are as low as 1.3 %. That is what Dr Peter McCullough, expert Cardiologist in Texas, has stated.

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch this short 15-minute video and see how Professor Richard Werner brilliantly explains how global banking systems really work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Peter,

I see money creation by the US public falling, such as demand for car loans, mortgages, etc. Credit cards are maxed out, student loan repayment has resumed. The money is getting tighter and tighter. Govt statistics are brazen lies. I don’t believe a word the beast puts out.

To counter this fall in consumer demand the war machine is cranked up. Treasury Sec Yellen had the balls to say “we can fund more than 1 war at a time”. With what exactly, all the savings the Treasury holds?-LOL

Central Bank print fest goes into high gear…”you get all the bombs you want, you get all the tanks and planes you need”…..OMG.

They have to pull more and more currency (it sure ain’t money they’re creating) into the now to prop up this fundamentally dead economic edifice.

The Central Banks become more powerful with each note of debt they create. In the end they’ll end up owning whatever parts of the world they don’t already own. They’ll own it all with currency created from nothing, while 99% have no idea that it’s even happening. It’s all so astonishing. I’ve used the word “astonishing” more in the last couple of years than I have my entire life because there is not many other words that signify or define the crazy events seen daily.

Like Gerald Celente says “when all else fails they take you to war”….WW3….probably.

As usual, I look forward to reading your articles. Thanks!

You are so right Steve, if you have a printing press you can own the world…for now. But it has to come to an end sometime and maybe that time is soon? But a history teaches the final conclusion is WAR! Ray Dalio knows the score:

Aside from the fact that we’re now about 50 time more fucked, the current situation reminds me of 1992 when Greenspan and the Fed kept raising rates despite the fact that the economy was weakening. I don’t remember inflation data at that time. Greenspan (and arguably Ross Perot) helped Clinton upset Bush the Elder. Jay Powell and the current Fed seem determined to raise rates a bit more and hold them. The ten year is almost 5%. Mortgage rates are approaching 9%. Real estate agents are running out of cash buyers. The media can keep pitching their happy horseshit about how great the economy is, but no one outside of DC and Wall Street believes it. Even if the Fed starts cutting short term rates, there’s no guarantee longer bonds would follow. Not with $2 trillion (and rising) deficits as far as the eye can see. “Deficits don’t matter” said Dick Cheney. Eventually they do. Hey Dick – give our regards to Beelzebub.

Thanks Iska – all true and time is running out -the elites know this, hence Gaza – next stop WW3 – out of chaos – order! “ex chao – ordo”

Compare that chart on full time employment to population growth.

Everyone’s “retired”.

GOOD ONE K31 – yes revealing

What people need to be looking at is the Federal Reserve Reverse Repo account. https://fred.stlouisfed.org/series/RRPONTSYD

This is the money the Fed uses to buy US Treasuries at auction, in order to bid up Treasuries and hold down interest rates.

As you can clearly see by the chart, the Fed has been spending a very large amount to keep interest rates down to their current levels.

The problem is, at this rate of spending, the account will be depleted in about 6 mos. and without the Feds bids in the Treasury Auctions, the interests rates will revert to market levels which will mean a big spike.

IMO, this will be the point at which the economy begins to really go sideways, as interest rates increase and liquidity dries up. About 40% of the companies on the S&P simply cannot survive at todays interest rates, and that number is going to get much worse going forward. We are beginning to see money destruction on a scale not seen since 1927.

And we have not even begun to talk about what will happen in the derivatives markets…… As George Galloway says, it is going to be a bumpy ride….

Many thanks Jdog – on the ball as usual. We will be seeing those swimming naked soon – easy come, easy go!

All those bankster charts are pretty cool.

I used to have buddies, the well-educated high-performer types, who would spend their days making such charts and/or referring to those charts made by those guys and/or with other guys similarly positioned. Most of the time it was gathered around various screens. The more screens the better. My knuckle-dragger cadre only had two, so we deferred to the guys with three or four because they obviously had a knack for the axis and allies of globofinance.

It went down much like way that us kids used to look baseball cards. Shuffling through lots of glossy and some dull reproductions of reality, familiar and obscure alike, that both lagged time in chunks as big as years and yet somehow also held the magic of predictive value, all while pretending to know what it all means, but mostly wanting to be playing actual baseball or maybe just spanking it to that old playboy one of the older kids left in the tree fort.

But you know, it was just part of the whole game of childhood. So you play it until a better game comes along.

Some cards were valuable. Most were not. The value being entirely a figment of a collective imagination, where millions of us boys would drift in and then out over time and once a blue moon rumors of a golden ticket would re-ignite a buying spree.

That the real value was decidedly one-directional as it hoovered up lawn mowing funds was a lesson that would take me a couple more decades to figure out.

That crumbly strip of “gum” with the dusty chemical coating to keep it dry was the actual value. Not a good deal by any standard unless you account for the magic.

You see, the actual value of that magical shared belief is harvested by a tiny minority of guys who, by dumb luck of acquisition or meticulous sperg-like attention to details and “performance” of all kinds of figures, was always out of reach.

There is a black box where such value is kept. All those cards are for the guys not playing pro ball.

Those guys tended to be the guys with allergies to peanuts and PE. I chalk it up to the Long Coincidence.

I know the whippersnappers think thats normal but back in the hateful 80’s, when retards were retards and faggots were not necessarily homos but mostly just being lame and homos were not necessarily gay and everybody was queer when they had the football, and nobody was prepping for “college” in sixth grade and everybody ate peanuts such kids were outliers.

Anyhow, there was a day in ’08 when even I was looking at one of those charts, furrowing my brow in that corporate-brochure kind of way, except I’m not diversity so never made the brochure, while I was thinking deeply about something totally unrelated like playing doctor with our Brazilian admin, and the whole baseball card feeling hit me again.

I had just been on the phone with two traders from Lehman who were most certainly allergic to peanuts and had been really pissed that I was able to “steal” their pool of CMBS scratch and dent even though it was all still “basically” AAA paper.

I was after the collateral. Which was covered in chemical dust I’m sure. Plus I was not a trader and the whole thing to them was really annoying because they could sense I did not know the stats on the back of the card. They cried out as I had the nice asian girl in finance wire the funds.

By the end of that week Lehman was gone and I never spoke with those nice boys again. The mistakes were made parade marshalled in River City and the band marched on.. .

Many thanks DV – history lesson gratefully shared 🙂