Direct from BOOM Finance and Economics at the links below

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

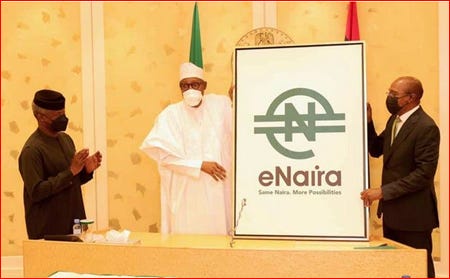

CENTRAL BANK DIGITAL CURRENCIES CANNOT SUCCEED – THEY ARE INTELLECTUALLY BANKRUPT – THE DISASTROUS FAILURE OF NIGERIA’S CENTRAL BANK DIGITAL CURRENCY – The eNaira is Nigeria’s failed Central Bank Digital Currency (CBDC) experiment, launched in October 2021.

The eNaira was not based upon an interest-bearing debt contract which means that it was meant to exist more as a form of electronic cash. Disastrously, the government deliberately decided to restrict and withdraw physical cash as a key part of the experiment. That was a very grave mistake, similar to what had happened in India during 2016 when the Indian Government instantly removed 86% of physical cash from circulation. This plunged the poor of India into a huge crisis and a desperate search for survival.

But Nigeria’s central bank and government ignored all that, and was not all they ignored.

Cash is the People’s money, non-interest bearing and anonymous which must be made available by the government upon demand from The People. That is what all monetary history tells us. To ignore such is to court social, financial, and economic disaster. In Nigeria, the rationale for the eNaira was threefold:

- To increase financial inclusion for 38 million people in Nigeria who are unbanked

- To reduce the cost of foreign remittances, for money transfers from Nigerians working in foreign countries, totalling $24bn in 2019. They pay commissions of up to 8% to do that. The eNaira was supposed to make that far cheaper and more convenient

- To reduce the black market economy; where cash is used as settlement

- They can and do live quite happily without bank accounts

- They don’t want Big Brother watching their remittances

- They don’t want to lose their Black Market economy, based upon cash

Of course, the protagonists of the eNaira made the proposition right at the outset that there is such a thing as a “Cashless Trend”, an inevitable move towards cash-free economies. This is a common theme in monetary circles promulgated principally by bankers, who make zero profit from cash, in fact it’s a cost-centre for them and for totalitarian governments who want to peer into every citizen’s financial affairs. The unelected IMF and the unelected WEF (World Economic Forum) also promote such falsehoods. However, BOOM cannot find a demand from the people to eliminate cash.

Of course, the big question to be answered is this – how popular has it been? The answer, according to an IMF Paper released in early May, is that “the take-up of the eNaira by households and merchants in Nigeria has been slow”.

That’s a gross exaggeration. The total population of Nigeria is 224 million people. After an initial surge of wallet downloads, the uptake was very slow indeed.

After 12 months, there were 860,000 retail wallets downloaded (retail – meaning in the hands of individuals) and the vast majority of those were downloaded at the very outset with relatively few being loaded each month as the year progressed. That represents 0.35% of the population and 0.8% of Nigeria’s active bank accounts. And only 10% of merchants with suitable equipment had downloaded a merchant wallet.

But it’s actually worse than that – disastrous in fact. 98.5% of the retail wallets that were downloaded were not used even once! And the average total value of eNaira transactions was merely 923 million eNaira per week or 0.0018% of the average amount of M3 Money during that 12 month period.

These are disastrous figures. It represents an almost complete failure of general acceptance. In the (real) world of money, General Acceptance is the Sine Qua Non. Without general acceptance then whatever is being used is not money by definition, no matter how theoretically sound it may appear.

CENTRAL BANK DIGITAL CURRENCIES CANNOT SUCCEED – THEY ARE INTELLECTUALLY BANKRUPT. At the end of May this year, the President of Nigeria, Bola Tinubu restored the validity of the old currency and issued fresh new physical bank notes. He ordered an investigation into the Central Bank of Nigeria (CBN) and, quite rightly, this resulted in the arrest and detention of the former CBN governor, Godwin Emefiele, on June 10, 2023. In late July the court released him but the security service re-arrested him and is holding him in custody. The investigation is ongoing as far as BOOM is aware.

BOOM suggests strongly to the Government of Nigeria to abandon the experiment completely and immediately. It is dangerous in the extreme to the Nigerian nation and to the national economy, especially if allowed to fester and undermine the social fabric of the nation.

A central bank issued CBDC should NEVER be contemplated. It suggests and provides a false alternative to the sovereignty of the nation and a threat to social cohesion. It arguably amounts to a Treasonous Act, not dissimilar to the adoption of a currency union. (Long term readers will know that BOOM is not a fan of currency unions either such as the Euro).

General Acceptance of a currency MUST originate and reach fulfilment in and from The People for it to be a successful reflection of social bonds. From first principles, it cannot be imposed upon The People by a non-representative body such as a central bank or the IMF or the World Economic Forum WEF (or, by the way, by a mysterious Japanese figure claiming the name of Satoshi Nakamoto).

The stakes are high in this game. If a CBDC is launched and is seen by The People as not emanating from them, and is perceived to be an alternative to their national currency, then it will potentially threaten the acceptance of that national currency.

Trust in government and in the institution of the central bank will be simultaneously weakened. In such a circumstance, The People may decide to generally accept another currency of convenience, such as the US Dollar or any other currency readily available from a neighbouring State.

Or … they may decide to overthrow the Government and charge the politicians and central bankers with Crimes against the State.

Social trust is hard won but can be quickly lost if the fundamental principles of what makes money accepted as money are ignored. And especially so if a currency experiment is launched from unelected institutions to solve ‘problems’ that don’t exist in the minds of The People.

BOOM waits on the day (which will never come) when The People of any nation demand the issuance of a currency by their unelected central bankers in opposition to the currency of The People, issued and overseen by their representative Government.

CBDCs may be popular among unelected central bankers, unelected WEF members and unelected IMF apparatchiks, but money is ultimately a tool created by and for The People. That fact must not be overlooked when monetary reform is being considered.

FINANCIAL HISTORY IN THE MAKING — THE EVISCERATION OF ‘SWIFT’. ‘SWIFT’ is the major global financial messaging system allowing banks and other financial institutions to communicate with each other securely. It was established in 1973 when 239 banks from 15 countries met to improve communications concerning their cross-border payments.

The banks formed a cooperative utility, the ‘Society for Worldwide Interbank Financial Telecommunication’ (SWIFT), headquartered in Belgium. SWIFT went live in 1977 when 518 institutions from 22 countries were connected to SWIFT’s messaging services. Today, it operates across 200 nations and territories and has more than 11,000 financial institution members. Despite this success, SWIFT is perceived as being dominated by the United States.

Then in early 2018, Donald Trump’s unilateral decision to withdraw from the Iran Nuclear Deal, known as the ‘Joint Comprehensive Plan of Action’ (JCPOA), put a lot of pressure on its European partners in the deal. They expressed their strong opposition to Trump’s decision. The largest nations Germany, France, and UK were especially aggrieved.

As a result, only a few months later, the European Union created a special payment channel in September 2018 to facilitate trade with Iran and this effectively circumvented the US sanctions that Trump had placed upon Iran.

A “Special Purpose Vehicle” was created to “assist and reassure economic operators pursuing legitimate business with Iran.” Federica Mogherini, the High Representative for Foreign Affairs and Security of the European Union, made the announcement after a meeting with foreign ministers from Britain, France, Germany, Russia, China, and Iran. She had previously played a decisive role in negotiating the JCPOA with Iran.

Thus, US Dollar dominance in global trade and capital settlements was weakened by the US itself and it was not politically partisan. Both the Democrat and Republican parties were equally guilty.

However, please note, BOOM does not forecast the imminent demise of US Dollar dominance; quite the opposite. That process will take between 50 to 100 years because of the convenience factor of very large Eurodollar volumes that currently exist on bank balance sheets outside of US borders. Those volumes make the US Dollar available, acceptable, and convenient for banks to use in making global payments.

VTB BANK ABANDONS SWIFT – VTB Bank is a Russian bank with its headquarters in St Petersburg. It is majority owned (92.23%) by three State agencies and is generally regarded as the second largest bank in Russia. Its CEO is Andrey Kostin. In 2021, its Net Profit was recorded as 327.4bn rubles. That is equivalent to US$3.27bn at the latest exchange rate of 100 rubles per US Dollar.

Last week, Kostin said this at the International Banking Forum in Sochi. “We need to kill SWIFT in our transactions, the issue is quite simple, but it will require certain actions, including within individual countries”. He also said that the goal is not to fight the Western financial system but to build a parallel system and that this was actually necessary because of the sanctions imposed by the United States. He noted that most of Russia’s payments are already made in national currencies, including in trade with China, Indonesia, India, as well as Arab and African states.

BOOM has documented the movement towards a multi-polar currency world in many editorials over the last few years. Due to poor decisions by the US political class, it appears now to be (probably) inevitable. The only question remaining is the time span required to achieve acceptance of all national currencies in settlements of international trade and capital movements. That cannot happen rapidly. It will be a slow process. As BOOM has stated many times, US Dollar dominance will continue for perhaps another 50 to 100 years, after which it will slowly decline.

THE RADICAL IDEA OF DIPLOMACY – US Dollar dominance globally could possibly last longer if the United States can discover diplomacy as a means to run its foreign policy rather than the issuance of ultimatums, (Full Spectrum Dominance). Read the link and you will understand why America does what it does, if you don’t already!

Somehow, the last four words in that statement seem to have become lost, forgotten as American politicians dominate their diplomats at the Department of State with confrontational approaches to the settlement of international disputes.

Unfortunately, US politicians also tend to see their Department of Defense capability as a means of extending their influence. The evidence for this can be found in the many US military bases scattered around the Globe. Some suggest that they number in excess of 900 – 1,000. No other nation does this. And what is often overlooked (by America) is the fact that America does not employ those bases for defence. Clearly, there is no military force anywhere on the planet that intends or is positioned to invade the borders of the United States. So the bases appear to be out there in far flung places to intimidate and to project US Dollar dominance.

An outbreak of true peace-oriented diplomacy by the US would herald a new era in global affairs and, in BOOM’s mind, would strengthen their influence and the role of their Dollar. That would be wise. However, wisdom seems in very short supply in Washington DC. Self-destruction appears to be the preferred course of action. The rest of the world can only pray and hope that this does not result in a nuclear war.

Remember the comment (attributed to Winston Churchill): “The Americans can be relied upon to do the right thing, after they have exhausted all other possibilities”.

BORDER WARS — STOPPING INVASION – Last week, Elon Musk visited the US border with Mexico. He pointed out the sheer volume of illegal immigrants’ crossing over to the US and called it “complete madness”. The current estimate for August illegal border crossings is 304,162. At that rate, the annual total would be over 3.5 million people. If it were to continue for ten years, it would amount to more than 35 million people.

Clearly the current US Government is not concerned about that invasion. It is focused on the Russian “special military operation”/invasion in Ukraine and funding the war there with over US$75bn of assistance.

- Can you imagine the outcome if the US had spent $75bn on diplomatic efforts to settle the Mexican border dispute?

- Can you imagine the outcome if the US had spent $75bn on diplomatic efforts to settle the Ukrainian border dispute?

The US position in world affairs would have been strengthened and their currency would not be a point of contention.

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch this short 15-minute video a see how Professor Richard Werner brilliantly explains how global banking systems really work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

My hope is the CBDC is such a failure that it backfires and the people force the Treasury to issue a sovereign currency.

Yeah, I like dreaming….

We need to use money which governments and bankers do not control.

Currently the choices are gold, silver, and privacy cryptos.

Gold and silver are first choice, but are not practical for payments over distance.

Most cryptocurrencies, like Bitcoin, Ethereum, have a major problem, anyone can find out how much you have, what you’ve been buying, and to whom you’ve donated.

Privacy cryptos take care of all these problems, they reveal nothing to anyone.

At this time, the only cryptos which maintain such privacy are Monero, Dero, and Pirate Chain.

Pirate Chain would be the perfect replacement for cash. They have perfected privacy.

That was an interesting read and a welcome diversion from kinetic jew wars.

Florida has banned retail CBDCs and other states should do the same ASAP.