Authored by Charles Hugh Smith via OfTwoMinds blog,

What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn’t optimism, it is folly.

Predictions are hard, especially about the future, but let’s look at what we already know about 2022.

Viewed from Earth orbit, 2022 is Year 14 of extend and pretend and too big to fail, too big to jail and Year 2 of global supply chains break and energy shortages.

The essence of extend and pretend is to substitute income earned from increases in productivity–real prosperity–with debt–a simulation of prosperity –that doesn’t solve the real problems, it simply adds a new and fatal problem: since productivity hasn’t expanded across the spectrum, neither has income or prosperity.

All that happened over the past 13 years is that debt–money borrowed against future productivity gains and energy consumption–funded illusions of prosperity in all three sectors: households, enterprise and government.

The explosion of debt and interest due on that debt could not occur if interest rates still topped 10% as they did 40 years ago in the early to mid-1980s. We couldn’t add tens of trillions of dollars, yen, yuan and euros in new debt unless interest rates were pushed down to near-zero (for the government, the wealthy and corporations only, of course–debt-serfs still pay 7%, 10%, 15%, 19%, etc.)

This monetary trick was accomplished by making central banks the linchpin of the entire global economy as central banks created “money” out of thin air and used the currency to buy trillions in government and corporate bonds, artificially creating near-infinite demand which then drove the rate of interest into the ground.

Without continuous injections of more “free money” and suppression of interest rates, the market–oh, the horror!– would re-assert its price discovery mechanisms which tied interest rates to risk. The cost of money is causally tied to the perceived security of the currency (i.e. risk) and the interest earned when lending it out (i.e. return or yield).

The $100 USD bill (good old Benjamin) protected from the tropic environment in a plastic bag will have more value than a 100 peso bill in any jungle on the planet because of the general perception that the Benjamin will still have considerably more value tomorrow, next month and even next year than the 100 peso note.

If risk is perceived to be higher, then interest rates must compensate for this risk by being much higher for risky currencies, borrowers and investments.

The central bank-engineered suppression of interest rates has destroyed the market’s core mechanism of causally linking risk and the cost of money. Near-zero interest rates implies near-zero risk, and so this entire 13-year spree of suppressing the cost of money has institutionalized moral hazard, the disconnect of risk and consequence.

The ultimate artifice of extend and pretend is that risk has been vanquished: over-extended and over-leveraged borrowers can always roll over their existing debt and borrow more as ever-lower rates of interest, in effect paying interest with new debt.

Since risk is essentially zero, then why not make use of this opportunity by gaming the system? The big players who broke the laws against insider trading, selling securities designed to fail, etc., found that the global Empire of Debt viewed prosecuting financial crimes as potentially upsetting, so not only did risk fall to zero, so did the consequences of fraud, collusion and malfeasance.

And since the bigger players had unlimited access to central bank credit, their bets quickly became so risky and so large that the entire financial system became fragile and vulnerable to cascading collapse. Central banks and state treasuries were forced to bail out the most egregious criminal firms and ignore the criminality of individuals in those firms, institutionalizing too big to fail, too big to jail.

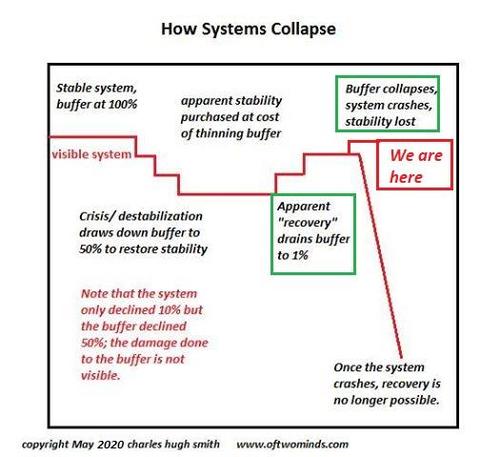

The truly interesting thing here is that the stability of any system depends on precisely what central banks have extinguished: a transparent market that prices risk within the constraints of consequences. Over the past 13 years, the invulnerability and rewards bestowed on those who borrowed to the hilt and then borrowed even more and put all the central bank-issued “money” on leveraged bets has trickled into the consciousness of retail punters, individuals, households and small-scale gamblers, oops, I mean investors.

With real productivity and earnings stagnant and all the gains of gaming the central bank’s suppression of risk flowing to the top 0.1%, the commoners have now followed the Nobility into the casino. Wealth is no longer perceived as flowing from productivity but from speculation and the leaping from one asset bubble to the next.

Since increasing productivity cannot be made risk-free while speculation can be made to appear risk-free for a time, all the money and talent has flowed into speculation. The real world rots away as everyone pursues the incentives that the central bank regime have created to game the financial system and speculate as wildly as you can because there’s no longer any risk of any asset ever declining ever again.

The central bank regime incentivized speculation by rewarding those who borrowed and leveraged the biggest bets. In the central bank casino, everyone who bets on asset bubbles expanding to the sky is a winner. Anyone who took real-world risks by investing in the production of goods and services was a loser.

I often refer to first-order and second-order effects, and that’s the story that will be told in 2022 with explosive results. First-order effects: actions have consequences. Second-order effects: those consequences have consequences.

The first-order effects of central banks’ suppression of rates and risk were spectacularly rewarding: assets soared to ever higher highs and enough of the flood of new credit reached the masses to spark an orgy of consumption paid not by earnings and productivity but by debt. Corporations didn’t boost productivity, they borrowed billions and bought back their own shares, reducing the float and thereby generating higher profits per share.

But the new incentive structure generated by this destruction of market dynamics destroyed not just price discovery of risk, it also destroyed the foundation of true prosperity: investing in increasing productivity rather than in speculative gains.

The Federal Reserve managed to suppress interest rates but it doesn’t control risk or consequence. On the systems level, all that central banks accomplished was to transfer all the risk piling up as a consequence of their incentivizing of speculation to the entire financial system itself.

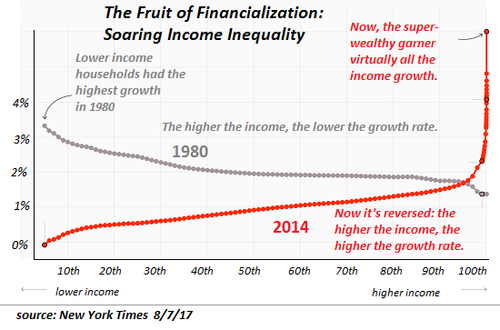

By incentivizing speculation and feeding the belief that assets can never decline, the central banks have implicitly made a promise they cannot keep: consequences have been extinguished along with risk. One consequence of incentivizing speculation and backstopping the biggest players’ bets is that the biggest players have garnered the vast majority of the gains (see chart below). This vast differential has generated unprecedented wealth inequality, a concentration of wealth in the hands of the few at the expense of the many that has completely corrupted the nation’s political and social orders.

2022 is the year that the second-order effects come home to roost: all the risk that has been transferred to the financial system as a whole will generate consequences the Fed and other central banks are unable to control. The stupendously toxic incentives to speculate will generate consequences the Fed and other central banks are unable to control. The stupendously toxic wealth inequality will generate consequences the Fed and other central banks are unable to control.

The hubris and magical thinking of the central bankers has infected the entire populace, the majority of whom now confuse magical thinking with optimism. The belief that central banks can extinguish risk and consequence and the second-order effects of those consequences is magical thinking. The belief that asset bubbles will keep expanding because of the omnipotence of central banks is magical thinking. The belief that prosperity is the result of shifting bets from one gaming table to the next is magical thinking. The belief that central banks have god-like powers and nothing can limit their power is magical thinking.

The funny thing about system dynamics is they don’t respond to what we like, want or believe. Believing that central banks can make the financial system and economy do whatever they want doesn’t mean they actually have that power. Believing that second-order effects have been extinguished doesn’t mean they’ve actually been extinguished.

What will surprise us in 2022 is the exposure of central banks’ limits of power and the explosive consequences of second-order effects. What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn’t optimism, it is folly.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Here’s something that shouldn’t surprise anyone…not even Big Mike.

https://citizenfreepress.com/breaking/amazons-gender-recognition-system-identified-michelle-obama-and-serena-williams-as-men/

Another example of “technology” that we didn’t need, to merely confirm observable reality.

My favorite aspect of the technocrats’ fetish for AI is how AI’s skiplogic underpinnings consistently cranks out hatefacts and wrongthink even better than our own spergy deplorable meatsacks.

Watching this tech-woke tug-o-war real-time is a small satisfaction in an otherwise dystopian progression. In the end they will find a way to bend their dark anti-reality back into conformity just like academia has gone from “studies” that show that women prefer tall, wealthy, high-status men (shocking!) to “studies” that show that short, poor, low-status men are just bitter losers who can’t get laid. See how that works? Its Science!

Fauci & Macron come to mind. They’re the guys that were constantly pantzed and shoved in lockers in high school. They hate the world. They hate themselves. And somebody’s going to pay for ir.

“…spergy deplorable meatsacks…”

Where else will you run into phraseology like that besides right here on TBP comment boards?

And going online to read Michelle Obama’s “thesis” written at Princeton U. can only be described as ‘comedy gold’.

Hartford Healthcare has 600 employees out with Covid. You can’t make this kind of stupid up.

https://www.wfsb.com/news/hartford-healthcare-says-600-workers-are-out-with-covid-19/article_0c14ea9c-6e4c-11ec-bff6-a7125671a589.html?block_id=994091#tncms-source=article-nav-next

Pity – can’t read it in UK. I think the EU is blocking it – I am getting this error message more often these days. Even DDG won’t allow it. Look out below!

451: Unavailable

The page you are attempting to access is not available in your country.

Ha ! After some digging with DDG – I finally came up with this one:

“Balcezak said the current spike in coronavirus infections has created staffing problems because hospital workers are coming down with the virus at a rate not seen before during the pandemic. “Today we had 630 staff out with COVID; we’ve never seen numbers that high,” he said.”

https://www.sfgate.com/news/article/Connecticut-emergency-rooms-strained-as-virus-16749085.php

Are you using Brave?

Probably 15% of site links I try come up,

————

Your connection is not private

Attackers might be trying to steal your information from http://www.sfgate.com (for example, passwords, messages, or credit cards). Learn more

NET::ERR_CERT_AUTHORITY_INVALID

————

I have to open them in Firefox if I care to see them.

Or try,

https://www.proxfree.com/

Many thanks for your link – I use Firefox generally, I have Brave. I am using a Win7 desktop only for my WP – writing etc. I have a Win 10 laptop for everything else. I have tried for a VPN supporting Win7 but couldn’t find one. No worries though – I do stay safe. I use free AVG which is always asking to upgrade and reporting unsafe.

You need a vpn. I use Astrill, works very well.

You’re right – I will have a look thanks

Well done Hugh. I’ve been forecasting this for 13 years too – one day it will happen – they can’t alter the laws of physics.

They’ve been doing an impressive job of suspending them.

Agreed – but rather ‘extending’ them – kicking cans down the road until they can’t – I think we are approaching the edge of the cliff – maybe this year.

Here’s a surprising story that could lead to some interesting developments….

Unvaccinated Novak Djokovic Denied Entry Into Australia, Will Be Deported On Thursday

https://thecovidworld.com/unvaccinated-novak-djokovic-denied-entry-into-australia-will-be-deported-on-thursday/

What will surprise US in 2022? It’s already started in my area for several months I can recall. Anybody buy saltine crackers? They are essential for chili, soups, stews, sliced cheese, sliced summer sausage , peanut butter, etc. IMO. Those crackers are not on the grocery shelves here.

High dollar cheezy and exotic flavored fancy “crackers” are on the shelves but no old fashioned like soda crackers.

We’re in the “Slowly at first.” stage of totally empty shelves. Soon enough we’ll enter the “Then all at once.” phase.

“The hubris and magical thinking of the central bankers has infected the entire populace, the majority of whom now confuse magical thinking with optimism. The belief that central banks can extinguish risk and consequence and the second-order effects of those consequences is magical thinking. The belief that asset bubbles will keep expanding because of the omnipotence of central banks is magical thinking. The belief that prosperity is the result of shifting bets from one gaming table to the next is magical thinking. The belief that central banks have god-like powers and nothing can limit their power is magical thinking.”

He’s right that it has infected the entire populace but his wisdom stops there.

For a Prognosticator to accuse the Central Bankers and their bosses of hubris and magical thinking show me he know nothing worth knowing and is in words and deeds spreading misinformation to the uninformed who become the illinformed.

Now if he were referring to Babylonian Money Majik he would be correct.

My local grocery store is completely out of Top Ramen & clones…