Guest post from John Wilder at Wilder Wealthy Wise.

“Can the stock market survive a nuclear holocaust? Yes, says our next guest, and he’ll tell us what stocks to buy and what to sell in the event of a thermonuclear exchange right after these messages.” – Head Office

Superman® won’t take Bitcoin as payment after dark. He avoids crypto night.

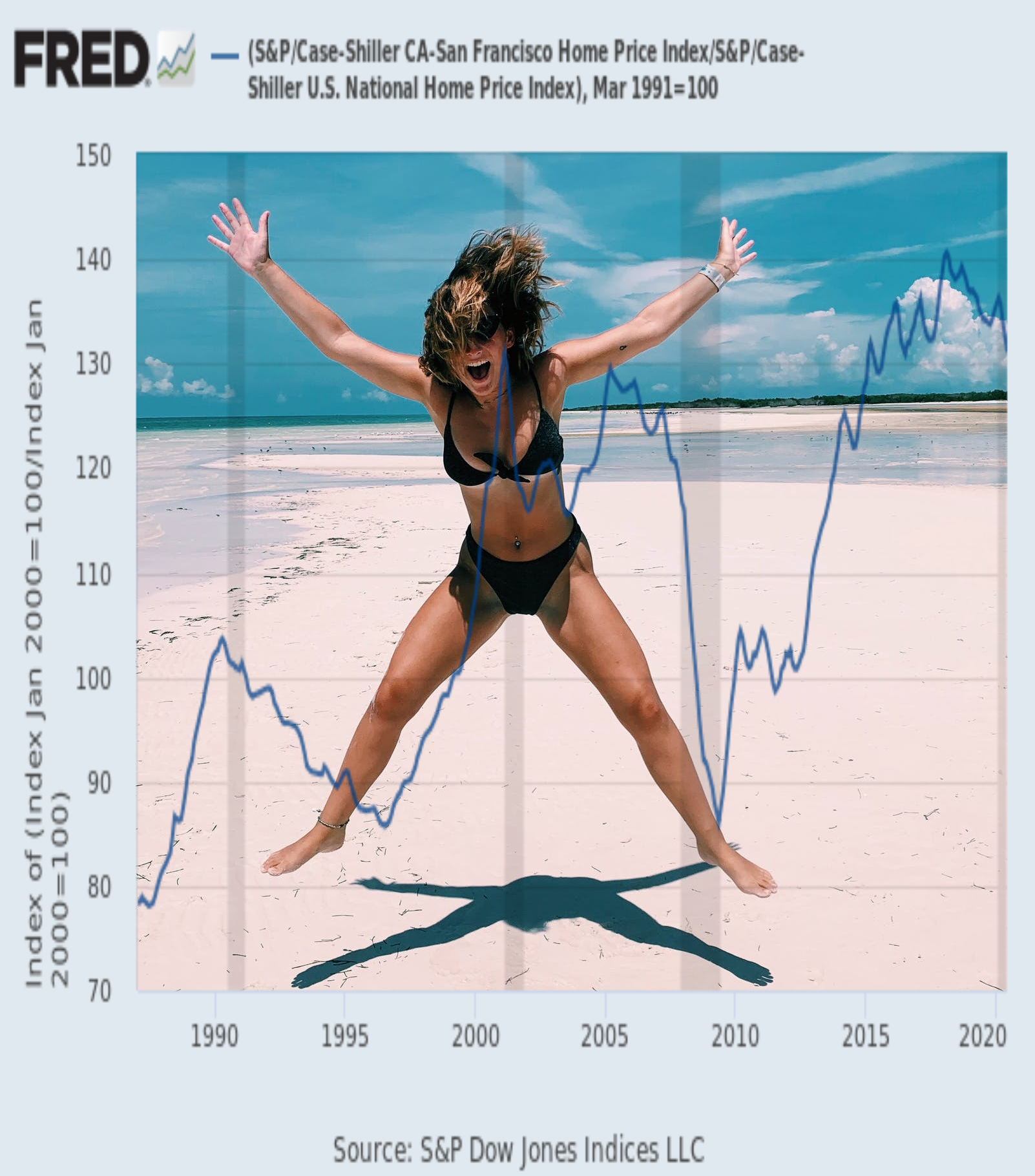

“Housing prices only go up.” I first heard that in the 1990’s when I was buying my first house. The realtor was quite clear that a house wasn’t just a house, it was an investment in the future. He had no idea what my kids could do with Sharpies®, hot sauce, and matches. And that was just the living room carpet.

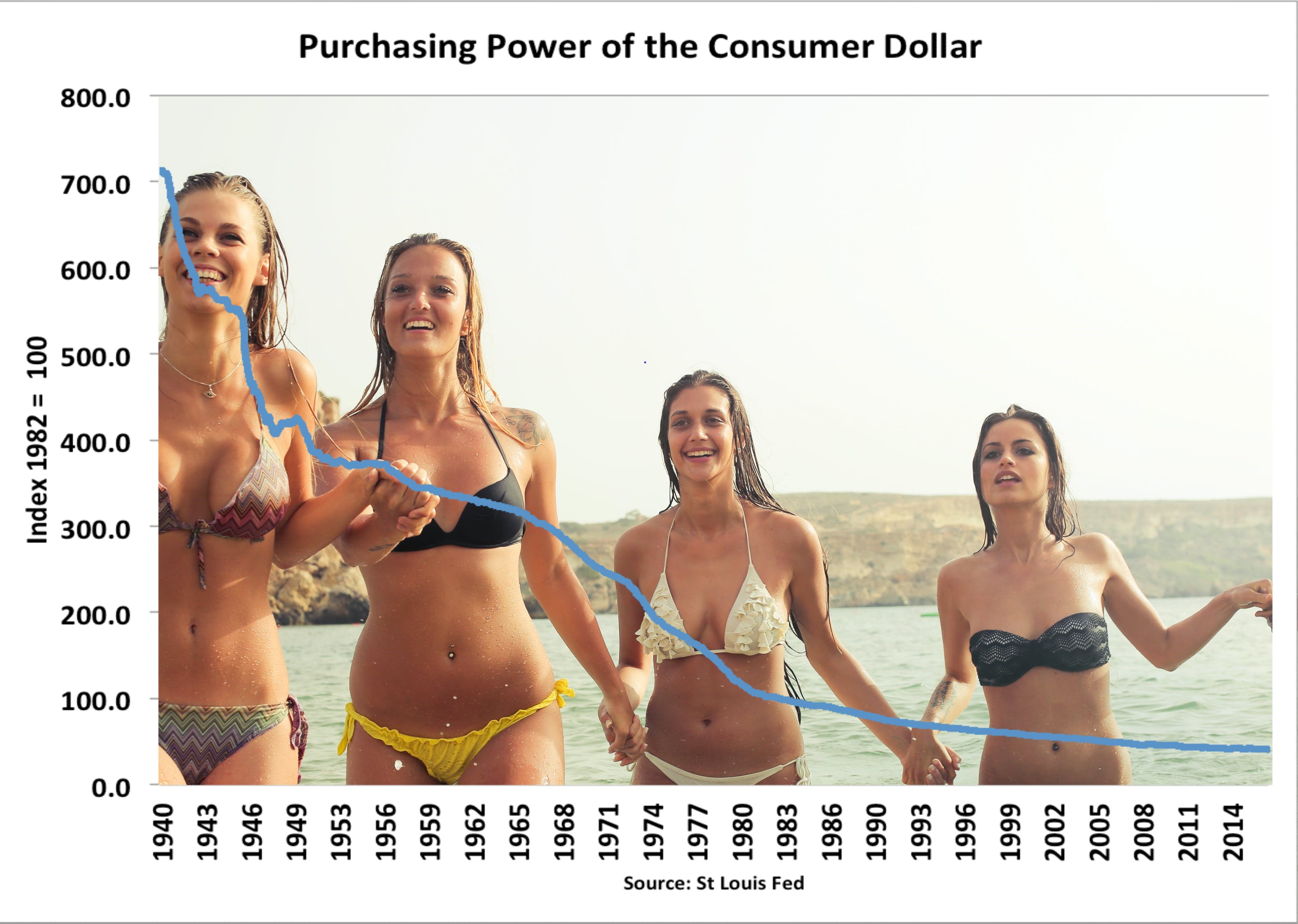

“The dollar is as good as gold.” I haven’t heard that one used about the dollar in my lifetime, because the dollar hasn’t been backed by gold since August 15, 1971.

“The stock market is the place to put your money.” That’s still what people are saying.

One thing that I’ve found throughout my life is that, generally speaking, if everyone believes in it, it’s wrong. The major exception to this is physics, which explains gravity well enough that almost nobody can argue with it. I read a book on anti-gravity once – couldn’t put it down.

I always fall for gravity jokes.

This is especially true in human systems. If the entire crowd believes it? It’s nearly certainly wrong.

As mentioned above, a perfect example of this is housing markets. It was really common knowledge in the 1990’s that, barring a setback in a recession, housing prices always go up. Buy a house, wait, and sell it 10 or 20 years later, and you’ll make a bundle.

In certain times and places, that’s true. And during the 1990’s and the early 2000’s, the idea that “housing prices always go up” became firmly fixed in the minds of, well, most everyone. That made it true, for a while. As the banks noticed this, they decided that mortgages weren’t a risky investment at all, unlike when I broke COVID-19 lockdown to go play board games. That was a lot of Risk.

On top of that, banks decided to make changes to the way that they had lent in the past. Houses were a sure thing, right? They could make them even safer by creating mortgage-backed securities. Some of these were really unique. You could buy the “best” performing loans out of a group of loans. If there were 100 houses in the group, 90 would have to default on their mortgages before your security was impacted.

This mastery of risk was amazing! Now all you need are more people to loan money to. But not everyone qualifies, which is a problem. They tried offering 0% loans, but there was no interest.

Solution? Everyone qualifies. No income? No job? No problem. These were even called NINJA (no income, no job) loans. The pool of borrowers expanded more rapidly than Joe Biden’s memory loss. And if we add in refinancing of home equity?

That added even more borrowers!

What could go wrong?

And, hey, housing prices have reached new records. Certainly they won’t fall?

Well, gravity kicked in on housing prices. They dropped. And when they dropped, the entire industry built up around building houses dropped. And then the industries that supplied lumber, and pipe, and wire, and pavement, and concrete for driveways . . . dropped.

This mathematical fiction based on a delusion created a massive recession. But, hey, housing prices always go up.

Except when they don’t.

Just like the dollar fell from its perch. Originally, the dollar was backed by actual, physical gold. That’s when the phrase, “as good as gold” was first used. Why? Because at any moment, you could go and change your dollars into gold. Walk into the bank with a $20 bill, and walk out with $20 in gold.

This wasn’t always the case, there were periods in the history of the country where this wasn’t so (greenbacks issued during the Civil War backed by the credit of the country), but it was generally the case. But after Franklin Roosevelt made gold possession by Americans illegal (yes, this happened) then you couldn’t go in and get gold for your dollar. Once that link was broken, the government was free to print money more or less at will, creating inflation even in a “gold backed” currency.

You can plainly see that women are shorter now that the purchasing power of the dollar has dropped.

Now? The dollar isn’t worth but a few percent of what it was in 1940.

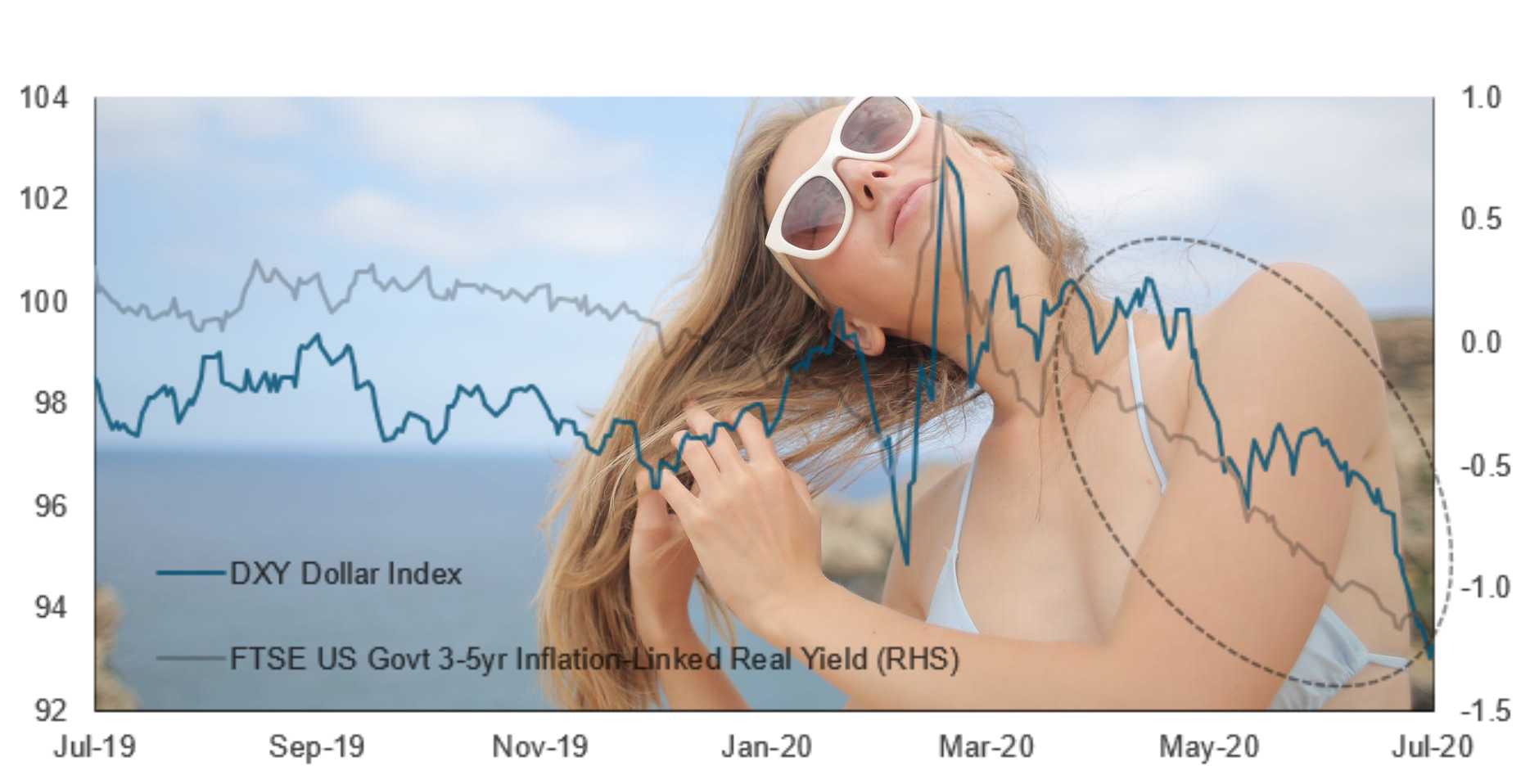

And other countries realize it, too. As the multiple trillions of dollars are printed this year to prop up everything from the airlines to the banks to the stock market, the value of the dollar has dropped. Why? The rest of the world can count. There is only so much printing you can do before it starts to add up.

The dollar has dropped 10% in the last three months.

The dollar’s fall is fast, but not as fast as when I fell into the coffee. It was instant.

Good as gold?

No.

Which brings us to the stock market. Money in the stock market is always safe, over a long enough term. It took six years to recover from the Great Recession. In real terms (inflation adjusted) it took from 1928 to 1955 for the Dow© to recover from the Great Depression. It took until 1994 for the Dow™ to recover from the 1964 peak. So, if you’re good waiting thirty years to break even, the stock market is a sure thing.

Speaking of up and down – I got a free yo-yo. No strings attached!

While the economy is still stuck in lockdown in many parts of the country, massive unemployment, and a “riot-a-day” social structure, the Dow Jones Industrial Average® is only down 3%.

I wonder, just maybe, if everyone is wrong?

If everyone thinks that everyone is wrong, then that must be wrong….but then everyone would be right, which is also wrong……

Buy gold, vote Trump. start in Australia in Risk, and post many women in bikinis, even if they are short……that solves that…..or does it? Hmmm…….

Excellent! Give us a crypto bikini piece with rising charts and no shorts.

I prefer puts and naked shorts on the downside swing….jus sayin

It’s always interesting to listen to a police/crime show on SiriusXM Radio Classics (Ch. 148). Hey, they have “payroll heist jobs” netting $150K cash ($1.5MM adjusted for inflation) back in the late 40s-early 50s. Jack Benny would give the bum John L.C. Saboney 50¢, and it was a big deal.

So 10X inflation since I was born. Now down more of memory lane.

I’m 67 and remember the sticker price on our ’56 Bel Air was $2,250. Being an atty, Dad kept every piece of paper. No A/C but a great AM radio to listen to Dick Biondi on WLS. Sadly, my Mississippi parents had to go nawth to do his career. Happily back in the SC Lowcountry.

Oh well, back to TCM and “North By Northwest”. Jimmy Garner in “Grand Prix” earlier today. Prompted me to change the oil on the diesel Cayenne.

Were there graphs in the bikini pictures?

I have heard lots of stories about how people bought a home and after a few years sold them at a healthy profit. I guess those years are a thing of the past now.