Authored by Lance Roberts via RealInvestmentAdvice.com,

At the beginning of August, I discussed the following tweet from the President:

What the Market wanted to hear from Jay Powell and the Federal Reserve was that this was the beginning of a lengthy and aggressive rate-cutting cycle which would keep pace with China, The European Union and other countries around the world….

— Donald J. Trump (@realDonaldTrump) July 31, 2019

“But if it is the ‘strongest economy ever,’ then why the need for aggressive rate cuts which are ’emergency measures’ to be utilized to offset recessionary conditions?”

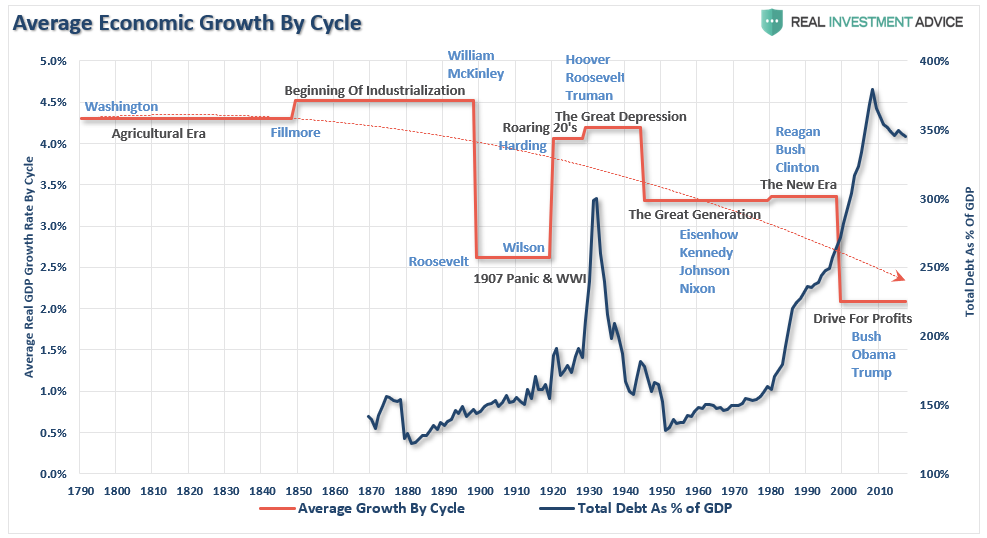

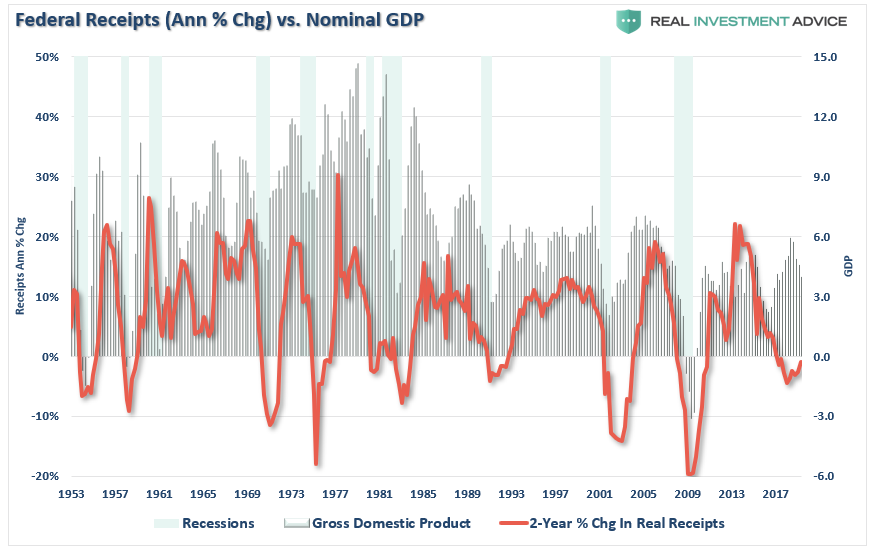

The following chart should quickly put that claim to rest.

While the claims of an exceptionally strong economy rely heavily on historically low unemployment and jobless claims numbers, historically high levels of asset prices, and strong consumer spending trends, there is an underlying deterioration that goes unaddressed.

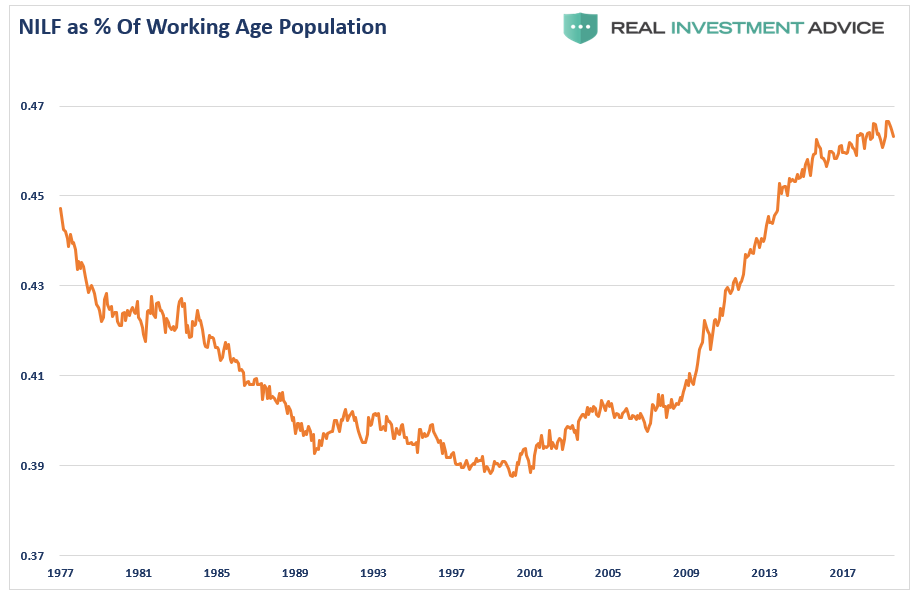

For example, while reported unemployment is hitting historically low levels, there is a swelling mass of uncounted individuals that have either given up looking for work or are working multiple part-time jobs. This is shown by those “not in labor force” as a percent of the working-age population, which has skyrocketed since the recession.

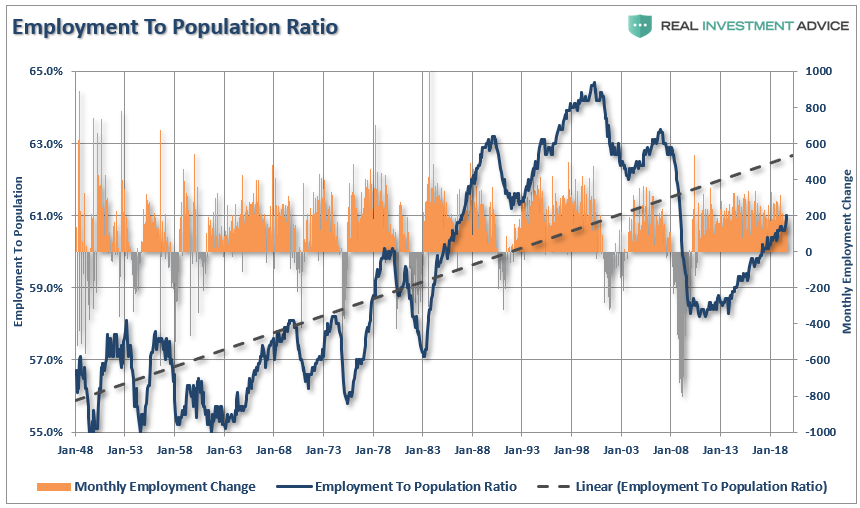

The employment to population ratio would not still be at levels from the 1980s.

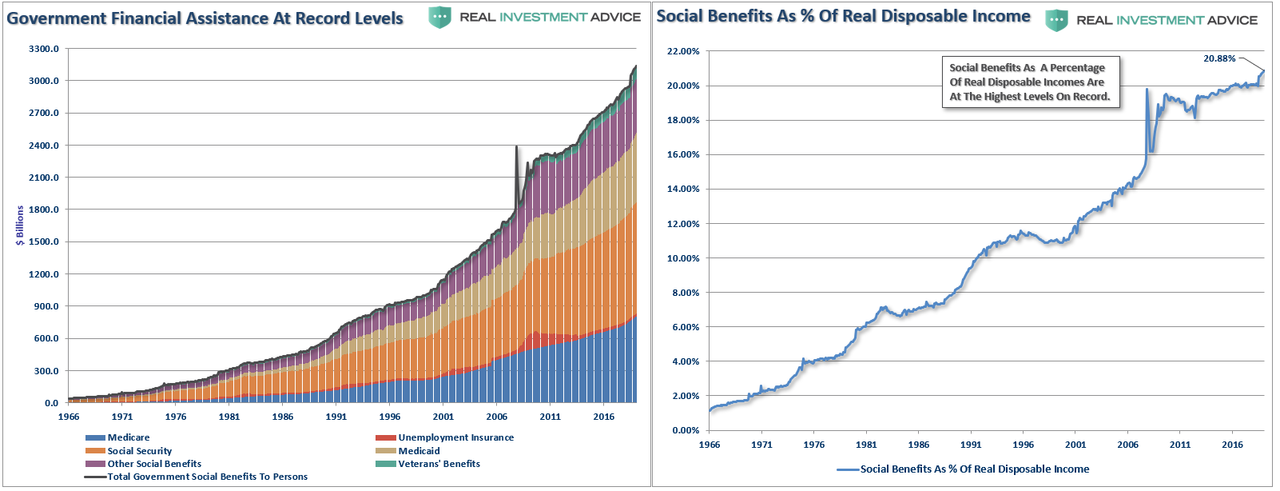

If employment was indeed as strong as reported by government agencies, then social benefits would not be comprising a record high of 22% of real disposable incomes. Here is the breakdown:

- 40 million Americans on food stamps

- An estimated 50% of the 330 million Americans in this country get at least one federal benefit, according to the Census Bureau.

- An estimated 63 million get Social Security; 59.9 million get Medicare; 75 million get Medicaid; 5 million get housing subsidies; and 4 million get Veterans’ benefits.

Those numbers continue to rise.

Without government largesse, many individuals would literally be living on the street. The chart above shows all the government “welfare” programs and current levels to date. While unemployment insurance has hit record lows following the financial crisis, social security, medicaid, veterans’ benefits, and other social benefits have continued to rise and have surged sharply over the last few months.

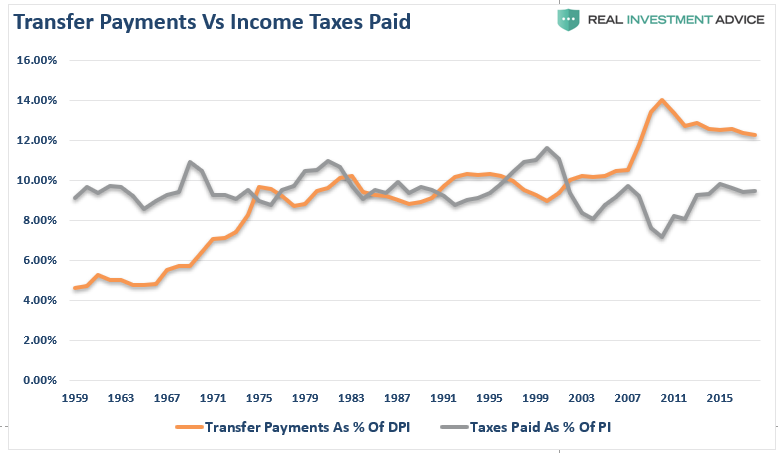

With 1/5 of incomes dependent on government transfers, it is not surprising that the economy continues to struggle as recycled tax dollars used for consumption purposes have virtually no impact on the overall economy.

In fact, in the ongoing saga of the demise of the American economy U.S. households are now getting more in cash handouts from the government than they are paying in taxes for the first time since the Great Depression. This, of course, at a time when the current administration is more enthralled with trying to find some universe where cutting taxes actually increases tax revenues as a percent of GDP rather than actually cutting spending.

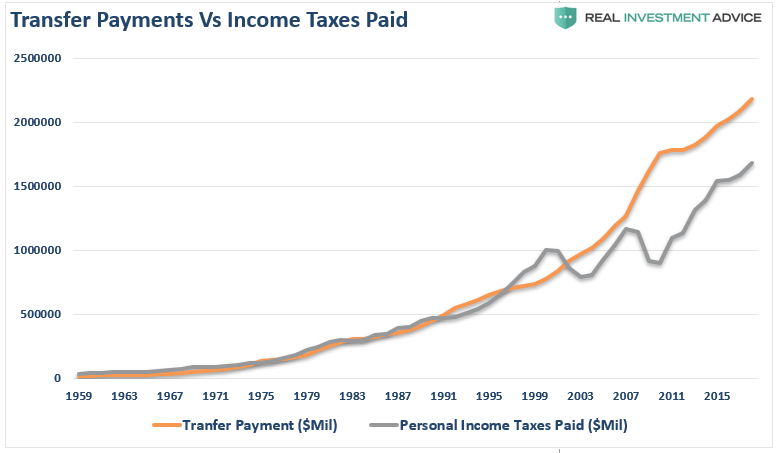

In 2018, households received $2.2 trillion in some form of government transfer payments, which was more than the $1.7 trillion paid in personal income taxes.

“Yes, but wages are now the highest ever.”

Fair enough, but if that were truly the case, then why are transfer payments as a percent of disposable personal income still hanging near its highs from the “Great Recession?”

In the “strongest economy in history,” American’s should be earning a bulk of the income from their labor, rather than from Government handouts. This is why, despite tax cuts, tax revenue growth has waned as the economy has remained weak.

You simply can’t create economic growth by recycling tax dollars.

In short, Americans have the government, not private enterprise, to thank for their wealth growth – but, of course, there are massive implications to this.

As I noted in our recent discussion on the fallacy of the “savings rate:”

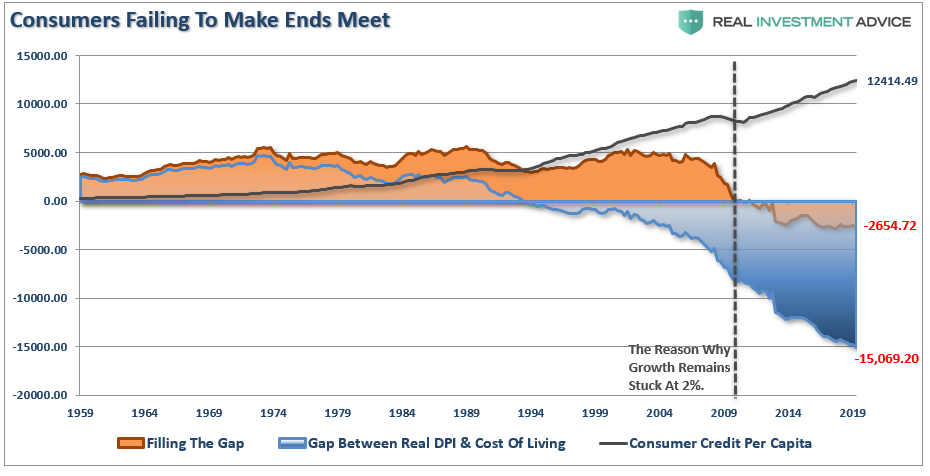

“The ‘gap’ between the ‘standard of living’ and real disposable incomes is shown below. Beginning in 1990, incomes alone were no longer able to meet the standard of living so consumers turned to debt to fill the ‘gap.’ However, following the ‘financial crisis,’ even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $2654 annual deficit that cannot be filled.”

That gap explains why consumer debt is at historic highs and growing each year.

Furthermore, if more households have the government to thank for their wealth, does that mean those households are more inclined to re-elect politicians who are pushing for more government handouts?

The answers to that question is quite obvious if you look at the candidates currently running for President on the Democratic ticket.

The bottom line is that America can’t grow its way back to prosperity on the back of social assistance. The average American is fighting to make ends meet as their cost of living rises while wage growth largely remains stagnant.

This brings us to the hard truth.

The budget deficit is set to grow over the next few years as interest payments alone absorb a chuck of the tax revenue. This comes at a time when that same dollar of tax revenue only covers entitlement spending as 75 million baby boomers begin their migration into the social safety net.

The call by the American people at the last election was a mandate to reduce the size of government and spending, however, that has fallen on deaf ears and weak stomachs. The current electorate is log jammed by personal agendas as the White House elected to cut taxes, increase defense spending, and exacerbate the crony-capitalism which currently plagues the country.

By the way, the only other time government income support exceeded taxes paid was during the “Great Depression” from 1931 to 1936.

Strongest economy ever? Hardly.

But it could be.

Today, we have the ability to choose our battles, make tough choices, and restore the economic balance for future growth. However, 800-years of history tells us that we will fail to make those choices, and at some point, those choices will be forced upon us.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Competing currencies, strong families and every man for himself.

There is no ‘we’ in all this. Chasing policy reform is wasting one’s life.

Can anyone judge the graphs for accuracy. The Not In Labor Force (NILF) graph is wrong. If it is really percent, then less than half a percent is nothing. If it is really fraction, it is too high by about 10 percent according to the data retrieved from the top section at https://www.bls.gov/webapps/legacy/cpsatab1.htm .

Here we go again…Social Security tax was supposed to be collected and used ONLY for fulfilling the program which was to help older Americans, instead it was made into a general catchall tax starting with Johnson. There is tax monies going into it, but that money is funding wars and politician lifestyles among other things.

The author also makes no mention of how a huge push for getting people on the government dole was part and parcel of Obama’s reign. Cloward-Piven was the policy, and his administration went so far as to advertise on Mexican radio, telling people IN MEXICO, how to apply for and get food stamps and other government bennies. The IRS has it’s own little welfare distribution to illegals scam:

In 2011, the Treasury Inspector General for Tax Collection released a shocking report detailing how illegal aliens are able to utilize a filing loophole to obtain $4.2 billion every year in Additional Child Tax Credit (ACTC) funds. The ACTC, much like the Earned Income Tax Credit (EITC), is refundable, meaning it’s essentially a welfare payment through the tax code. While the IRS requires tax filers to supply a valid Social Security number in order to receive the EITC, they purposely allow illegal aliens to get the ACTC by simply providing an Individual Taxpayer Identification Number (ITIN) supplied to them by the IRS itself. It’s yet another classic case of the fox guarding the hen house.

The IRS could easily check with DHS and the Social Security Administration to verify one’s legal status and hold up any tax credits for illegal aliens, yet they concocted a scheme to ensure they get welfare.

This author might want to look into some of those welfare bennies first and then start making statements. He may also want to examine how many people have gone Galt, the numbers may be surprising….

https://www.conservativereview.com/news/irs-gives-illegals-welfare-forces-obamacare-tax-on-americans/

Why must you confuse us with facts. Our president who isn’t a democrat tells me everything is great !

One of the things we fail to realize in our complex managed world is that nothing can change without the law changing. This is the way we set things up in administrative law to ensure stability. Creativity is stifled by law.

When something can’t continue indefinitely, it will stop.

Sooner or later, the people on the dole are going to get cut off. It might happen because the economy collapses or the US dollar hyper inflates or any one of a number of reasons. Sooner or later, this money to keep the unproductive alive will cease. What happens then?

Reality has a way of making itself felt eventually. The Fed Gov can’t survive. The states need to kill it before the SHTF. Waiting for the inevitable means violence. It would be better to start curtailing ‘free stuff’ now and telling the recipients that this is the new reality; deal with it. Those that riot for more ‘free stuff’ get shot. Pretty simple really.