Guest Post by Ben Hunt

Tony Soprano: My estimate, historically? Eighty percent of the time it ends up in the can like Johnny Sack. Or on the embalming table at Cozzarelli’s.

Bobby Bacala: Don’t even say it.

Tony Soprano: No risk, no reward.

Bobby Bacala: I mean, our line of work, it’s always out there. You probably don’t even hear it when it happens, right?

― The Sopranos, “Soprano Home Movies” (2007)

I’m going to jump right into this sequel to Things Fall Apart (Part 1), without a heavy recap of that note. The skinny recap is that if you have a two-party political system with high-peaked bimodal electorate preferences, as the United States began to develop in 2014 and has now fully formed, there are no winning centrist politicians and no stable centrist policies. Instead you have – politically speaking, at least – what Yeats called a widening gyre, where a steady stream of extremist candidates, each very attractive to their party base, pull the overall electorate into a greater and greater state of polarization. In other words, if you enjoyed the choices America had in the 2016 presidential election, you’re gonna love 2020.

Just as our politics are falling apart, our portfolios are falling apart, too.

It’s a different kind of falling apart. A less urgent kind of falling apart. Our current market equilibrium is not a widening gyre. It’s something else, which I’ll elaborate on in a second, where our prevalent emotions are bland disappointment and ennui, not urgent fear and loathing like in our political lives. If the signature image of Things Falling Apart in our modern political context is an enraged Tony Soprano pointing a gun at one of Phil Leotardo’s crew, the signature image of Things Falling Apart in our modern investment context is a weary Tony Soprano sitting at that diner in the very last episode, thinking that everything is … okay … definitely not great, but okay, totally oblivious to the reality of how his life has actually already fallen apart, how lethal decisions have been made away from him in ways he cannot observe or control, how his life is literally about to fade to black in 3 … 2 … 1.

It’s a different kind of falling apart. A less urgent kind of falling apart. Our current market equilibrium is not a widening gyre. It’s something else, which I’ll elaborate on in a second, where our prevalent emotions are bland disappointment and ennui, not urgent fear and loathing like in our political lives. If the signature image of Things Falling Apart in our modern political context is an enraged Tony Soprano pointing a gun at one of Phil Leotardo’s crew, the signature image of Things Falling Apart in our modern investment context is a weary Tony Soprano sitting at that diner in the very last episode, thinking that everything is … okay … definitely not great, but okay, totally oblivious to the reality of how his life has actually already fallen apart, how lethal decisions have been made away from him in ways he cannot observe or control, how his life is literally about to fade to black in 3 … 2 … 1.

The doomed-but-doesn’t-know-it Tony Soprano portfolio isn’t infamous. It’s not a meme. It’s not the public pension plan that is so dramatically underfunded that it contemplates selling billions of dollars in taxable bonds so that it can lever up in the equity market after a nine-year bull run. It’s not the 25-year-old who put the $30,000 he inherited from grandma into crypto because you gotta take chances when you’re young, right?

No, the Tony Soprano portfolio is the private endowment that has done … okay, I guess … but more because operating draws have gone down over this nine-year expansion than because investment performance was good. It’s the IRA that is … up a bit, yeah … but somehow always seems to zig when it should’ve zagged, so that it lightens up at the bottom of every two-week swoon and goes all-in in months like this January. It’s the wirehouse model portfolio that has done everything right in its analysis and its diversification and yet STILL underperforms the S&P 500 every year. Every. Freakin’. Year.

The Tony Soprano portfolio is, I would guess, 95% of us. What drives our disappointment? For a decade now …

- It is a fact that NONE of us have done as well in our individual real-life portfolios as ALL of us have done in aggregate hypothetical indices.

- It is a fact that Value has waaay underperformed the S&P 500.

- It is a fact that Trend has waaay underperformed the S&P 500.

- It is a fact that Quality has waaay underperformed the S&P 500.

- It is a fact that Emerging Markets have waaay underperformed the S&P 500.

- It is a fact that Real Assets have waaay underperformed the S&P 500.

- It is a fact that Hedge Funds have waaay underperformed the S&P 500.

- It is a fact that smarts and experience of every sort have waaay underperformed the S&P 500.

And if that weren’t enough, here’s the kicker that’ll get everyone mad at me, because it challenges the central tenet of the Church of Modern Portfolio Theory.

It is a fact that diversification has failed us for a decade.

The entire edifice of diversification and Modern Portfolio Theory is built on a simple and powerful idea – that it is meaningful to talk about uncorrelated asset classes and factors with positive expected returns. It’s built on the belief that all of these Things we call asset classes or factors will work over the long haul, but not all of them will work all of the time or in lockstep with each other, so you’re (much) better off owning a mix of these Things rather than just one of these Things.

Put another way, well-diversified portfolios work great in a widening gyre.

But our current market equilibrium is the opposite of a widening gyre. Where our politics have moved from a roughly single-peaked distribution of electorate preferences to a bimodal distribution, so that there is no effective center, our markets have moved from a multi-modal distribution of investor preferences to a single-peaked distribution, so that it’s all US large-cap stocks all the time.

If our politics are a widening gyre, our markets are a black hole. In both cases, resistance is futile. Fight the political centrifuge spinning you into the extremist arms of a two-party system … and you are left behind as an impotent “centrist”. Fight the investment gravity pulling you into passively managed large-cap US stocks … and you are left behind as an impotent “diversifier”.

Here’s the bottom line for how Things Fall Apart in the widening gyre of modern politics. In a two-party system with high-peaked bimodal electorate preferences:

There is no winning centrist politician.

There are no stable centrist policies.

And here’s the bottom line for how Things Fall Apart in the black hole of modern investing. In a multi-asset class market with high-peaked unimodal investor preferences:

There is no winning diversification advocate.

There are no outperforming diversified portfolios.

Sorry.

I can’t overemphasize how damaging the failure of diversification is to both our portfolios and the stability of our financial advisory system. As both investors and advisors we have put our faith in the power of diversification, and when that Greater Power deserts us we are left open and exposed. We are all Tony Soprano sitting in that diner, aware that something is not quite right, but also not quite able to put our finger on it. So we go on about our business. We order a basket of onion rings. And then it happens.

The bullet for so many smart and competent and well-diversified portfolios is the next recession. Why? Because these portfolios have not made nearly enough money in this long-running bull market to achieve their owners’ investment goals over an investment cycle. A 20% down move in the S&P 500 index would hardly make a dent in that hypothetical price series. But for a real-life portfolio that’s up half that … maybe a third of that … down 20% is a disaster.

The bullet for so many smart and competent and well-diversified financial advisors is also the next recession. Why? Because your clients will tolerate an underperforming theology in their investment lives so long as they are doing okay in their non-investment lives. Begrudgingly. Complainingly. For the most part. But the thing about recessions is that they’re not just a market phenomenon, they’re also a real-life phenomon where jobs are lost, businesses are strained, and debts come due. Your clients have zero tolerance for disappointment in both their investment AND their non-investment lives. Zero. So unless you’re making money for your clients when the next recession hits, and that’s NOT what that well-diversified wirehouse model portfolio will do, then you’re going to lose clients. Because no one ever thanks a financial advisor for losing money, and you’re already on thin ice.

Here’s the thing about recessions.

Just like the bullet that gets Tony Soprano in the end, you never hear it coming.

Anyone who tells you otherwise is either kidding you or kidding themselves. I mean, we can’t even identify a recession when we enter one, much less predict the timing of the next one. (Seriously, the official adjudicators of recession dates – the National Bureau of Economic Research – always backdate the start of a recession to several months before we first realize we’re in a recession.)

Will there be another recession? Yes. Does anyone know when that recession will happen or how severe it will be? No. If you get nothing else out of Epsilon Theory, get this: there is no algorithm for predicting anything long-term in macroeconomics, there is only non-algorithmic estimation for short-term events. In investor life as in mobster life, the bullet always comes for us eventually. We just can’t predict when.

Wheee! Well, Ben, as usual you’re a total downer. And we didn’t get the usual quota of movie lines, so this is shaping up to be even less enjoyable than usual, if such a thing is imaginable. I don’t suppose there’s anything we can, you know, maybe DO about all this to improve our situation?

Well, yes. Yes, there IS something we can DO about all this, as both investors and as citizens. Maybe not to rekindle some Golden Age, but at least to improve our chances above the 20% that Tony Soprano figures as the odds of avoiding prison or a violent death. To mark out that path, though, first I need to cut through what I think is the origin story for our sorry state of affairs.

What links the widening gyre of politics and the black hole of markets? They’re caused by the same thing. They’re what happens when emergency government action to rescue the financial system from political ruin becomes permanent government policy to use the financial system for political gain.

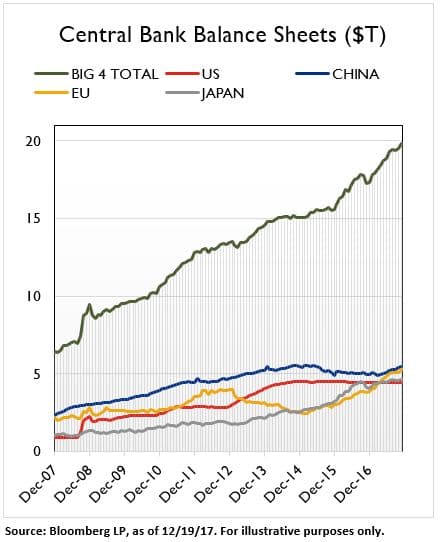

They’re what happens when an emergency QE1 becomes a permanent policy of QE2 and QE3 and QE Forever-and-Ever-Amen, not just in the US but (even more so) in Europe and Japan. They’re what happens when an emergency bank recapitalization becomes a permanent policy of Get Out of Jail Free and interest on reserves and consolidation and Treasury-backstopped debt. They’re what happens when central banks buy $22 TRILLION of stuff.

Central banks don’t care about Value. Central banks don’t care about Trend or Quality or anything else that rewards “good” investments and punishes “bad” investments. No, all they care about is lifting the price of ALL financial assets, which means – let’s be real here – if central banks have a bias on Quality, their bias is to protect low quality companies. Particularly European low quality banks.

Every policy decision made by China and Europe and Japan and the US in the wake of the Great Financial Crisis was made with a singular goal in mind – to prop up and inflate financial asset prices. Originally, it was to keep the status quo financial system from imploding. But soon after … and still now … it was to keep the status quo political system from imploding. What started as an entirely laudable effort to keep capital markets from collapsing became an entirely problematic effort to turn capital markets into political utilities. This has been a Team Elite goal since at least 1997.

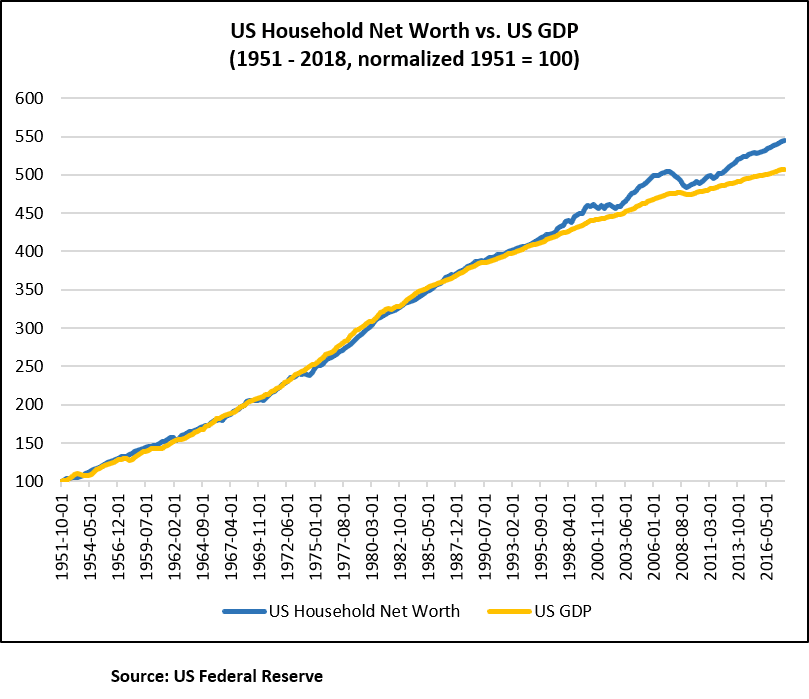

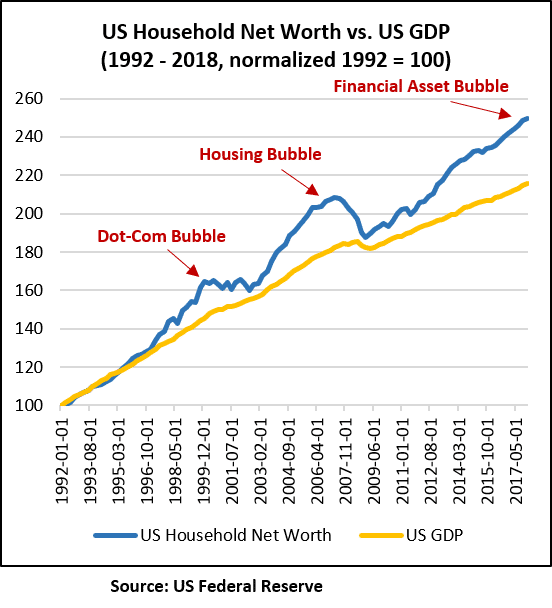

You can see this effort most clearly in the relationship between U.S. household net worth (how rich we are) versus U.S. GDP (how much our economy has grown). I created these charts with data that the Fed has collected on a quarterly basis since 1951. They’re, ummm, kinda crazy.

Here’s the full relationship since 1951. To be clear, both data sets are nominal (meaning neither is adjusted for inflation), measured in exactly the same units – billions of US dollars – and normalized at 100. That’s an excellent way to make an apples-to-apples growth comparison in these circumstances, so don’t @ me about semi-log charting. Also to be clear, the Fed’s Household Net Worth category includes nonprofit organizations, so it includes the assets of pension funds (but not social security).

For 46 years, from 1951 to 1997, we were no more and no less rich than our economy grew. Which makes sense. That’s the neutral vision of monetary policy, where you’re not trying to pull forward future growth through leverage and easy money in order to create more wealth today. For the past 20 years, however, we have had a series of wealth bubbles – first the Dot-Com bubble, then the Housing Bubble, and today the Financial Asset Bubble – that have made us (temporarily) richer than our economy grows.

And yes, that’s what a bubble IS … it’s when you’re richer than your economy grows. Can you do it? Sure! Here’s the proof. But can you keep it?

If I could ask Alan Greenspan one question, because he’s the guy who started all this “wealth creation” effort, it would be this: do you think it’s possible for a country to be long-term richer than it grows, and did you talk with the White House about this? Okay, that’s two questions. Sue me. Same questions for Bernanke, Yellen, and Powell. My guess on answers: “Define long-term.” and “Define talk.”

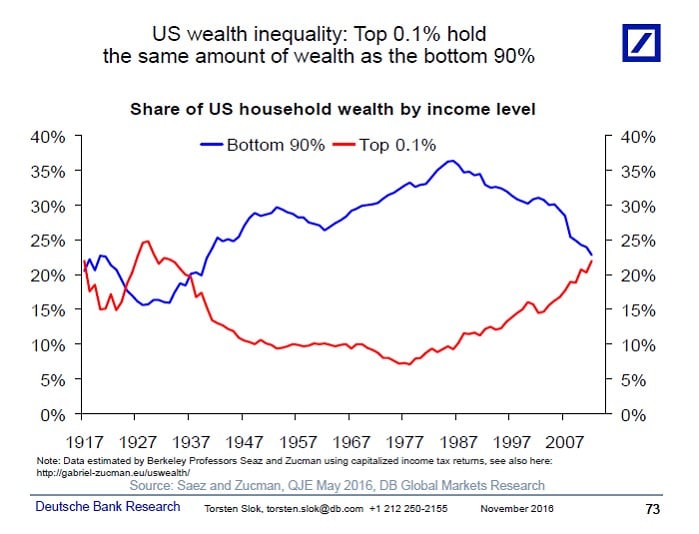

So what’s the problem with being richer than you “should” be? The problem is how those riches are distributed. The problem is that the road to hell is paved with good intentions, sure, but even more so with hubris and post hoc rationalizations. Here’s a 2016 chart from Torsten Slok at Deutsche Bank that illustrates what I’m talking about.

Because financial assets are primarily held by the rich – and by the rich I’m not even talking about the 1%, but the 1/10th of 1% – a bubble in stocks and bonds primarily works to the benefit of the very rich at the expense of the non-rich. The well-off to merely-rich (the top 9.9% of US households by income) own pretty much the same share of US household wealth throughout this ONE HUNDRED YEAR DATA SERIES. All of the action is a give and take between the top 1/10th of 1% in US households and the bottom 90%.

And before everyone at the Hoover Institution has a fit … did the 1997 Greenspan Fed’s bubble-blowing start the wealth redistribution from the non-rich to the very rich? No. Rock-bottom wealth ownership by the very rich coincided roughly with the Jimmy Carter administration, and it’s been a nice ride for the 1/10th of 1% ever since Ronald Reagan came to the White House. Is it the same US households in the 1/10th of 1% by income over the past 30 years? No. There’s still more income (and wealth) mobility in the US than pretty much any other country. Does it make a difference for questions of wealth that social security exists today and didn’t in the 1930s. Yes, it makes a difference.

But I’m not trying to say that wealth inequality per se is a bad thing or a good thing. I’m not trying to make a close comparison between the meaning of wealth inequality today and wealth inequality in the 1930s. What I’m saying is that wealth inequality in 2018 is greater than it has been in 3+ generations. I’m saying this is a fact. I’m saying that wealth inequality has been exacerbated by the inflation of financial asset prices. I’m saying that if you don’t think this is a problem for political fragmentation … well, then you’re just not paying attention.

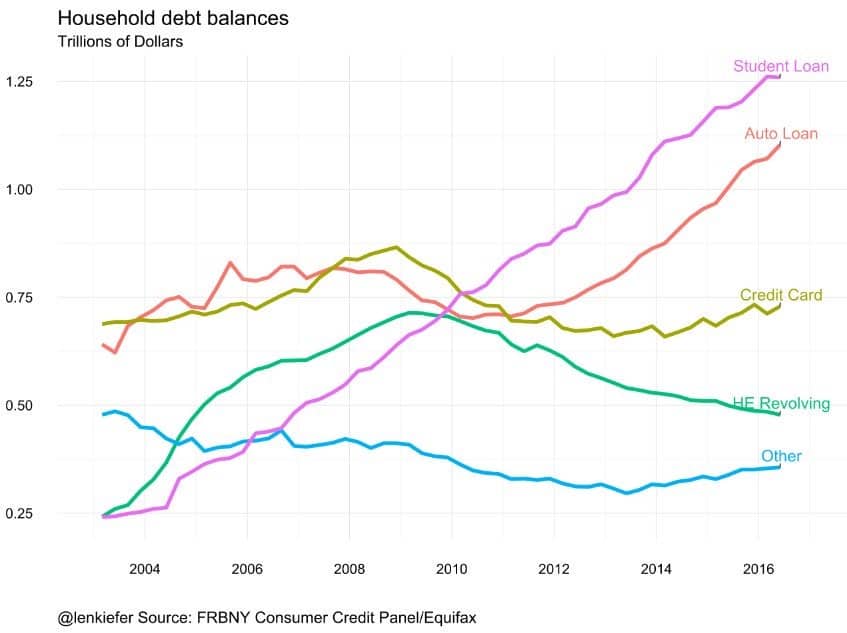

But wait, there’s more. This aggregate picture doesn’t do justice to how wealth inequality is experienced in America. Why not? Because of debt, particularly student debt.

If you’re young in America, you don’t feel the wealth inequality that bears down in truth and in spirit on the old non-rich. You don’t feel the wealth inequality because you have unlimited credit to live in a collegiate or graduate school bubble. If you’re young in America you FEEL RICH even as you BECOME POORER. This is not an accident. It is part and parcel of the widening gyre of American politics and the intentional use of the financial system to buy off young Americans and their adult parents. Ditto with Medicare buying off old Americans and their adult children. All while making the very rich very richer.

Okay, so there’s a common core for both the widening gyre of politics and the black hole of markets. But how does this move us from description to prescription? How does this put us on a path where we can DO something to improve our lot?

Let’s go back to that definition of diversification. Let’s go back to that central assumption of Modern Portfolio Theory that the investing world is made up of meaningfully different Things we call asset classes and factors, that all of these Things will work over the long haul, but not all of them will work all of the time or in lockstep with each other, so you’re (much) better off owning a mix of these Things rather than just one of these Things.

What if it’s really just one Thing?

Or rather, what if there’s a New Thing – call it the intentional policy creation of global wealth bubbles through insanely easy credit and, most recently, $22 trillion in outright asset purchases – that DID NOT EXIST when Harry Markowitz was calculating efficient frontiers and all that? What if this New Thing is so big and so powerful, what if it exudes so much gravity, that it has altered the basic geometry of our political and economic systems?

In both our political lives and our investing lives, we are prisoners of the Three-Body Problem.

What is the “problem”? Imagine three massive objects in space … stars, planets, something like that. They’re in the same system, meaning that they can’t entirely escape each other’s gravitational pull. You know the position, mass, speed, and direction of travel for  each of the objects. You know how gravity works, so you know precisely how each object is acting on the other two objects. Now predict for me, using a formula, where the objects will be at some point in the future.

each of the objects. You know how gravity works, so you know precisely how each object is acting on the other two objects. Now predict for me, using a formula, where the objects will be at some point in the future.

Answer: you can’t. In 1887, Henri Poincaré proved that the motion of the three objects, with the exception of a few special starting cases, is non-repeating. This is a non-predictable system, meaning that the historical pattern of object positions has ZERO predictive power in figuring out where these objects will be in the future. There is no algorithm that a human can possibly discover to solve this problem. It does not exist.

This is the foundational statement for a new path through the investing and political wilderness:

Geometry is not true, it is advantageous.

It’s not that diversification and Modern Portfolio Theory and Markowitz and all that is wrong in the sense that there’s a mistake in the math. It’s that when the geometry of our world changes enough, then these elegant and smart constuctions we have made to make sense of the prior geometry are no longer particularly advantageous. I say this not to bury diversification, but to rehabilitate it. I say this because diversification as a tool is extremely useful. Diversification as a religion … not so much.

The path forward is to call things by their proper names, even if that means making painful admissions like … ummm, sorry, but Emerging Markets is not a Thing. What you’ve been calling “Emerging Markets” is just one of many shadows of Big 4 monetary policy. So your well-diversified portfolio that has an “asset class” slot for Emerging Markets? You’re going to have to rethink that. You’re going to have to rethink a lot of things.

Ditto with our path forward as citizens. We’re going to have to rethink a lot of things.

And unfortunately, there is no Answer waiting for us at the end of the rainbow, no algorithm or equation or religion or anything else. That’s life in the Three-Body Problem. A “general closed-form solution” does not exist. It’s just math, as the cool kids say. What there is, though, is a Process. And that will be enough.

What you’re talking about is 4 frickin stocks. AMZN, AAPL, NFLX, and MSFT. None of those stocks are compelling. Amazon is still a shit retail business that makes little money, or is actually in the red if you count international. They make their money off that stupid cloud crap. Is it really a compelling investment when anyone can come in with a stack of cheap AMD many core chips and underbid AWS’s juicy 26% margins? Hell no thats a goddam awful proposition. Yet that’s where the money is. And microsoft? A frickin travesty. Garbage software, reliant on monopoly. Poorly performing game console. Horrible mobile devices. Complete trash investment. But up massively nonetheless. And netfux? Makes all their money by cost shifting bandwidth onto others. Bleeds as red as Tesla. Are you frickin kidding? These are the market leaders for whom without them the S&P500 would actually be in the red this year? And then there’s apple. Jesus where to even begin with that garbage. Dead on revenue for 3 whole frickin years. Yet up over 100% in that time. My god. But that’s our market. That’s the four horsemen of this apocalypse. Which is how you know it is indeed going to be an apocalypse. Just … not today. No one should feel bad about underperforming all the indices which are heavily weighted on those 4 trash stocks. Because putting your money in them is almost as stupid as putting your money into crypto 9 months ago. The only thing that makes owning them better is that central banks are literally printing fiat and buying those stocks.

It’s all bullshit and shit.

Nike just regained entirely its $3 billion “loss” from the Kaperdick crap.

Tesla is up 9% yesterday because of a single tweet from Musk … that the next quarter will be the bestest quarter in the company’s history, ever, really and truly ….. or, some such bullshit WORDS

Last week the NY Post carried an article which claimed that new studies show that people who eat a LOT of meat and CHEESE live longer than those who don’t. fuck. me. ded.

The same paper the same day (really) had another article about yet another study which concluded that COCONUT OIL is “pure poison”. Really. Not just poison but, “PURE poison”. Man, oh man, fuck me up da ass!!

Maybe I’d be happier if I just fucken stopped reading. Anything.

My sentiments exactly, Stucky. I just couldn’t figure out how to articulate it.

Stucky , I’m so glad my post last night help you get off on your ass. You can thank me in the next life.Stop eat Cononut oil – didn’t you Know that stuff will kill you.

Doctors told me that is what fuck up my heart . That and bad genes.

Greetings,

Given that there appears to be a bubble such that people are living beyond their means then the big question is this: How do I keep my seat when the music stops?

See, I’ve come to realize that I have zero control over the Fed’s Bubbles but what they do most certainly can have an effect on my life as demonstrated by 2008 which was an event that knocked the crap out of me. Of course, I can recognize that we are at the end of a business cycle and to prepare for it we have begun hoarding cash as it was a lack of cash that shut me down last time. Had I been able to weather the downturn for 18 months then I would have been in a position to really capitalize on my position of being the last man standing. As it stands, I’ve needed these last ten years to get back to where I was at that time and this time around I’d like to keep what I’ve earned.

As always, the thing that gets you is the thing you didn’t see coming and I’m wondering what it is that I do not see coming?

“Geometry is not true, it is advantageous.”

Ah Ha, an answer to the religion question… see Peterson Harris debate.

Religion is not true, it is advantageous.

Or perhaps, God is not true, it is advantageous?

My maf is not so good but geometry was easy for me.

This three body deal spins mostly above my head…

“And unfortunately, there is no Answer waiting for us at the end of the rainbow, no algorithm or equation or religion or anything else. That’s life in the Three-Body Problem. A “general closed-form solution” does not exist. It’s just math, as the cool kids say. What there is, though, is a Process. And that will be enough.”

I will be an obscure set of initials soon hopefully a blending into the shadows.

There will be no answer to the religion question unless there is agreement to a true “meeting of the minds” as occurred when those two very strong minds assessed each other and found shared ground from which they could proceed. I really did think the way they each assessed one another was amazingly spot on with the way I would have assessed each of them, in turn. In other words, it was some of that Johari’s window psychobabble stuff from Psychology Class back in the days when I was in AWACS at Tinker and got my associates degree through the CCAF.

The Summary of the Harris Peterson Debate was meant to be an intellectual challenge that went awry. However, it has revealed a great deal to me about the difference in money-grubbing botz and really bad botz and made me think about what sort of botz I want my cybersnooping son thinking I hang around with. LOL.

So, if you have any parts of it you would like to discuss, then perhaps we will just cross chatter about it on a couple of our favorite threads, keeping that author’s piece in the window of opportunity, as a certain Public Relations teacher taught me long ago.

Laura, who took a six figure Public Relations job with Jostens and left the OU teaching staff.

The author whines about value as he writes about paper and digital credits on an electronic ledger. Again, check your premises. Let history be your guide.

Finally a very good article from Ben! We have walked into a universe of stocks where a few super-powerful attractors have taken over the market, for no particularly obvious reason…The predecessor was the Nifty 50 back in ’70s, but 50 is way more diverse than 5…This will not end well…

He makes some good points about the political system and central banks. But his understanding of portfolio theory is limited and risks losing his good points in the goulash of his rambling on MPT and factor models, which he clearly doesn’t understand that well.

The problem with Emerging Markets is not that it is not an asset class, it’s that its correlation to developed markets has increased so much in recent years as to reduce greatly its benefit to a diversified portfolio. Meanwhile, Arbitrage Pricing Theory tells us there should be no sustainable alpha accruing to any “factor” over time. So I cannot imagine why he’s upset that “factors” like Value have underperformed so badly in recent years.

He’s directionally correct that coordinated central bank policy has made the world market “one big trade”. It’s a simple and good point and he should leave it at that.

He’s like my long time college buddy Fred Meyer who got one million dollars from his dad, invested it in securities, and bought a Frank Lloyd house in Phenix, Az. His only work was to check the Market about every 15 minutes and make trades, preach portfolio diversity (to me a poor guy) and stuff like Buddhist-Nietzsche nonsense (I was a Jew who has converted to Jesus). All you guy’s Great Extensive Stock Market Analysis is Of a Bubble (fake), gonna be a Huge Bust, real soon and Real; gonna make Oct 1929 seem like a little correction. Diversity should now mean farmland, livestock, militia, etc.

Bingo! Great comment. But TRUTH is hard to see, especially to those whom deny that TRUTH exists. I would add to your ‘diversity’ the age old heavy metal, for after things calm once again.